Louis Navellier goes live at 8 PM Eastern … the last great mania of his career … more from master trader Jonathan Rose … how he’s pulling millions from the market

Before we jump in today, a reminder that tonight at 8 PM Eastern, legendary investor Louis Navellier is holding his Prediction 2024 Event.

As we’ve been detailing in recent Digests, Louis believes we’re about to see the last great investment mania of his lifetime – yours too if you’re over 50. But if he’s right, this one will be big enough to transform your portfolio, providing financial freedom in retirement.

Here’s Louis:

Today, I have some good news and some bad news for you.

The good news is another financial mania is coming that could open the kind of moneymaking opportunity I haven’t seen in two decades. The closest comparison to what’s coming next is what happened 25 years ago: The dot-com boom.

The bad news is it will likely be the last financial mania of my lifetime. And yours, too, if you’re over the age of 50.

In short, Louis’ quant-driven computers systems, that have flagged most of the financial manias of the last two decades, are pointing toward a massive investment growth story that’s only on page one today.

His algorithms have spotted a growing wave of buying pressure, and Louis sees a handful of investments going vertical – leaving the average stock (and average portfolio) middling along.

Back to Louis:

I know exactly what to buy – because I’ve been tracking this mania with the same system that allowed me to nail the dot-com era mania and every one since then, from the GameStop chaos to the software-as-a-service boom, and more…

If you’re over 50, I’d encourage you to join tonight simply to hear what a market veteran believes is at our doorstep. These types of manias are rare – and can be incredibly lucrative when harnessed.

So, listen in and decide for yourself whether you want to position a few dollars in front of what Louis believes will be the best moneymaking opportunity in two decades. I’ll note that Louis will give away two of his favorite ways to play this mania – totally free.

We’re expecting thousands of attendees. To be one of them, click here to automatically reserve your seat and we’ll see you tonight at 8 PM Eastern.

This discussion of “mania” reinforces a point we’ve been highlighting recently in the Digest – the narrow, uneven nature of today’s stock market

While a handful of mega-cap AI technology leaders have soared in 2024, the average S&P 500 stock have been largely flat.

This is the opposite of the post-pandemic halcyon days when just about everything was climbing. Today, you’re either in the right stocks and making money, or you’re in the average stock and mostly treading water.

In the background, we have the Federal Reserve that appears to be in no hurry to cut interest rates. The longer it waits, the greater the risk that parts of our economy will break, and/or low-income consumers will tap out.

If this happens, then today’s “every stock for itself” environment will grow even more divergent.

Finally, let’s throw in the impact of today’s broad market valuation…

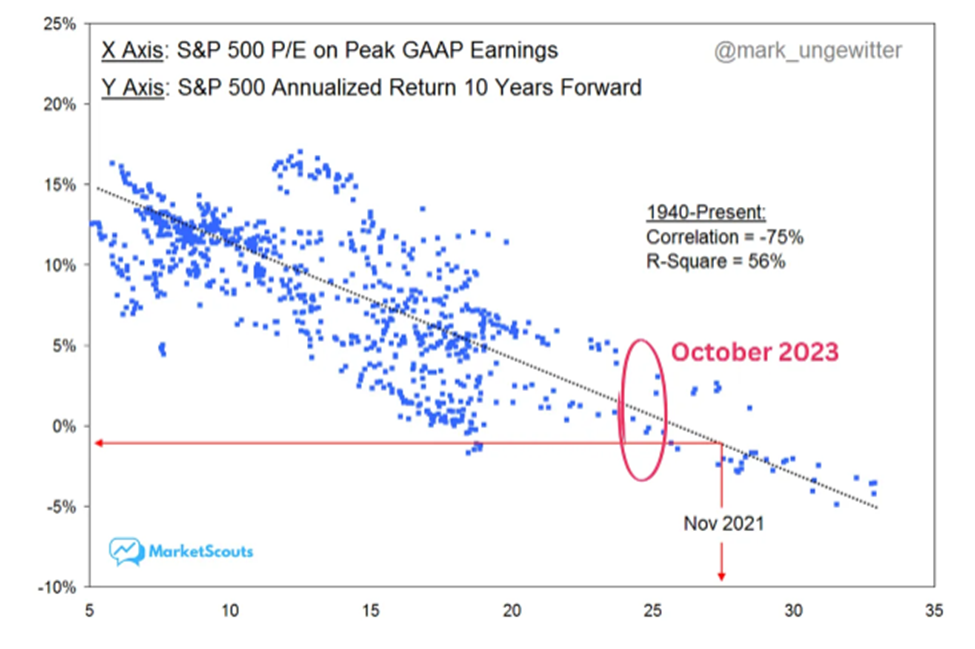

The chart below uses historical market data to plot forward-looking 10-year returns based on beginning normalized price-to-earnings (PE) ratio levels.

Basically, it answers the question “when the S&P begins at a PE ratio of ‘XYZ,’ what has its ensuing average 10-year return been?”

As you’d expect, the higher the starting PE ratio, the lower the ensuing 10-year returns.

So, what is the expected 10-year forward-looking return for the average stock today based on our current normalized PE ratio?

About 0%.

Here’s how this looks (we’re roughly on par with the highlighted “Nov 2021” return, not October 2023):

Put it altogether and this tells us two things:

One – you want to be extremely careful with which stocks you’re trusting as the buy-and-hold pillars of your portfolio.

Two – if we’re truly entering a market environment in which the average stock will return 0% for a decade, then the ability to trade profitably isn’t just helpful, it’s critical.

To reach your retirement goals, you’re going to need ways to generate returns if most stocks will be middling along.

This puts trading in the spotlight.

In recent Digests, we’ve highlighted different ways to trade with the help of Jonathan Rose

For newer readers, Jonathan is the analyst behind the free trading service Masters in Trading Live. He’s also a trading veteran who’s pulled millions out of the market over the last 10 years.

In last Thursday’s Digest, we profiled one of Jonathan’s favorite ways to trade earnings. It doesn’t require you to know which direction a stock will move; you just need to take advantage of a pricing imbalance.

The example we used was Jonathan’s trade on Pure Storage (PSTG). When it reported earnings back in February (its 2023 Q4 earnings report), Jonanthan’s subscribers walked away with 193% gains in just over three weeks.

We’ve received some great feedback from that Digest, as well as interest in additional details about how Jonathan trades.

To help, I interviewed him last week. Below are annotated excerpts.

Jeff: For anyone just becoming familiar with you for the first time, can you describe your trading approach to earnings season in a nutshell?

Jonathan: Sure. What we’re doing is using historical data, the historical movement of stocks and options, and we’re making sure the options are pricing in enough movement relative to history. If not, we’re making calculated bets of a fixed amount of risk with the potential for big gains.

Jeff: And this is the approach that was behind the 193% win that we highlighted in the Digest last week on Pure Storage trade?

Jonathan: Yes.

Jeff: So, for this type of win, you don’t need to correctly guess the direction a stock will move post earnings. You just need more movement than what had been priced into the options market. But doesn’t it require a ton of time to scan the market to find these pricing imbalances?

Jonathan: Well, it used to for sure. But today, we’re using the technology that our corporate partners have built.

We’re scanning the entire market, looking for those inefficiencies and putting out a top 10 list that are cheapest relative to historical movement, and top 10 list that are most expensive relative to historical movement. And so, the tool does all the heavy lifting.

Jeff: So, these potential trades are already teed up then?

Jonathan: That’s our goal, yes.

Jeff: Back to the strategy itself, so many people hear “options” and get nervous. But my impression is you’re not out there taking big risks. Your approach is tightly controlled and opportunistic – you only trade when the math appears to be in your favor.

Jonathan: Exactly. The smartest guys I know in the options market don’t use options to speculate. It’s just not something that’s really done. They use it when it presents fantastic opportunities.

Why just trade stock when options give you a million other possibilities? I can buy a stock or sell a stock, or I can decide, do I want to risk $10 to make $100? Risk $10 to make $1,000? It’s just a game of probabilities. Once you learn that stuff, trading can be really fun.

Jeff: So, why aren’t more people trading this way?

Jonathan: For the same reason you don’t have the secrets of any other business. It’s not that it’s so hard necessarily, it’s just you must be aware of how to do it. It’s about just being in the know.

Jeff: My impression is that you’re not swinging for the fences. Your goal is to hit a bunch of singles, doubles, and triples versus the guy going out there, trying for a homerun every time through a single directional bet with an option.

Jonathan: Absolutely. We trade like the pros. This is very disciplined.

Jeff: I’m guessing a benefit of this is it helps you stay alive a lot longer and watch your trading account grow with less volatility than a “homerun” approach that could kneecap you when your bet is wrong.

Jonathan: Yes. If you have set rules for yourself and you don’t break those rules, you won’t suffer a major portfolio crash because you always define your acceptable risk level.

Jeff: So, what’s the projected win percentage on this strategy?

Jonathan: I think if you’re winning 50%, that’s really good.

Jeff: This must mean that the absolute dollar value of your wins nets out to being much bigger than the absolute value of your losses. Otherwise, you wouldn’t be profitable if you were winning just, call it 41% of the time.

Jonathan: Yes. And thank you for clarifying that because I could have an option strategy where you win 99% of the time. And that might sound really good to somebody, but to me that sounds like death because imagine what is going to happen to you in that 1%.

Comparing somebody who is winning 30% of the time to somebody winning 90% is an incomplete comparison. I’m more concerned with their overall risk profiles that include what they lose when they’re wrong and what they win when they’re right.

The benefit of trading earnings the way we do it is, again, it’s a fixed amount of risk. You know what you’re comfortable risking. It’s all about how you’re putting on risk.

Jeff: Let’s switch gears. Beyond your trading style itself, one of the most appreciated features of your services are your communities in Discord where traders get together to discuss trades, swap war stories, and generally, just be a part of a trading family.

The feedback has been great so far. My guess is because our industry doesn’t have a great deal of these community-based networks. What do you think?

Jonathan: I think that’s a lot of it. People have been saying that nobody else does this. Every morning, we say good morning. It’s a community. I’m in there every morning, we’re sharing, and it’s just silly in the morning before we start.

Meanwhile, people get their questions answered, I answer things live. We also have a handful of smart traders who have been with me for a long time, so they answer a lot of questions in there.

We’re not looking to solve the world. We’re just looking to grow our trading accounts. So, we just keep it simple, fun, and supportive.

You should get in there, it’s a great time.

Jeff: I’ll take you up on that. Thanks for the time, Jonathan.

Jonathan: My pleasure.

To get a better feel for Jonathan’s trading style, join him – for free – tomorrow morning

Every day that the market is open, Jonathan airs a live video at 11 AM Eastern as part of his free service, Masters in Trading Live.

- They’re short – about 15 minutes each, so they won’t eat up your morning…

- They highlight attractive trading opportunities that Jonathan sees materializing…

- They’re chock-full of explanations, education, and context so that even newer traders can benefit…

- And again, they’re free.

If you’re curious, just sign up for Masters in Trading Live and see for yourself how it all works. If it’s not for you, no problem, cancel whenever you want.

Plus, when you sign up today, you’ll get immediate access to Jonathan’s three-part video series that explains why earnings matter, the wrong way to trade them, and the way Jonathan trades them.

Also, when you click below, you’ll instantly be registered for Jonathan’s free Masters in Trading Live service and will start receiving email reminders about his daily live streams.

Click here to instantly access Jonathan’s free videos and join him in Masters in Trading Live.

We’ll end today with some feedback from some of Jonathan’s followers

It’s one thing for us to sing Jonathan’s praises – it’s another for you to hear it from fellow investors/traders like yourself.

To that end, here’s just a little bit of the feedback Jonathan has been getting. We’ll let this take us out today:

- “Jonathan, I want you to know I really appreciate the way you teach us from a professional perspective. It’s helping”

- “Appreciate all that you’re doing and planning for us!”

- “Thank you, JR! As a self-learner, you can get info from so many resources, but until someone who really understands can show you a hard example, I am always a little apprehensive. Thanks for helping build my foundation of knowledge.”

Have a good evening,

Jeff Remsburg