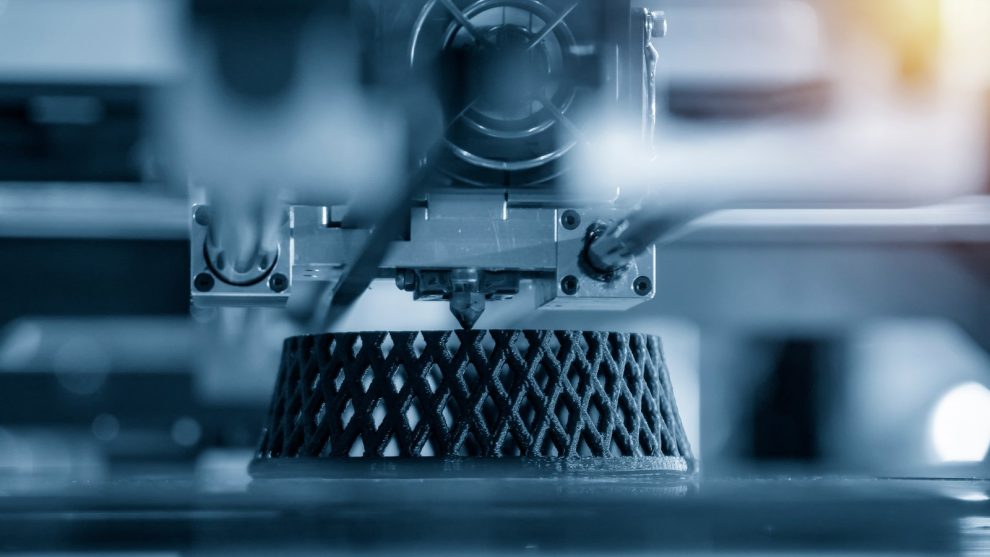

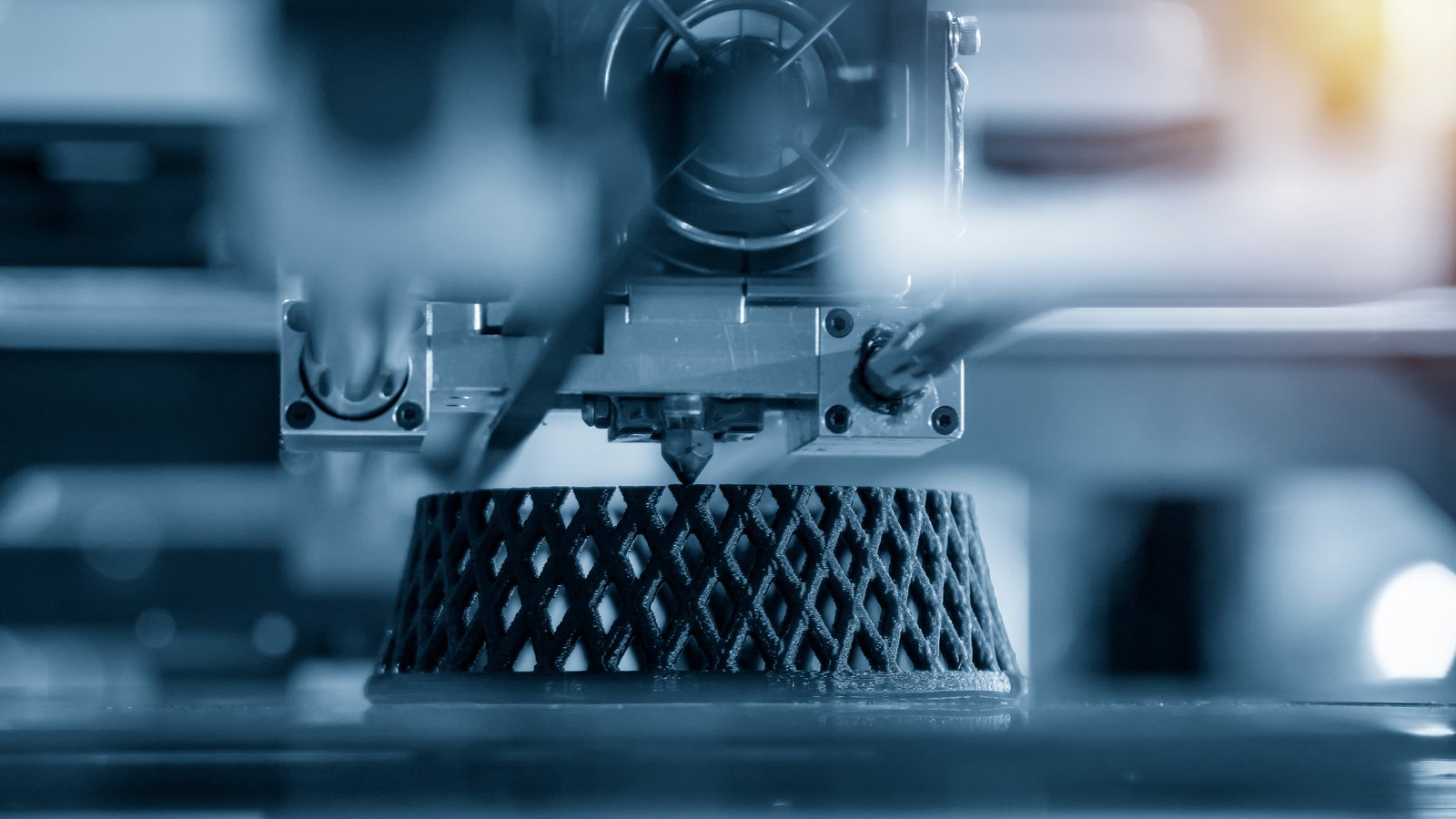

You’ve come to the right place if you’re looking for secular growth stocks. This article explores 3D printing stocks, poised to benefit from an annualized industry growth rate of 23.5% until 2030.

The depth of application of 3D printing has become known to many. However, for some reason, numerous 3D printing stocks remain grossly undervalued. As such, I decided to delve into the 3D printing arena to pick out three best-in-class 3D printing equities.

Considering the above, I framed my screening methodology around a few salient factors: systematic analysis, company-specific variables, and quantitative inflection points. Moreover, I phased technical analysis into the analysis to ensure complete alignment.

Here are three 3D printing stocks that I believe will prosper for years to come.

FARO Technologies (FARO)

FARO Technologies (NASDAQ:FARO) is an industry-leading 3D measurement, imaging, and realization solutions company. In essence, the firm operates across mid-to-end stream channels, helping manufacturers and builders optimize their processes.

FARO’s nimble business model, which allows it to sustain a prominent market share in a high barriers-to-entry business, is impressive. Although FARO has yet to achieve profitability, it has a highly scalable business model that aligns with future shareholder value.

Furthermore, FARO Technologies’ short-term variables are intact. For example, the company delivered a robust first-quarter earnings report, beating its revenue estimate by $3.17 million. Moreover, FARO maintains a solid cash position. It has $99.3 million in cash & equivalents on its balance sheet, allowing it to reinvest in scalable solutions while maintaining its solvency ratios.

Lastly, key metrics suggest that FARO stock is grossly undervalued. For instance, FARO has a price-to-sales ratio of merely 0.87x and trades below its 10-, 50-, 100-, and 200-day moving averages.

Although a risky bet, FARO stock can produce asymmetrical returns.

Align Technology (ALGN)

If you want exposure to the medical aesthetics market, look no further. Align Technology (NASDAQ:ALGN) develops 3D scanners and Invisalign Clear Aligners, providing it with access to the dental aesthetics market, which is set to grow by 13.5% annually until 2030.

I added ALGN stock to today’s list because I have a granular understanding of its market. Moreover, Align Technology operates a flawless business model, echoed by its key metrics. For instance, Align Technology has a return on common equity ratio of 12.77%, illustrating its efficiency. Additionally, ALGN possesses a five-year compound annual growth rate of 13.51%, conveying its secular attributes.

Furthermore, Align Technology has numerous short-term tailwinds. For example, the firm is in the middle of a $1 billion share buyback program. Moreover, in April, Align Technology announced that it anticipates its revenue to settle between $4.1 billion and $4.2 billion for 2024, presenting a potential year-over-year increase of between 6% and 8%.

A final consideration is ALGN stock’s valuation outlook. I consider ALGN stock undervalued as its forward price-to-earnings ratio of 34.19x is at an 18.84% five-year discount, illustrating relative value. In addition, ALGN stock is supported by spectacular growth rates, placing it in the upper echelon of 3D printing stocks.

Proto Labs (PRLB)

Proto Labs (NYSE:PRLB) is a 3D printing company that emphasizes speed. The firm claims to be the world’s fastest and most comprehensive digital manufacturer. Among other products, Proto Labs manufactures sheet metal and injection-modeled custom parts, lending it the latitude to service more than one end market.

Although inconsistent at times, Proto Labs has shown impressive long-term growth, conveyed by its ten-year compound annual growth rate of 11.40%. Much of its growth ignited after acquiring Rapid Manufacturing in 2017, providing it with vital synergies and access to the metal sheet fabrication end market. Additionally, Proto Labs has made numerous strategic decisions over the years, leading to best-in-class status via a horizontally integrated business model.

Lastly, PRLB stock appears undervalued with its price-to-sales and price-to-book ratios trading at five-year normalized discounts. Although PRLB stock has its flaws, I’m incredibly bullish about its prospects.

On the date of publication, Steve Booyens did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.