If you’re looking for a high-risk, high-reward trading opportunity, look no further than ChargePoint (NASDAQ:CHPT). Indeed, the dramatic rise of electric vehicle manufacturer Rivian Automotive (NASDAQ:RIVN) makes a compelling case for broadening public charging solutions. That clearly benefits the narrative for CHPT stock, making it a tempting proposition for speculators.

On Tuesday, Rivian saw its shares rise nearly 9% in part due to Guggenheim analysts broadcasting their bullish thesis. Their optimism centers on the company’s R2 SUV – scheduled for release in 2026 – and the compact R3, which may hit showroom floors in 2027. Rivian’s website states that the former vehicle should start at $45,000. Automotive journal Car and Driver believes that the R3 could start at $37,000.

This thesis received a blistering catalyst when Volkswagen (OTCMKTS:VWAGY) announced a major investment in RIVN stock. Starting with an initial influx of $1 billion, the German automaker could put in up to an additional $4 billion. The news saw Rivian shares fly nearly 50% during Tuesday’s afterhours session. Fundamentally, the investment should help the EV manufacturer release the R2 and R3 as scheduled.

In my opinion, that’s mixed news for Rivian. However, I believe CHPT stock could end up being the real winner.

A Near-Perfect Setup for ChargePoint’s Core Business

According to Boston Consulting Group, prospective drivers looking to transition to electric mobility seek three attributes: a price under $50,000, a 350-mile-plus driving range and charging solutions under 20 minutes. Among the three must-haves, Rivian would decisively hit the mark on only the price element with the R2 and R3.

Where Rivian falls short is in the charging time component. That’s not a Rivian-specific challenge, but a sector-wide one. Many EV owners rely on at-home charging. However, as Rivian and its peers start to target a wider audience with lower vehicle prices, they may run into customers without access to home charging. Plus, even drivers with access to home charging still need on-the-go options.

This framework sets up a perfect canvas for CHPT stock.

Trade of the Day: Buy CHPT Stock

Today’s trade of the day is really the entry point for the year. With Rivian making a concerted effort to grab middle-income market share, public charging demand should rise. That’s a powerful upside catalyst for CHPT stock.

On a technical note, CHPT stock is even more enticing because of its severe volatility in the prior day’s session. However, Rivian’s big news item may help provide a lifeline for the EV charging specialist.

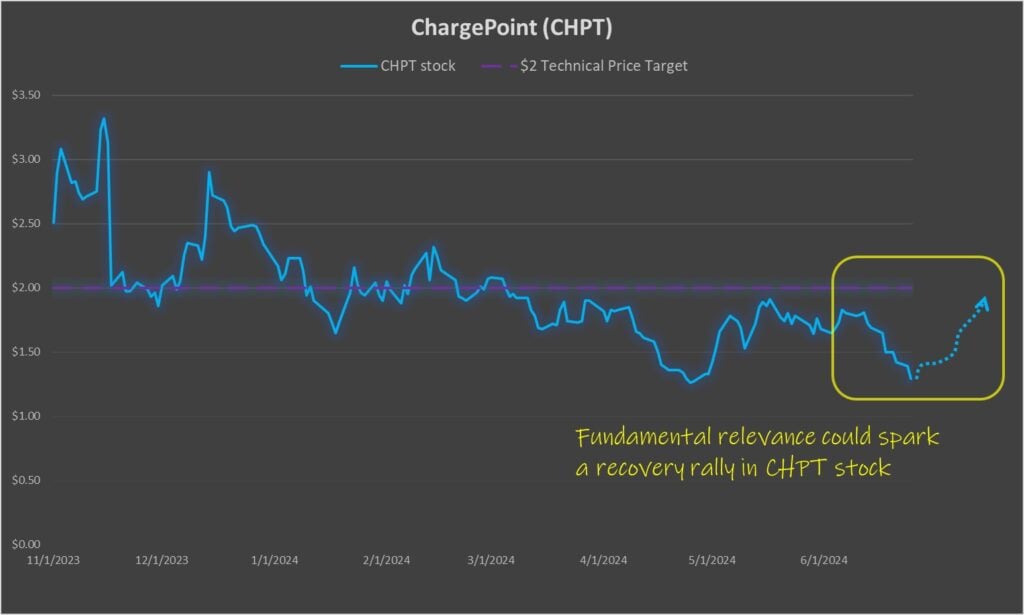

As for price targets, CHPT stock previously enjoyed support at $2. Therefore, I would expect the bulls to attempt to drive shares back to this point. Speculators could enjoy a very handsome return if this materializes.

At this moment, I’m not a big fan of CHPT stock options because of the wide spreads. However, given the news, extreme speculators may consider the 2024 Nov 15 $2 call, which features relatively high volume and several months for the bullish thesis to pan out.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.