Fintech stocks have been languishing since the end of the post-Covid boom, and most fintech names have been trading at bargain-basement levels for the past two years. That said, I believe it makes sense to use this near-term weakness as an opportunity to buy some of the top fintech stocks for the long-haul.

I think most fintech stocks will recover once interest rate cuts are handed down and transaction volumes increase. Most tech companies have seen a significant recovery so far. I expect this recovery to extend into the fintech sector in due time, especially when the banking sector also makes a full recovery, and lenders are more comfortable partnering up with fintech firms.

With that in mind, here are three fintech stocks to consider right now.

StoneCo (STNE)

StoneCo (NASDAQ:STNE) provides payment processing solutions and financial services in Brazil. The company delivered solid Q1 2024 results, with the company’s financial services segment performing well across all client offerings. While the company’s total payment volume growth, including PIXs, nearly matched the holiday shopping season volumes, the launch of instant payments fulfilled a key request from micro-merchant clients. I believe StoneCo is an undervalued fintech gem primed for an explosive bull run.

Despite trading sideways around $10-$20 per share for over two years, StoneCo’s underlying financials have steadily improved amidst challenging macro conditions. The company’s earnings per has have also rebounded significantly, and revenue has continued to grow.

As interest rates normalize and transaction volumes rebound globally, I expect STNE stock to inevitably break out as powerful tailwinds converge. Brazil’s rapidly digitizing economy presents a massive growth runway. And StoneCo’s structural renewal positions it to capitalize on a projected 30%+ compounded annual growth rate (CAGR) in adjusted net income through 2027.

While near-term headwinds have weighed on the stock, I view any weakness as a compelling buying opportunity for this misunderstood fintech leader. As StoneCo’s payments, banking, and credit offerings gain traction, the market should soon recognize its immense long-term upside potential.

Remitly Global (RELY)

Remitly (NASDAQ:RELY) provides cross-border remittance services to migrants worldwide. Despite facing significant headwinds that have pushed the stock down 34% over the past year, I believe RELY stock is an attractive long-term buy.

Yes, the company’s marketing spending is high, and profitability is elusive for now. However, Remitly’s strong Q1 results prove that its value proposition is resonating with consumers. Revenue surged 32% to $269 million, nearly matching estimates, while earnings per share of 8 cents handily beat expectations by 3 cents.

Analysts project revenue leaping from $1.24 billion in 2024 to $2.13 billion in 2027. More importantly, the company’s bottom-line earnings should skyrocket from 41 cents per share to $1.70 over that span as margins expand.

At just 29-times forward earnings and 1.9-times sales, Remitly’s growth potential looks drastically undervalued. I expect surging migration into Western nations to turbocharge growth ahead as more expatriates send money back home. The remittance mega trend has room to run. Analysts are also very bullish on this name, and I think they’re onto something.

PayPal (PYPL)

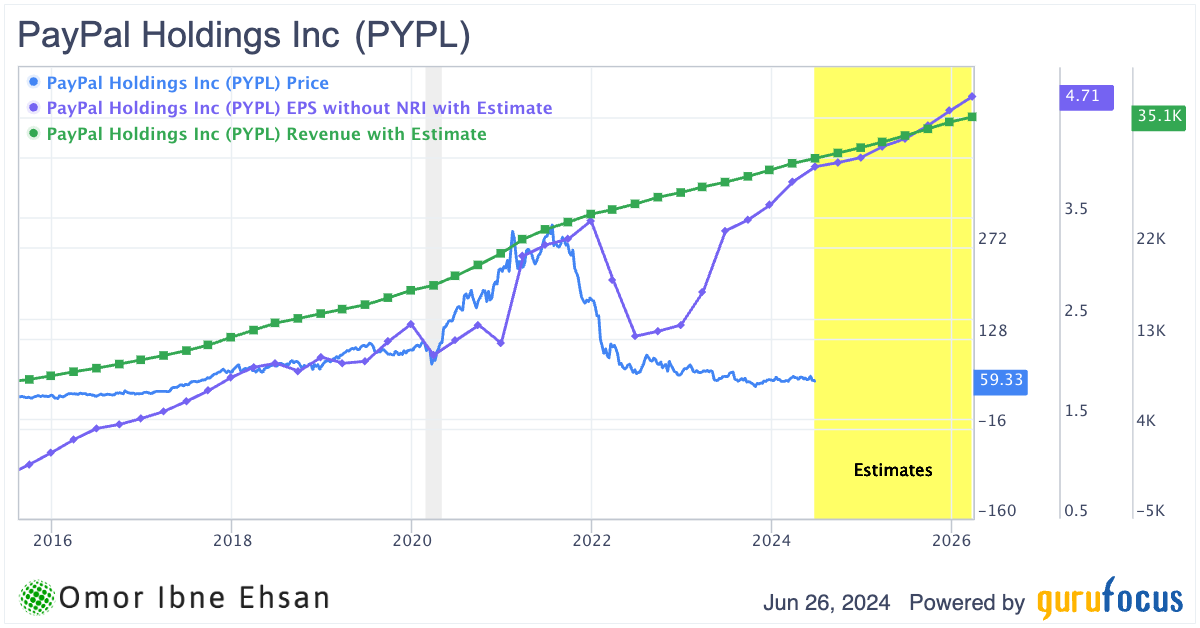

PayPal (NASDAQ:PYPL) is a leading digital payments platform connecting merchants and consumers worldwide. I believe PayPal stock is unfairly trading at half its pre-COVID levels despite delivering solid Q1 results that point to brighter days ahead for this fintech behemoth. The company delivered 10% currency-neutral revenue growth on an impressive $404 billion in total payment volume. This was driven by transaction margin dollars growing a better-than-expected 4% thanks to management’s targeted actions. While PayPal is still in the early stages of a multi-year transformation, Q1 provided encouraging signs that its efforts to drive profitable growth are bearing fruit.

Active account growth is still a problem. But even then, I believe that PayPal should have a much higher valuation since it has proven that it can squeeze more and more out of its existing user base. Its core financials have been very solid and many metrics have seen a full rebound.

Notably, PayPal repurchased $5 billion of its undervalued shares last year and is executing another $5 billion buyback this year. The company has also reached an inflection point in active accounts, and revenue growth has stabilized at around 8%. I believe the market is myopically mis-pricing this household name.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.