Hello!

Thomas Yeung here.

In September 2001, I made my first Amazon purchase – a two-quart Brita water filter pitcher. My housemate called it “free water,” and so my second purchase from the then-young e-commerce site was for three filter replacements.

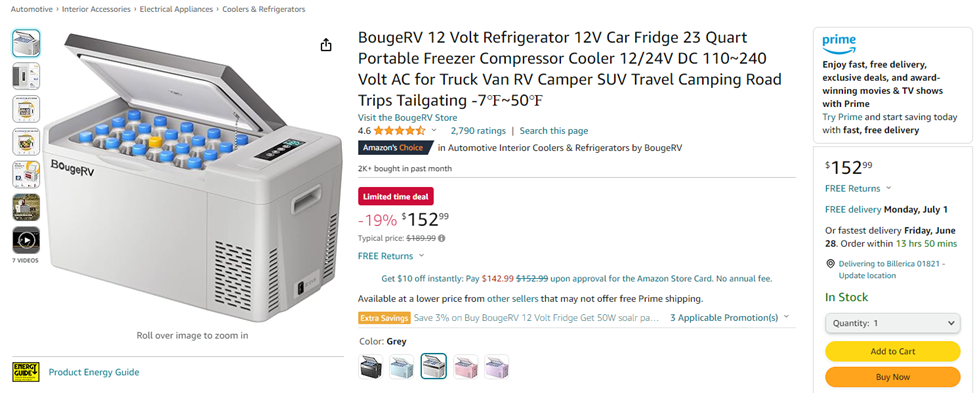

Fast forward two decades, and Amazon.com Inc. (AMZN) has become far more than a place for the bare necessities. When its 10th annual Prime Day event arrives next month, it will feature deals on everything from pickleball paddles to 12-volt car refrigerators.

No assembly required

Users will be lining out the virtual door to snap up these items. According to website tracker Similarweb, Amazon is expected to generate a record $14.7 billion in Prime Day sales – a 14% increase from $13 billion in sales the year before. Lower-ticket products have become particularly popular, as American customers seek to cut back on spending while still having some fun.

The company’s popularity has done wonders for Amazon’s share price. Since 2001, Amazon’s stock has risen from a split-adjusted $0.40 to well over $180 today. Even its recent history has been nothing short of spectacular. Since Eric added shares of Amazon to Fry’s Investment Report in 2022 (current members can log in here), shares have notched a 101% return.

But Amazon’s 30th birthday next month – and its 10th Prime Day – hides an even more significant fact…

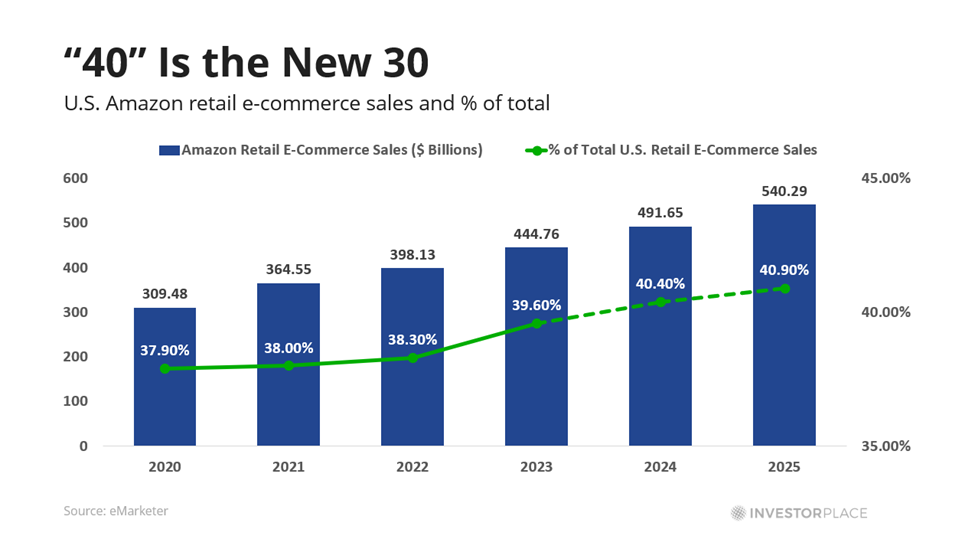

Amazon could hit a record 40% e-commerce market share later this year.

In today’s Smart Money, let’s take a look at why that number is so important…

And at a company that could soon reach a 40% market share itself…

Why 40 Is One of Investing’s Magic Numbers

It turns out that 40% market share is the “magic number” when companies begin earning supernormal returns. Apple Inc. (AAPL) reached that figure in the early 2010s with U.S. mobile phones, giving it the profitability needed to keep expanding. And roughly 40% of U.S. digital advertising spending goes through Alphabet Inc.’s (GOOG) ad services. Once companies reach that threshold market share, they can often appear to be a monopoly (and charge customers like one), even when they are not.

The gold-standard Profit Impact of Market Strategy (PIMS) study, for instance, notes that companies with market shares above 40% earn returns on investment of 30% on average – three times more than the average firm. A separate 1991 landmark study found that company profitability began to rise exponentially at 40% market share. (The effect begins to taper off at roughly 50%.)

In fact, this 40% figure is so notable that even the European Commission (EC) uses it as the cutoff point in antitrust cases to determine whether a company is “dominant” or not. (As a sidenote, the EC makes it clear that holding a dominant market position is “not in itself illegal,” since the company must also abuse that power before getting further scrutiny.)

That’s significant because Amazon has historically emphasized revenue growth over profits. The company has averaged single-digit returns on invested capital for the past decade, and remains stingy with what cash it generates. The firm has never issued a single dividend and has only bought back shares once, in 2022.

That could soon change as Amazon reaches its 40% market share in e-commerce. Analysts now expect return on invested capital to surge from 13% to 21% this year, and for free cash flow to rise 77% to a record $57 billion. By 2026, the e-commerce juggernaut could be printing $100 billion in free cash flows annually.

That will completely change the economics of the company. Not only will the Seattle-based firm begin generating more money than it can reinvest… it will be doing so all at once.

That means Amazon will suddenly find itself in a position to rule over e-commerce. The company could invest in infrastructure and bring same-day shipping coverage to nearly 100% of major American metro areas drive up its market share and future profits. Amazon could also funnel its cash into dominating other industries like cloud computing (where it currently has a 31% market share), video streaming (22% share), and online pharmacies. It could also start issuing a dividend, which has historically boosted share prices for tech firms.

The near term is also looking strong for the tech giant, thanks in part to AI and data center demand. Analysts have now raised their 2024 earnings-per-share estimate to $4.54, up from $3.61 earlier this year. And analysts aren’t just raising their earnings estimates, they’re hiking their price targets, too. On Wednesday, Justin Post, a Bank of America Securities analyst, upped his price target on Amazon from $210 to $220. The firm broke through a $2 trillion market cap following the news – joining the ranks of Apple, Alphabet, and Nvidia Corp. (NVDA), all of which sport market caps of at least $2 trillion.

The Next Amazon

Companies like Amazon are easy for most investors to overlook. These firms can have slow earnings growth to start and are generally priced at a premium. This has the unexpected effect of turning off both growth and value investors simultaneously!

Fortunately, those who “missed” Amazon’s rise now have another chance at capturing meteoric gains… through Eric’s most recent Fry’s Investment Report recommendation.

It’s the dominant e-commerce player of a fast-developing country…

It’s growing more than twice as fast as Amazon…

And it’s just turned cash-flow positive for the first time last year.

In other words, Eric’s latest pick is where Amazon was in 2014… right before free cash flows took off. To learn more about this global company aiming to be the next Amazon, click here.

As a reminder, our offices will be closed next Thursday and Friday in observance of Independence Day. So, I’ll see you here again in two weeks.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace