The biggest fear in this market … comparing 2009 to today … are we facing the end of an empire? … what’s at risk of breaking … “eat your vegetables” investing

The #1 macro fear today boils down to this:

The Fed will keep rates too high, for too long, until something breaks.

What, exactly, does this mean?

Some investors answer this by looking back to the Great Financial Crisis where “something” was the banking system, and “breaks” meant a meltdown of the global economy.

This isn’t where we are today.

Different factors have gotten us into our latest mess. And that means that the potential headwinds in front of us will be different than in 2009.

To position our investments appropriately for this difference, we need to accurately contrast “then” versus “now.”

Why 2008/2009 isn’t a good comparison for where we are today

Joy filled bubbles and despair filled bursting bubbles begin with an abnormal money expansion.

A torrent of capital floods into a corner of our economic or investment system, traditional dynamics become distorted, the weight grows unbearable, and something breaks.

The 2009 meltdown originated from a massive money expansion from private credit that fueled the bull market/bust in housing. The private sector leveraged itself to the eyeballs as it chased gains in the housing boom.

Eventually, the weight of the leverage grew unbearable, resulting in a violent economic fracturing. The fallout nearly took down our banking system.

This is not where our primary risk lies today.

Yes, some regional banks appear fragile thanks to the trainwreck in commercial real estate.

Plus, last Friday, banking regulators pointed at some weaknesses in the resolution plans of Citigroup, JPMorgan, Goldman Sachs, and Bank of America (how banks will unwind their operations in case of a failure). They also highlighted “shortcomings” about each of these banks’ derivatives portfolios.

While this raises an eyebrow – and we’ll be monitoring closely – our banking system appears in mostly decent shape today.

So, what’s at risk then?

To answer that, let’s begin by asking a different question: What’s fueling today’s money expansion?

While we had private credit to thank for the 2007-2008 money expansion, today, there’s a different source…

Global government spending.

In the wake of the pandemic, governments flooded the financial markets with a multi-trillion-dollar tsunami of capital, inflating the money supply to historic levels.

Unfortunately, U.S. government outlays haven’t slowed much since.

As we noted in the Digest two weeks ago, President Biden has proposed spending nearly $7.3 trillion in Fiscal Year (FY) 2025. That’s 24.8% of GDP under his latest budget.

This would be the largest amount ever spent in nominal dollars – even higher than COVID-era levels.

And relative to GDP (which Treasury Secretary Yellen loves to reference, assuring us today’s level is okay), this spending would be larger than any time in history beyond World War II and the pandemic.

Now, when the private sector credit gets too big as a percentage of our nation’s GDP and “something breaks,” you get a dangerous credit event.

The question today is what will break when it’s our government’s debt spending that gets too big as a percentage of a nation’s GDP?

While we don’t know the exact answer, history offers a clue – or rather, lots of clues.

Here’s historian Niall Ferguson:

Any great power that spends more on debt service (interest payments on the national debt) than on defense will not stay great for very long.

True of Habsburg Spain, true of ancien régime France, true of the Ottoman Empire, true of the British Empire, this law is about to be put to the test by the U.S. beginning this very year.

If you’re wondering, yes, the Congressional Budget Office projects that the federal government will spend $892 billion this year for interest payments, which will surpass the amount spent on defense.

(It’s also nearly as much as what’s spent on Medicare.)

Brushing this off suggests that you probably weren’t a history major

The duration of Rome’s empire puts ours to shame.

While American dominance really began after the second World War, Roman dominance spanned 500 years (we’re focusing on the Western Roman Empire, not the Eastern, which added another 1,000 years).

Many factors fueled its decline, but Rome’s excessive spending on its administrative state was a big one. Debt financing led to currency debasement, which led to high inflation, which weakened its economic stability and defense capabilities.

Fast forward to the fifth century and the Roman Empire could no longer defend against Germanic barbarians. The fall of Rome ensued.

This pattern of fiscal irresponsibility weakening a powerful nation, eventually resulting in collapse repeated with Spain. Its military and global explorations required enormous debt funding and high taxation which led to debasement and the end of its global dominance…

We then saw it with France. Excessive government spending and high taxation led to defaults, wealth inequality, and ultimately, the “let them eat cake” French Revolution in 1789…

China – the Qing Dynasty fell in part due to its excessive spending and borrowing…

And Britain – its vast global colonial empire required enormous debt spending that zapped economic strength and eventually crushed the British pound…

Bottom line: This is a well-worn pattern – one that our nation’s leaders appear to be repeating today.

Now, could this time be different?

Sure, it’s possible. At a minimum, we could kick the can down the road for years to come. In discussing this with our Editor-in-Chief and fellow Digest writer, Luis Hernandez, he pointed out a few key differences:

- The U.S. dollar, which remains the world’s reserve currency, will help support U.S. power on the global stage for the foreseeable future

- If necessary, our nation could be food and energy independent

- And our borders are protected by oceans and friendly neighbors, whereas many European dynasties of the past had no such luxury.

Nevertheless, paying attention to history’s cautionary tale is warranted.

So, what’s at risk of breaking when governments are behind money expansion distortions?

History suggests that there are a few consistent frontrunners.

We’ll briefly walk through them from a U.S.-centric perspective, looking forward from today:

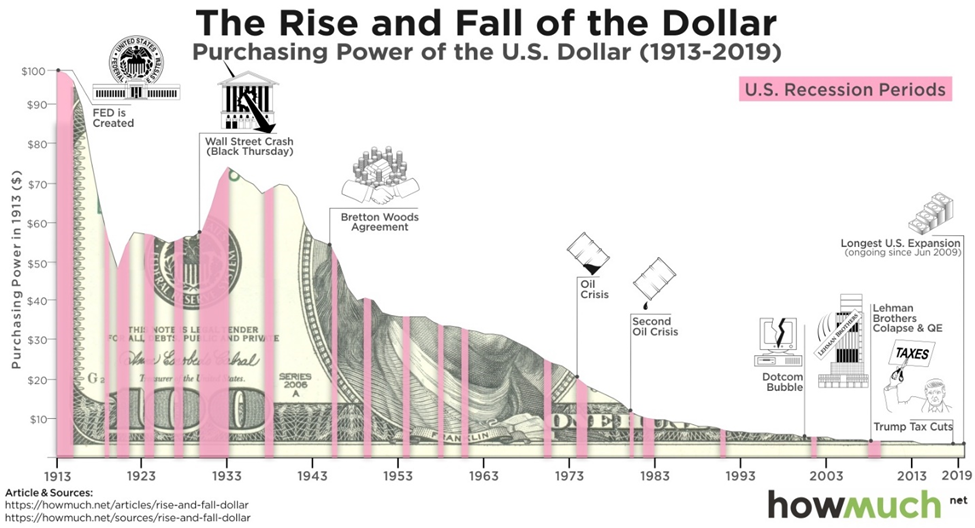

Potential break #1: The purchasing power of our currency.

The buying power of the U.S. dollar has been in a slow-motion trainwreck for decades.

This will only accelerate as our government borrows and spends more.

Potential break #2: Lower-income Americans who can no longer make ends meet each month.

The headline retail spending data suggesting we have a relatively strong U.S. consumer is deceiving. The financial position of lower-income Americans is deteriorating.

As just one illustration, the number of Americans working two jobs is soaring.

From Benzinga:

8.7 million Americans are now balancing two jobs to make ends meet… The number of people working multiple jobs has seen a significant increase, a clear sign of the economic pressures still burdening the average person.

This number is the highest since pre pandemic and is growing by hundreds of thousands per month. In October, the number was just under 8.4 million jobs.

Potential break #3: U.S. Treasury yields soar as foreign buyers eye our government’s financial position with increasing skepticism.

This past October, Chinese investment in U.S. debt hit a 14-year low. This is happening at the same time that our Treasury is having to issue more securities to pay for all its spending obligations.

To be clear, there’s still enormous demand for our federal debt and will be for years. The issue is at what price and what yield, and what will those yields to do the economy?

Potential break #4: Higher for longer inflation.

While many talking heads are declaring that our victory over inflation is imminent, just yesterday, we learned that inflation in Canada unexpectedly came in at 2.9% versus the 2.6% forecast.

And for anyone wondering, yes, Canada has already cut rates.

Don’t think that Fed Chair Powell isn’t watching this with an icy shiver running down his spine.

But the greater concern is long-term inflation. Enormous debt and deficit spending is inherently inflationary. Without a marked change in policy, higher inflation is in our future.

Potential break #5: A fracturing of our nation’s social cohesion.

Our nation faces two widening gaps: our economic “haves” and “have nots,” and the political left versus right.

The lack of overlap in both Venn Diagrams threatens to rot out our nation from the inside as we lose common values and a collective sense of shared identity.

Now, stepping back, none of these potential “breaks” will happen tomorrow.

It’s not as though you’ll wake up to The Wall Street Journal featuring the headline: “China Officially Stops Buying 10-Year Treasuries.”

It’ll be more like how Hemingway wrote about one of his character’s going bankrupt – gradually, then suddenly.

We’re into the “gradually” part now. No one knows when the “suddenly” will appear. But the fact that we’ve crossed the proverbial Rubicon in terms of our national debt service topping our defense spending is a notable red flag.

The timing of potential fallout will be greatly influenced by our political leaders, and whether they’re willing to make wise-yet-unpopular policy choices.

So, what do you do from an investment perspective?

Balanced diversification.

You want to own the stocks of fantastic companies that will be around in 20 years. Look for companies that can raise their prices to protect margins in an inflationary environment. And if they pay healthy dividends, all the better.

You also want some cash. Too much is dangerous to your overall wealth as currency debasement continues melting purchasing power. But if there’s a quick and violent market dislocation, you want dry powder to take advantage.

Then there are hard assets. Homes, rental real estate, farmland, gold, silver. Anything that will retain value outside the U.S. dollar.

All of this is common sense. It’s the investment equivalent of “eat your vegetables.” The problem is a lot of people don’t eat vegetables.

Finally, rather than another asset for your portfolio mix, we suggest a diversified action for your portfolio mix. Specifically, earmark some of your wealth for trading rather than buy-and-hold investing.

If our nation continues down this path, our investment markets are in for heighted volatility. This will be a fantastic environment for traders who know how to benefit from the fear and greed of other investors.

Here in the Digest , we’re going to be highlighting all sorts of trading opportunities from our experts in the coming months. Perhaps this is the Ozempic of investing…

Coming full circle, what’s the takeaway from our “then” versus “now” comparison?

The biggest differences are in timing and scope.

In terms of timing, 2009’s credit event was fast and destructive. Today’s government spending event – though accelerated by the Fed’s current “higher for longer” rate policy – will be slower, yet no less destructive eventually (if not prevented).

However, the Fed’s timing in cuts is an important variable. If “higher for longer” wins the day, it will speed up the coming fallout. Similarly, if our new baseline for interest rates is, say, 4%, that will add to the financial pressures weighing on our government.

Meanwhile, in terms of scope, 2009’s credit event risked our banking system. Today, what’s on the line is America’s global leadership and the quality of life of its citizenry.

And if you think I’m being grandiose, please read more about the declines of Rome, Spain, France, China, and Britain that we highlighted earlier. You’ll see many parallels.

The good news is that there’s still time to slow down or even avoid a worst-case scenario. The bad news is doing so will require new policies from our politicians that are unlikely to get them re-elected.

In any case, one thing is true…

The damages from our politicians’ bad choices from yesterday are increasingly obvious today… and appear increasingly ominous tomorrow.

Have a good evening,

Jeff Remsburg