Louis’ take on the presidential debate … his timing for rate cuts … where the market goes over the next few weeks … your last chance for Louis’ AI mania stocks

Will President Joe Biden be replaced on the Democratic ticket?

Where is the market headed over the next several weeks?

Will the Federal Reserve cut rates in September?

Today, we’ll get answers from legendary investor Louis Navellier.

In Friday’s Special Market Update Podcast in Breakthrough Stocks, Louis walked through the issues above and far more. In this Digest, let’s see how this 47-year veteran of the markets is sizing up the current state of the world.

We’ll begin with Louis’ thoughts on last Thursday’s Presidential Debate:

It looks like Donald Trump is going to get reelected president because Joe Biden just wasn’t there. It’s sad to say.

All the pundits on CNN were calling for [Biden] to be replaced. The Financial Times has a poll where 91% of the respondents said he should be replaced.

Obviously [California Governor] Gavin Newsome was at the debate. Obviously, he’s waiting to step in and give it a go. He would get more votes than Biden…

There’s also a call not to have another presidential debate because as long as Joe Biden is not really with it, it’s a threat to our national security.

So, it will be fascinating to see if he is replaced. And it will be fascinating to see if there’s going to be a September 10th debate.

As I write Monday morning, RealClearPolling.com puts the odds of a Trump victory at 53.7%. A Biden win is at 19.7%. And Newsome comes in third (beating Vice President Harris) at 8.0%.

If President Trump is re-elected, what would that mean for the investment markets?

Wall Street might respond more favorably to Trump due to increased likelihood of tax cuts and deregulation compared to Biden.

Beyond that, a Trump win would mean more support for the oil and natural gas industry with less of a push behind green energy.

Long-dated bonds are likely to remain questionable because Trump’s spending (impacting our nation’s deficit and debt) probably won’t be materially different than what we’d see from Biden. That should keep a bid under gold and silver.

Meanwhile, though Trump was a vocal critic of Bitcoin in the past, he’s flipped his position recently, saying on the campaign road, “We will ensure that the future of crypto and the future of Bitcoin will be made in America. Otherwise, other countries are going to have it.”

In terms of the Fed, Trump has said that he likely wouldn’t bring back Federal Reserve Chairman Jerome Powell for another term. And it’s also safe to assume that – for better or worse – Trump would heavily pressure the Fed to begin cutting rates yesterday.

On that note, let’s dovetail into Louis’ thoughts on when Powell & Co. will cut rates.

What does last Friday’s PCE data mean for the timing of the first rate cut?

As we noted in the Digest, the Fed’s favorite inflation gauge, the Personal Consumption Expenditures Price Index (PCE) came in according to expectations last Friday.

The core personal consumption expenditures price index increased just a seasonally adjusted 0.1% for the month and was up 2.6% from a year ago. Those readings also were in line with expectations.

Over to Louis:

The annual core PCE inflation is now running at the lowest pace since March of 2021. So, inflation, according to the Fed’s indicator, is now at the lowest level in over three years.

What are they waiting for? Start cutting.

I’m still in the camp that they should cut on July 31st. Obviously, the consensus is they’ll cut on September 18th.

We’ll see.

If we look at the CME Group’s FedWatch Tool, traders are putting a 58.2% probability on the Fed cutting interest rates by a quarter-point in September.

However, let’s remember how quickly these odds can change. You’ll recall that at the start of the year, these same traders expected we’d get six quarter-point cuts this year. Today, the plurality expectation is for just two cuts, but that receives just 43% odds.

So, the probabilities mean very little. It’s all about the data – rather, it’s all about how the Fed feels about the data.

Turning to the market, where does Louis see it going, and what’s his approach today?

Back to the Breakthrough Stocks podcast:

We tend to rally going into the July 4th weekend.

After July 4th, we might pause, stutter-step… the next earnings announcement season is going to be great for us. Still very easy year-over-year comparisons.

Those comparison will get a little tougher moving forward. But hopefully the Fed will be cutting rates, and the stock market will get a boost from that.

Our best defense is a strong offense. You’ve got to be in the best stocks that are being accumulated by institutional investors.

That’s what our quantitative research does, which looks for high alpha stocks. Alpha is a stock’s movement independent of the market.

Louis then leaks the formula of his “top-secret quant ratio,” concluding “I’ve been doing this for over 40 years, and it’s very important.”

As to what this top-secret quant ratio is highlighting today, we profiled it last week – a mania in select AI stocks

Last Tuesday, Louis held his Prediction 2024 event that pulled back the curtain on what he believes will be the last great investment mania of his lifetime.

Here he is describing the potential impact on your portfolio:

This financial mania could open the kind of moneymaking opportunity I haven’t seen in two decades. The closest comparison to what’s coming next is what happened 25 years ago: The dot-com boom.

Now, while this mania does involve AI, it doesn’t focus on the obvious AI players you might expect, like Nvidia. While Louis love Nvidia, its current share price already reflects the massive, euphoric expectations about its forward-looking performance.

From Louis:

Don’t get me wrong, buying Nvidia was a good idea – twenty years ago when I first recommended it (for up to 37,000% gains).

But chipmakers are the first generation of AI. And just like the dot-come era, that’s not where the big money will be made.

Instead, Louis believes the “real” AI boom – has just begun with six other stocks. You can get the full rundown when you watch a free replay of Louis’ event last Tuesday right here.

But I’ll give you one example of the power of Louis’ quant-system when applied to today’s second generation of AI mania.

A stock that Louis gave away for free last Tuesday evening was Alarum Technologies (ALAR). Since then, the stock has jumped nearly 70%, before pulling back to being up about 43% as I write.

Alarum provides internet access and web data to clients around the world. It’s a strong long-term play on this AI mania that’s already seen its stock explode from less than $2 in March of last year, to nearly $40 as I write. This is the type of performance Louis believes is possible in what he’s called the last great investment mania of his career.

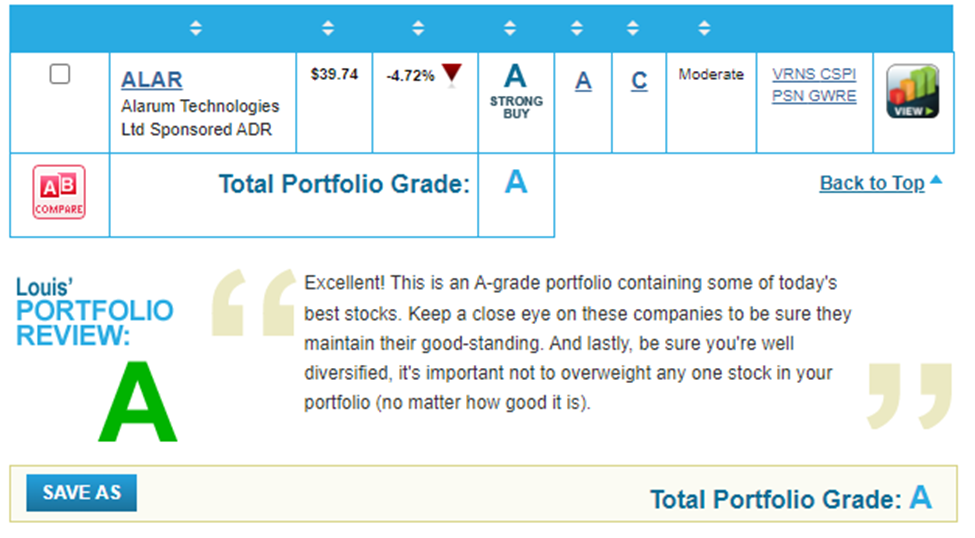

I’ll also note that ALAR receives an “A” rating in Louis’ Portfolio Grader tool.

Regular Digest readers know that fundamental strength, as evidenced through earnings superiority, underpins Louis’ entire market approach. Fortunately, Louis has codified much of his proprietary quant-based market system, and now offers it to the investment community through his Portfolio Grader.

Here’s how ALAR shapes up:

Just this morning, Louis leaked another recommendation. It trades for about $55 a share, and Louis thinks it’s going to double this year.

To get the full analysis of this AI mania, and to learn which stocks Louis believes are taking the baton from Nvidia, check out last week’s free presentation here. We’re taking the presentation down at midnight tomorrow, so this is your last chance.

Wrapping up, as we look around the world today, I think Louis said it best in his podcast…

Fascinating times we’re living in.

We’ll keep you updated on all these stories and more here in the Digest.

Have a good evening,

Jeff Remsburg