Editor’s Note: The stock market will be closed on Thursday, July 4, for the Independence Day holiday. The InvestorPlace offices and customer service departments will also be closed on July 4, as well as Friday, July 5, for the holiday. I hope you enjoy the long weekend!

Well folks, can you believe we are now officially halfway through the year?

And what a first half of 2024 it was! Following the market close this past Friday, June 28, the S&P 500, Dow and NASDAQ were up 14.5%, 3.8% and 18.1%, respectively. Not to mention that the S&P 500 and NASDAQ have hit a string of record highs, and the Dow broke above 40,000 – a key milestone for the index.

To put this into perspective, our friends at Bespoke pointed out that the S&P 500’s average gain in the past 71 years was 4.72%.

Now, following this strong start to the year, there are still several factors that could impact broader market direction (such as the Federal Reserve cutting rates, the presidential election and the lull of the summer months). So, I know some investors are wondering if this strength will continue.

However, I expect July to be a strong month for Wall Street, so I’ll use today’s Market 360 to explain why. Then I’ll share an event that could also impact the market this month… and how you can profit from it.

Another Fantastic Month in the Cards?

I don’t have a crystal ball and I am not a fortune teller. But I am a numbers guy.

So, I can tell you that, based on historical precedence, I believe July will be another fantastic month for the markets.

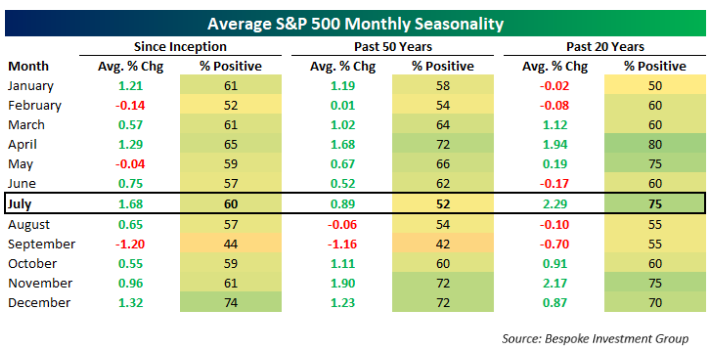

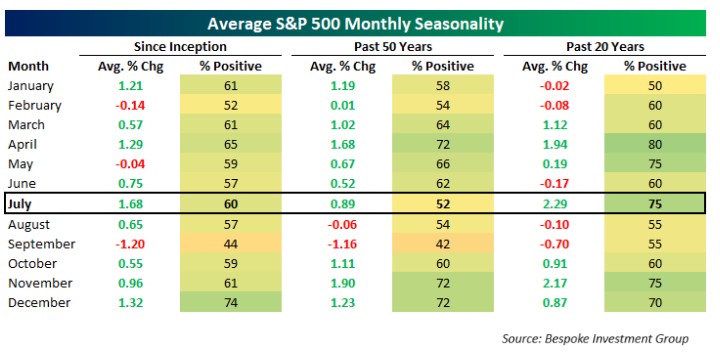

July is historically the best month of the year for the S&P 500. Our friends at Bespoke note that the S&P 500 has risen an average 2.29% in the past 20 years, with gains 75% of the time.

Equally impressive is the Dow’s historical precedence in July. The month of July has been the strongest month for the Dow for more than 100 years. In fact, the Dow has posted an average gain of 1.73% in the past 100 years, and in the past 20 years, it’s achieved an average gain of 2.09%, with gains 80% of the time.

The market is already off to a solid start this month, with the S&P 500, Dow and NASDAQ all meandering higher on Monday. This momentum should continue to build – thanks to the Fourth of July holiday this week. With the holiday on Thursday, the stock market will close early on Wednesday and be closed completely on Thursday.

Typically, the stock market will rally heading into long holiday weekends. The fact is folks on Main Street look forward to a few days off work, and this positive mood often spreads to Wall Street – and drives stocks higher.

Once the markets are back to a normal trading schedule, the second-quarter earnings season will start up…. and I’m anticipating some incredible fireworks.

The fact is the second-quarter earnings is expected to be even stronger than the first quarter. In the first quarter, the S&P 500 achieved 6.0% average earnings growth. For the second quarter, FactSet currently projects the S&P 500 will achieve earnings growth of 8.8%. Revenue is anticipated to grow 4.6%.

A New Market Boom

Now, earnings season is always my favorite time of year, as this is when Wall Street shifts its attention to fundamentals. Typically, companies that post strong earnings results are rewarded, while companies that announce weak results are punished.

But this summer, there is another event that could lift select stocks.

I’m talking about the Real AI Boom.

Right now, Wall Street is still focused on the first-generation artificial intelligence, the chipmakers and AI apps released by Big Tech companies. But what they don’t realize is that’s not where the real big money will be made.

Instead, the winners will be the companies that use AI to reinvent or automate some of our oldest business models. In other words, the next-gen AI companies.

I’ve been keeping a close eye out for next-gen AI company, and just yesterday I found a new one. This company created an optical compute and memory fabric solution that can help boost AI infrastructure. It also has the ability to create, scale and sustain future AI models. In addition, it boasts strong earnings, so it should benefit from the second-quarter earnings season and the Real AI Boom.

For more details on the Real AI Boom – and how to access my new next-gen AI pick – watch my Prediction 2024 briefing now. After midnight tonight, this briefing goes offline. So, today is your last chance to watch it.

Sincerely,

Louis Navellier

Editor, Market 360