How are Q2 earnings shaping up? … Wall Street analysts are sandbaggers … how to profit even if you guess the wrong direction … what will the next six months bring?

Second quarter earnings season kicks off in earnest next week when the Big Banks report.

How are the earnings expected to come in for the S&P?

Here is data from FactSet, which is the go-to earnings data analytics company used by the pros:

For Q2 2024, the estimated (year-over-year) earnings growth rate for the S&P 500 is 8.8%.

If 8.8% is the actual growth rate for the quarter, it will mark the highest year-over-year earnings growth rate reported by the index since Q1 2022 (9.4%).

In terms of estimate revisions for companies in the S&P 500, analysts in aggregate have lowered earnings estimates slightly for Q2 2024. As a result, the estimated (year-over-year) earnings growth rate for Q2 2024 is slightly below the estimate at the start of the quarter.

Regular Digest readers aren’t surprised by this lowering of earnings estimates. It’s all part of the game Wall Street plays to keep the market gains coming.

How professional sandbagging works on Wall Street

Buy-side analysts usually work for groups that manage money – think hedge funds and private equity groups.

These buy-side analysts know that their clients will be far more forgiving of earnings estimates that are too low rather than too high. After all, if you’re an analyst whose recommendations do even better than you projected, you have a happy client – and a loyal customer who keeps paying you.

But if real earnings consistently come in below your projections, your customers will likely be holding stocks that selloff in the wake of the earnings misses. This results in very unhappy clients who are likely to take their money elsewhere.

So, what we see, quarter after quarter, are earnings estimates that undershoot the mark. This way, earnings can miraculously beat expectations, financial talking heads can boast of the “unexpected” strength of the stock market, and analysts can keep their gravy trains rolling.

But don’t take my word for it. This time last year, FactSet ran the numbers on this, concluding:

…The actual earnings growth rate has exceeded the estimated earnings growth rate at the end of the quarter in 37 of the past 40 quarters for the S&P 500. The only exceptions were Q1 2020, Q3 2022, and Q4 2022…

If these analysts were truly impartial, it would be impossible for them to be wrong – in just one direction – 37 out of 40 quarters.

Now, if you’re looking to trade this upcoming earnings season, you might conclude that this sandbagging means you’re safer placing bullish bets based on “surprisingly” strong earnings.

And while you’re right overall, there’s a far better, less stressful approach.

How the pros use options to trade earnings

For newer readers, Jonathan Rose is the analyst behind the free trading service Masters in Trading Live. He’s also a trading veteran who’s pulled millions out of the market over the last 10 years.

In recent weeks, we’ve shone a spotlight on one of Jonathan’s favorite ways to approach earnings season. It involves options, which when used correctly, actually decrease your risk because you can specify ahead of time exactly how much money you’re willing to stake on a trade.

Don’t want to lose more than $100? Fine, you can engineer that.

If that trade goes your way, that $100 could turn into $500, $1,000, or more because of how powerful options can be.

Now, while the average trader will use an option to speculate on the direction a stock will move in the wake of its earnings announcement, that’s not how Jonathan, or other pros, trade.

Here he is describing his method:

What we’re doing is using historical data, the historical movement of stocks and options, and we’re making sure the options are pricing in enough movement relative to history.

If not, we’re making calculated bets of a fixed amount of risk with the potential for big gains.

Let’s make sure we’re all on the same page about how this works.

How to profit, even if a stock moves the opposite direction that you expected

Jonathan uses historical data to establish a baseline for how much a stock and its options move in the runup to an earnings announcement. For example, say the average baseline move is 8%, and this has been consistent for the last 10 quarters.

Though there’s no guarantee that the move will be 8% this time, history suggests the odds are good.

Next, imagine that 45 days from the earnings announcement, the market makers are pricing in a move of just 5%. Well, based on historical data, that’s a pricing imbalance – and potentially, a very profitable trade.

In this situation, Jonathan will buy two options – one that will benefit if the stock roars higher after earnings, and one that will benefit if the stock collapses.

It doesn’t matter which direction the stock moves, Jonathan profits as long as the move is big enough (enabling the winning side of the trade to net out higher than the losing side of the trade).

A recent example we’ve provided is Jonathan’s trade on Pure Storage (PSTG). When it reported earnings back in February (its 2023 Q4 earnings report), Jonathan’s subscribers walked away with 193% gains in just over three weeks.

Below, notice how one side of the trade went to $0, but because the profitable side exploded 474% higher, the overall gain was nearly 200%.

This can make trading far less stressful because you don’t have to guess the direction right. So, even though Jonathan might have a hunch that a stock is going to soar, if it implodes instead, and if that implosion is big enough relative to the size of the move that the market makers had priced in, he wins.

The key here is correctly identifying these pricing imbalances. That’s where Jonathan uses powerful computers that scan the market to identify these set-ups.

With Q2 earnings season beginning next week, this is a great time to learn more about Jonathan’s approach. For more details directly from Jonathan, click here.

Candidly, this is one of the best ways to play earnings that I’ve seen in my 25 years in the market. And Jonathan is one of the finest teachers I know.

Here are a few of the kudos he’s received recently from subscribers who share my opinion:

- “Jonathan, I want you to know I really appreciate the way you teach us from a professional perspective. It’s helping”

- “Appreciate all that you’re doing and planning for us!”

- “Thank you, JR! As a self-learner, you can get info from so many resources, but until someone who really understands can show you a hard example, I am always a little apprehensive. Thanks for helping build my foundation of knowledge.”

Here’s the link again if you’d to learn more about trading earnings with Jonathan.

Before we wrap up, a quick note about the back half of the year

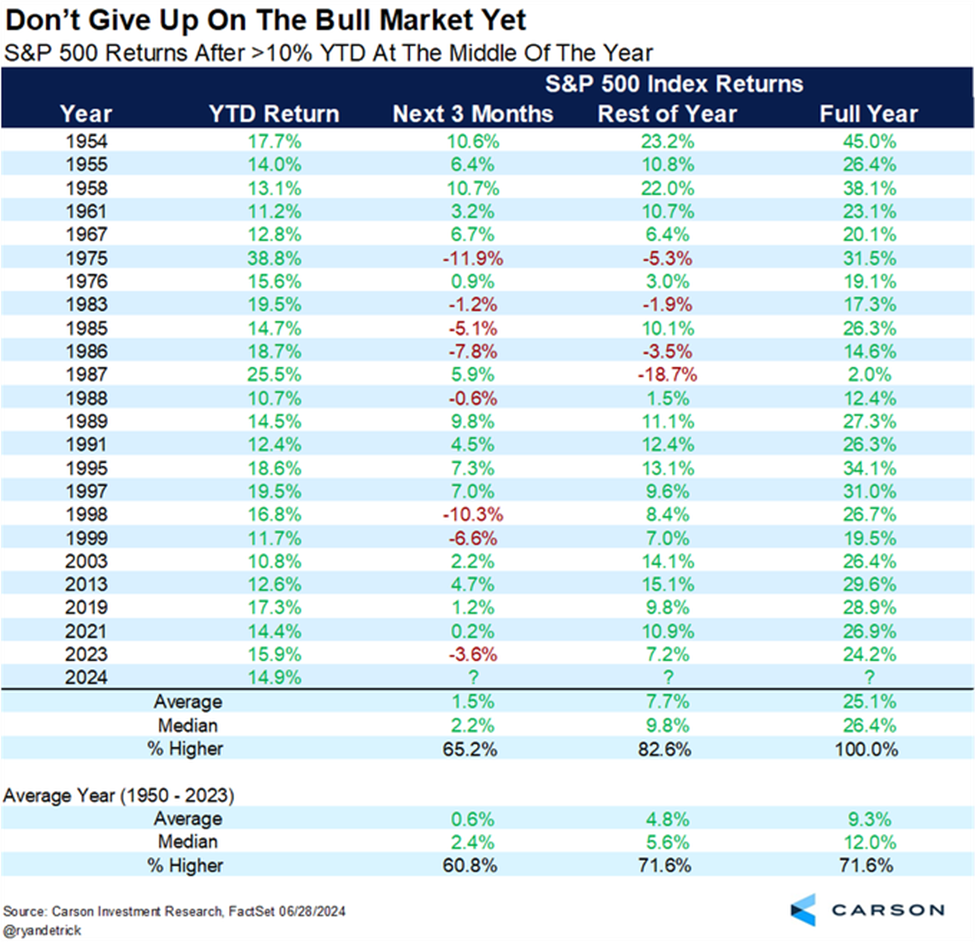

We’re going to do a “first half” retrospective in a future Digest, but as we enter the second half of 2024, after climbing 14% during the first six months of the year, what direction does history suggest the S&P is headed?

Up.

Our Editor-in-Chief and fellow Digest writer, Luis Hernandez, pointed me toward the following research from analyst Ryan Detrick:

S&P 500 up double digits at the midpoint of the year?

Full year never lower and up 25.1% on avg.

Rest of year up avg 7.7% (median 9.8%) and higher nearly 83% of time.

But what about the red flag issues we’ve identified over the last six months?

They’re still here, and we’re still watching them closely. But we don’t fight a market that’s trending bullish.

Even if a significant correction is on the way, there could be double-digit gains standing between then and now. So, let’s not outsmart ourselves. A bearish prediction – while eventually correct – could cost you tens of thousands of dollars in missed gains if your timing is wrong and you’re hunkered down on the sidelines.

Let’s avoid that.

So, our gameplan remains the same: Mind your stop losses, be wise about your position sizes, remain diversified, but stay in this market until its cardinal direction changes.

For now, the trend is our friend.

Have a good evening,

Jeff Remsburg