The attempted assassination of Trump … a huge redirect of capital in the financial markets … a multi-year bull? … how to invest in your portfolio

The historic news over the weekend was the attempted assassination of former president Donald Trump.

While we’re waiting for more details to emerge, that’s not stopping the betting markets from recalibrating the probabilities of each candidate’s presidential prospects.

As I write Monday morning, the implied odds of a Trump second term have shot up to 71%. This is fueling the so called “Trump trade.”

While we’d hardly consider the presidential race in the bag for Trump, it would be wise to consider what parts of the market would excel under his second presidency. We’ll bring you our experts’ thoughts in the coming days.

In the meantime, from a big-picture perspective, a Trump reelection would likely mean extended tax cuts and hawkish trade policies such as heavy tariffs. It also would mean more support for the oil and natural gas industry with less of a push behind green energy.

Long-dated bonds would remain questionable because Trump’s spending (impacting our nation’s deficit and debt) probably won’t be materially different than what we’d see from Biden. And his likely tax cuts/extensions could exacerbate our nation’s revenue shortfall. That should keep a bid under gold and silver.

Meanwhile, though Trump was a vocal critic of Bitcoin in the past, he’s flipped his position recently, saying on the campaign road, “We will ensure that the future of crypto and the future of Bitcoin will be made in America. Otherwise, other countries are going to have it.”

Lots of moving parts here. We’ll keep you updated.

Meanwhile, even before the assassination attempt, last week brought a massive redirect of capital with most of it flowing toward one corner of the market…

Small-cap stocks.

Let’s make sure you’re aware of what’s happening because this has the makings of a powerful rotation trade that could put a wad of cash in your pocket as we approach the end of the year.

About one month ago in the Digest, we wrote that it was time to give small-cap stocks a hard look.

This wasn’t a flippant suggestion. We made it knowing that small caps have been the “pain train” trade for many years.

To make sure we’re all on the same page, over a multi-year timeframe, small- and large-cap stocks jostle for market leadership. And though large-caps have dominated in recent years, historically, it’s small-caps that enjoy more time in the sun.

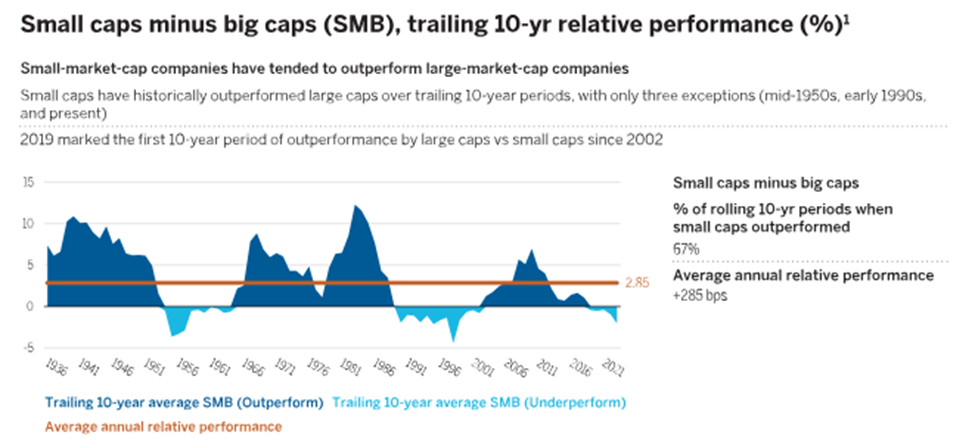

As you can see in the chart below from Professors Eugene Fama and Ken French, since 1927, small caps have beaten large caps two-thirds of the time when measured over 10-year investment periods. That outperformance clocks in at an average of 285 basis points.

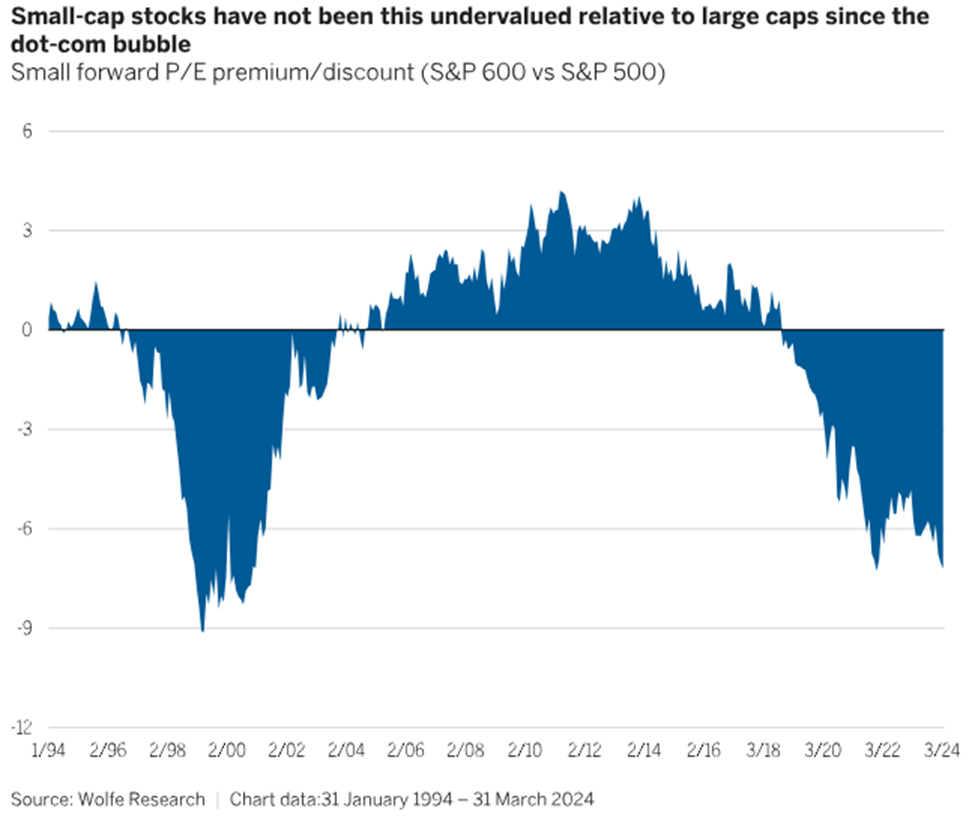

But over the last 10 years, small caps have lagged their large-cap counterparts. Meanwhile, the size of the performance differential recently registered its widest gap since the dot-com bubble almost 25 years ago.

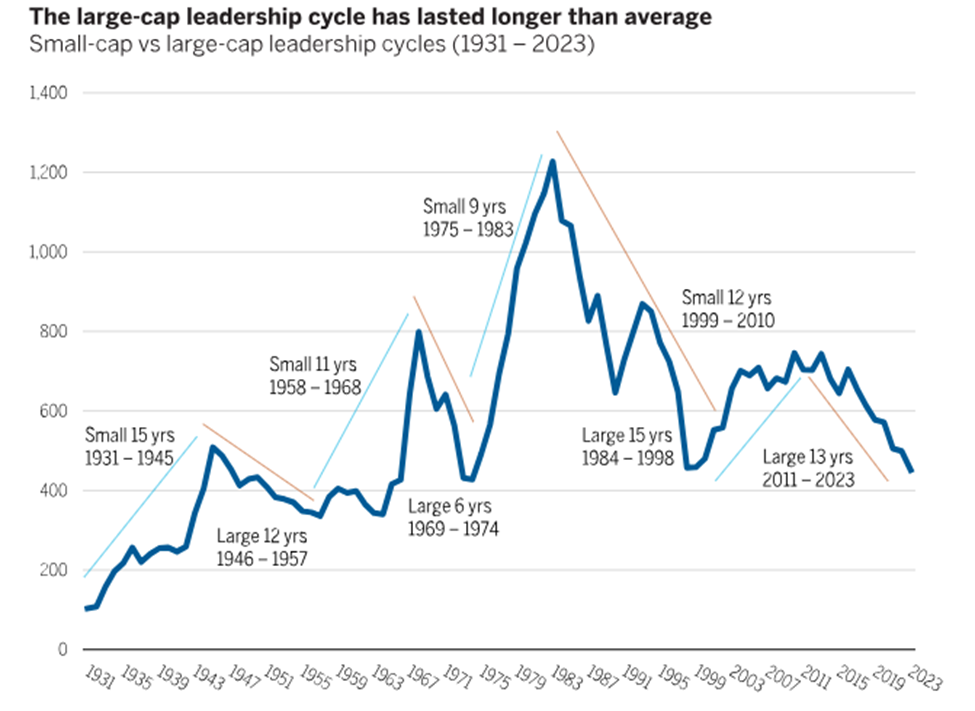

But it’s not just the size of the performance differential that’s noteworthy. The duration of this small-cap underperformance is longer than usual.

The average length of cycle leadership is almost 12 years. Well, small caps have underperformed large caps for 13 years now.

Here’s Cole Wilcox, CIO of Longboard Asset Management:

Large caps have been on a 13-year winning streak, which has pushed small vs. large relative values to levels last seen in 2000, which marked the beginning of an 11-year outperformance cycle for small caps.

“The rumors of our death may be greatly exaggerated” -small cap fund managers

We’ve been watching this for months in the Digest, waiting for an indication that the regime change was happening. But we weren’t the only ones.

Here’s what our hypergrowth expert Luke Lango wrote last month:

Small caps can’t stay this cheap forever.

The divergence between small cap stocks and Big Tech stocks appears to have widened to a breaking point. The Russell 2000 to Nasdaq 100 ratio has collapsed to 0.1 – its lowest level ever. Even during the peak of the Dot Com Bubble, this ratio never dropped below 0.12.

We therefore think the divergence between small cap and Big Tech stocks has widened to a breaking point. Soon, small cap stocks will rebound with a vengeance.

The question has been “what will be the catalyst that serves as the starting gun for a new small-cap leadership regime?”

That points us toward the Fed, interest rates, and inflation.

Last Thursday, the Consumer Price Index reading for June showed that prices fell for the first time since the beginning of the pandemic. The market interpreted this as the final piece of missing evidence required for the Fed to begin cutting rates.

In the wake of last Thursday’s CPI report, the CME Group’s FedWatch Tool reports a 94.4% likelihood that the Fed will cut rates by at least one-quarter point by the September meeting.

Legendary investor Louis Navellier believes a cut is all but a lock at this point. Let’s go to his Flash Alert podcast from Friday:

The Fed is going to have a dovish FOMC statement on July 31st, and they are going to be cutting on September 18th.

Shifting to the implications for small caps, this is huge news.

You see, due to their size, small-cap stocks are usually more sensitive to inflation and interest rates than large caps.

Smaller companies can be more vulnerable to rising operating costs during inflation. Also, they can find it tougher to adjust their prices to offset inflation and maintain margins.

But when interest rates fall, these dynamics reverse.

So, the market interpreted last week’s favorable CPI print as the starting gun on a small-cap surge.

But no one was prepared for the scope of what we saw in the market last Thursday.

An event a “billion years” in the making

Last Thursday was historic, featuring a statistical rarity of jaw-dropping proportions.

Let’s go to Charlie Bilello of Creative Planning to explain the enormity of what took place:

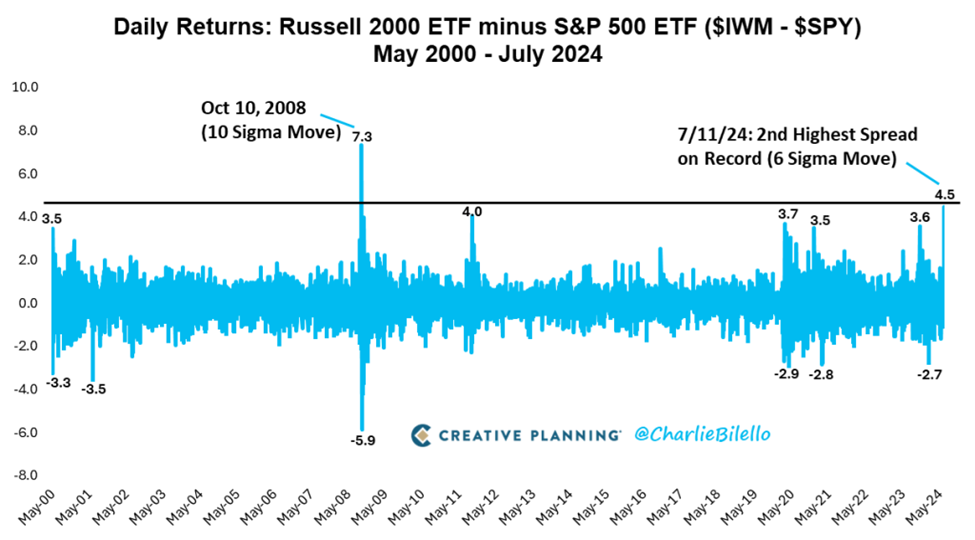

[Last Thursday,] we witnessed one of the wildest trading days in the history of markets, with all of the major secular trends of the past decade reversing course in dramatic fashion.

At the top of that list: the 180-degree shift in market cap leadership.

Small caps ($IWM ETF), which had been lagging large caps ($SPY ETF) by a massive amount this year, rocketed higher with a gain of 3.6%. At the same time, large caps fell 0.9%.

The 4.5% spread was a 6 standard deviation event and the 2nd biggest outperformance on record, trailing only the 10 sigma differential on October 10, 2008.

How unlikely is a 6 sigma event? If markets followed a normal distribution, such an event would be expected to occur only once every billion years. But clearly, they don’t, and it won’t take another billion years for it to happen again.

Now, consider three massive tailwinds for small-cap stocks going forward…

First, momentum.

If this is genuinely the start of a small-cap leadership cycle, we’re at the very beginning of wave-upon-wave of capital flowing into the sector – and not just for a month or two. It would be a multi-year process.

Second, valuation.

Data from FactSet show that companies in the Russell 2000 are, on average, trading at just 1.2 times sales, while companies in the S&P are trading at 3 times sales. This is among the widest gaps in history.

Third, earnings.

For small caps to begin a genuine multi-year leadership regime, they need fundamental support, not just hype. Well, it appears they have it.

Let’s go to Zachs:

The Russell’s year-over-year earnings are expected to grow a healthy 10% in 2024 and a robust 41% in 2025! Remember, markets tend to discount future earnings growth in advance.

For perspective, Louis’ favorite economist, Ed Yardeni estimates that the large-cap S&P Index will see earnings growth of just 8% in 2025. Now, 8% growth is nice, but it’s not 41%.

So, what’s the specific portfolio implementation?

Obviously, make sure you have exposure to small caps – but not necessarily at the expense of your large caps.

Here’s what Luke is telling his readers:

We believe the Great Broadening will be the most important dynamic in markets for the rest of the year.

That doesn’t mean, though, it is time to sell popular AI stocks.

Over the next several quarters, these popular AI firms will report strong earnings report after strong earnings report, which will collectively drive their stocks higher. We remain bullish on all AI stocks.

But the Great Broadening taking effect does mean that smaller AI stocks which have lagged the popular ones like Nvidia and Super Micro will outperform for the next six to 12 months.

We therefore think the best portfolio right now is one positioned for continued AI strength and the Great Broadening.

That means owning all sorts of AI stocks – builders, appliers, small-caps, and large-caps – with a bias towards small-caps and appliers. It also means owning rate-sensitive and economically-sensitive stocks like consumer discretionary stocks, real estate stocks, crypto stocks, and biotech stocks.

The best portfolio for the next 12 months will have a little bit of all of that.

If you’re overwhelmed by the opportunities available in the small-cap universe, you can always go the ETF route. Just be mindful of expense ratios. Don’t overpay for an index fund.

IJR, which is the iShares Core S&P Small-Cap ETF has the most assets under management, with an expense ratio of just 0.06%.

You can also look to steer your small-cap exposure using factor tilts if that’s more your style. For example, there are small-cap ETFs that provide weighted exposure to value, or growth, or even technology.

For example, PSCT is the Invesco S&P SmallCap Information Technology ETF. Its expense ratio is a reasonable 0.29%, and its top holdings include many strong small-cap names you’ve probably heard before including Fabrinet, Marathon Digital, and Axcelis Technologies.

Of course, when you go the ETF route, you’re going to get some dogs in there too which could drag down your returns. So, if you’d prefer more concentrated bets on the most likely small-cap tech winners, I’d point you toward Luke’s service Early Stage Investor which centers around small-cap tech stocks. Click here to learn more.

I’d also recommend you look at Louis’ Breakthrough Stocks service. It focuses on the most explosive small caps that Louis’ algorithms suggest are poised to climb over the next one-to-three months. Click here for more.

Whatever way you decide to play it, recognize the historic sea change that occurred last week

Yes, we might still be early in the leadership rotation – and yes, there will certainly be volatility – but signs point toward growing strength in small caps that could drive outperformance for years.

Don’t go “all in” or overextend yourself, but the current trajectory suggests the small-cap “pain train” is nearing its end. Make sure this opportunity is on your radar.

Have a good evening,

Jeff Remsburg