The evidence is piling up every day, folks. The American consumer is stressed.

Case in point: McDonald’s Corporation (MCD) is coming under pressure.

The company announced its first quarterly decline since 2020 in its earnings report on Monday, July 29. Specifically, in the second quarter, McDonald’s same-store sales declined by 1%.

This is not that big of a surprise since french fry supplier, Lamb Weston Holdings, Inc. (LW), also reported disappointing sales to restaurants and consumers. However, there is also evidence that some of this sales decline may be attributed to deflation.

McDonald’s CEO said its $5 meal deal is a big hit and will be extended to boost sales. Additionally, Burger Kingand KFC have also introduced $5 meal options. Furthermore, Target Corp. (TGT), Walmart, Inc. (WMT) and Best Buy Co. Inc. (BBY) have announced price cuts on selected items.

In addition, Diego plc (DEO), an alcoholic beverage company, warned that consumers are facing an “extraordinary environment” and announced its first decline in sales since 2020.

In other words, there are now signs of consumer distress everywhere. That’s especially true for the bottom 20% of consumers who are struggling with inflation and trying to make ends meet.

So that’s why all eyes were on the July U.S. retail sales report yesterday morning. Wall Street was eager to get the latest snapshot of how consumers are spending their dollars, and interpret what it might mean for the broader economy.

Likewise, the big-box retailers have begun to roll out their latest earnings as well. The most recent example was Walmart, which announced its latest quarterly earnings yesterday.

Given that Walmart is the largest retailer in America, outpacing Amazon.com, Inc.’s (AMZN) sales by nearly double, it’s a key barometer for how consumers are doing.

So, in today’s Market 360, let’s take a look at the latest retail sales report as well as review Walmart’s latest quarterly earnings. Then I’ll share some key takeaways and discuss if Walmart is a good buy following its earnings.

The July U.S. Retail Sales Report

Retail sales were up 1% in July, above economists’ estimates for a 0.3% increase. Excluding auto sales, retail sales increased 0.4%, which also bested forecasts for a 0.1% increase. Additionally, retail sales in June were revised to a 0.2% decline after initially being reported as flat.

Digging further into the details…

- Spending at bars and restaurants surged 5.3%.

- Spending on clothing and accessories jumped 2.6%.

- Electronics and appliance stores rose 1.6%.

- Nonstore retail sales increased 0.3%

I also want to note that, when we look at the retail sales report as a whole, 11 of the 14 categories surveyed saw sales rise. So, consumers are still spending, but are moving more towards bargain hunting and downgrading to lower-priced substitutes.

We can see this at work with Walmart, for example.

Breaking Down Walmart’s Earnings

Walmart reported its second-quarter earnings on Thursday, August 15, before the market opened. In short, the company reported solid results.

Earnings came in at $0.67 per share, besting expectations for earnings of $0.65 per share by 3.1%. Revenue rose 4.8% year-over-year to $169.3 billion, topping estimates of $168.53 billion.

Walmart’s e-commerce sales grew 22% in the U.S. and 18% internationally. Also important to note, the company’s global advertising business jumped 26%, including 30% for Walmart Connect, in the U.S.

Sam’s Club, the warehouse club retail chain that’s owned and operated by Walmart, saw total net sales with fuel rise 4.7%. These strong same-store sales were driven by food as well as health and wellness.

In the company’s earnings release, President and CEO Doug McMillon stated:

Each part of our business is growing – store and club sales are up, eCommerce is compounding as we layer on pickup and even faster growth in delivery as our speed improves. Our new businesses like marketplace, advertising, and membership, are also contributing, diversifying our profits and reinforcing the resilience of our business model.

And regarding the health of the average consumer, McMillion said, “We aren’t experiencing a weaker consumer overall.”

Walmart also upped its guidance for both the third quarter and its fiscal year 2025. For the third quarter, Walmart is now expecting net sales to grow 3.25% to 4.25% while operating income is expected to rise 3.0% to 4.5%. For full-year 2025, net sales are expected to grow 3.75% to 4.75% while adjusted operating incoming to expected to grow 6.5% to 8.0%.

Is Walmart a Smart Buy?

What we learned from yesterday’s retail sales report is that consumers are still spending. But the fact is, they are increasingly migrating to retailers like Walmart now, and it shows in this latest earnings report. Investors cheered Walmart’s report, and the stock closed 6.6% higher on Thursday. It also helped lift the overall market higher.

Following Walmart’s earnings, should you look to buy the company?

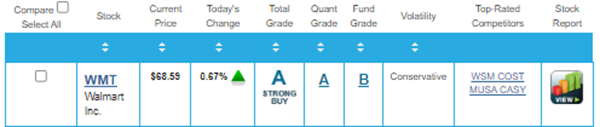

Well, according to my Portfolio Grader, the simple answer is yes. As you can see below, the stock holds an A-rating making it a “Strong Buy”. It also earns an A-rating for its Quantitative Grade and a B-rating for its Fundamental Grade. This tells us that the stock is still backed by both institutional buying pressure and fundamentals remain solid.

So, while the American consumer may be feeling stressed, Walmart is making all the right moves. The fact is, Walmart is a recession-resistant stock as its sales and revenues tend to be less affected by economic turmoil.

Now, while I personally don’t recommend the company to my subscribers, my Growth Investor portfolio is chock-full of high-quality companies that also boast strong sales and earnings. In fact, I have two Buy Lists, my High-Growth Investments and Elite Dividend Payers portfolios, that are full of fundamentally superior stocks across a wide range of industries.

A diversified portfolio can actually help lower the risk of your portfolio as some stocks will “zig” while others “zag”. And my Growth Investor recommendations fit this bill to a “T.”

So, no matter how the economy fares in the coming months, I am confident my Growth Investor stocks will continue to steadily prosper.

(Already a Growth Investor subscriber? Click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360