Existing home inventory has soared … but few sales are begin transacted … will the flood gates open after rate cuts? … three options for real estate investing

Remember when there were no available homes for sale on the market?

Well, that’s no longer a thing.

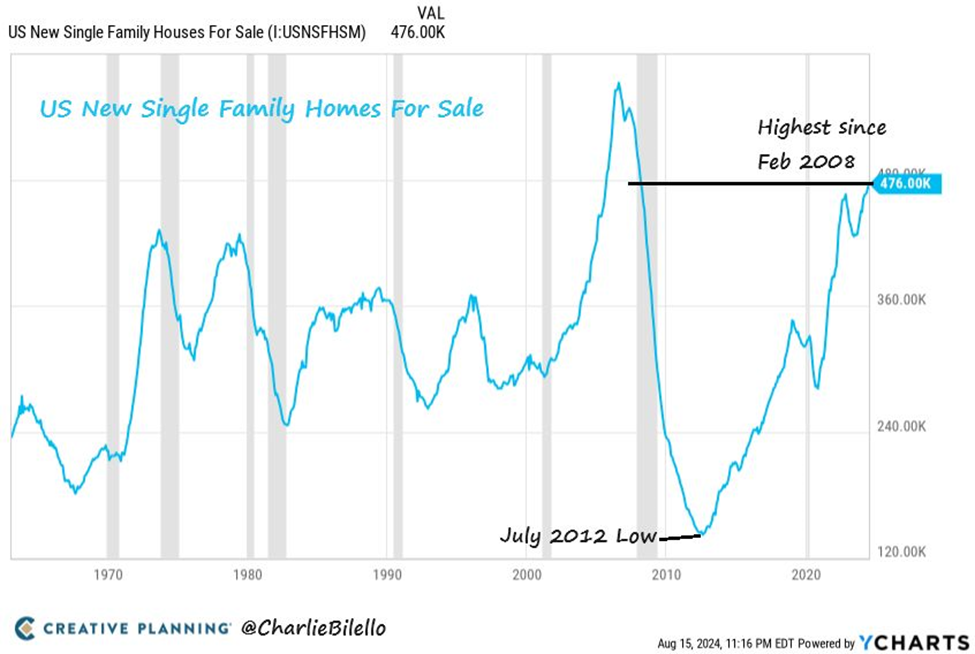

As you can see below, there are now 476,000 new homes for sale in the U.S. This is the highest level since 2008.

So, why are existing home sales still in the gutter?

You already know the reasons…

Record-high home prices (June marked the highest median sale price for an existing home ever) and mortgage rates which, while off their highs, are still multiples greater than they were three years ago.

Speaking of expensive home prices, here’s a pop quiz…

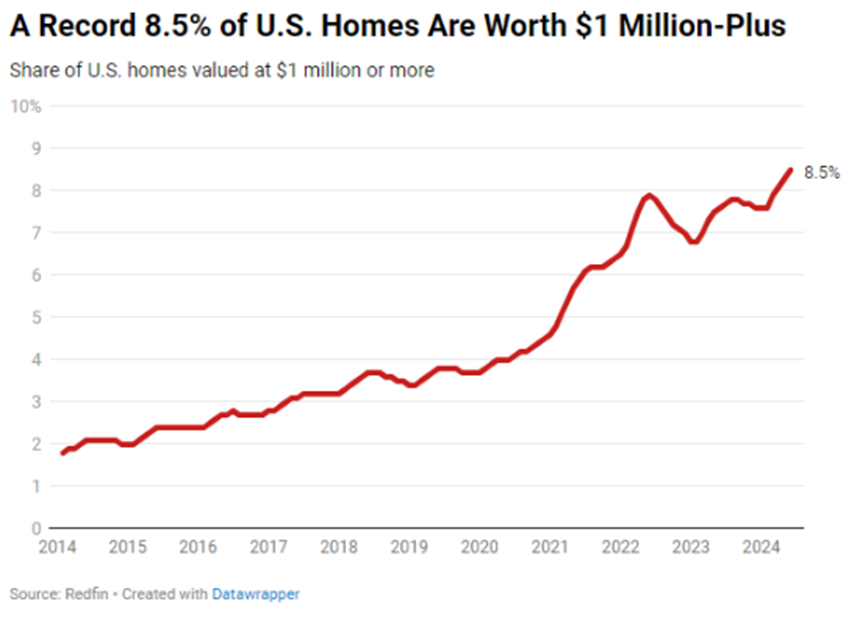

Ten years ago, the percentage of U.S. homes priced above $1 million came in at less than 2%.

Where is that percentage today?

Ready?

8.5%…which we’ll call a 350% explosion.

But with the Fed likely to introduce the first rate cut since the pandemic in just a few weeks, what’s the likely impact on housing, and how might we benefit?

We’ll begin by revisiting this rather colorful forecast from Barbara Corcoran, real estate entrepreneur and star of ABC’s “Shark Tank”:

The minute those interest rates come down, all hell’s going to break loose, and the prices are going to go through the roof. [Right now, sellers are] staying put. But they’re not going to stay put if interest rates go down by two points.

It’s going to be a signal for everybody to come back out and buy like crazy, and the house prices [will likely] go up by 20%. We could have COVID [market] all over again.

While that “up 20%” forecast feels like a stretch, let’s look at a few ways to take advantage of a ramp-up in home sales, beginning with mortgage demand.

Though home prices remain near all-time highs, mortgage rates have eased in recent months as the market anticipates interest rate cuts. This has already resulted in a surge in refinancings.

Here’s Fox Business from last week:

The Mortgage Bankers Association (MBA) reported Wednesday that refinancing applications soared 35% last week, when rates for the average 30-year and 15-year fixed-rate mortgages hit their lowest point in more than a year, according to Freddie Mac.

The surge in refinancing demand was the driving force behind the increase in overall demand for mortgage applications, which was up 15% on the week, the MBA said. For comparison, purchase applications only increased by 3%.

Year-over-year, refinancing demand was up 118%, MBA data showed.

Now, if we’re seeing this kind of increase already, what happens to refinancing demand, say, six-to-eight months from now when the Fed has cut rates a handful of times? What about mortgage origination demand?

“Way higher” seems to be a logical answer.

So, how can we benefit from that?

Well, by putting a few bucks into some leading mortgage lending companies.

If you’ve been with us a while, you may recall Louis Navellier’s pick for InvestorPlace’s Best Stocks for 2020 contest

PennyMac Financial (PFSI).

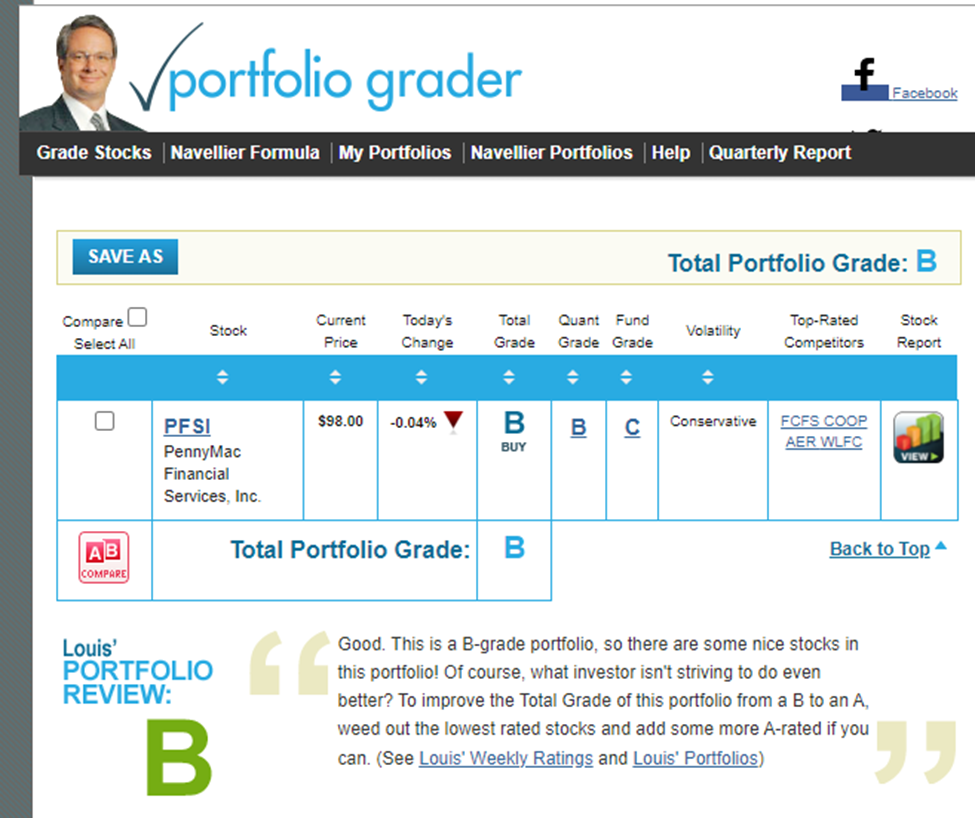

Louis has since taken profits on PFSI as the housing/mortgage market changed after the pandemic, but we can get a sense for how Louis’s quantitative market approach would size-up PFSI today by using his Portfolio Grader tool.

For newer Digest readers, fundamental strength, as evidenced through earnings superiority, underpins Louis’s entire market approach. Fortunately, Louis has codified much of his proprietary quant-based market system, and now offers it to the investment community through his Portfolio Grader.

Think of it as a diagnostic that gives you an instant snapshot of a stock’s financial strength. It focuses on the same eight metrics that drive Louis’ stock selection process for all his premium investment services.

Below, you can see how PennyMac gets a “B” rating today, which makes it an official “buy.”

By the way, PFSI doesn’t need lower rates to help its earnings. It’s already doing so well that they just goosed their dividend.

For more, let’s jump to Chairman and CEO David Spector, speaking on PFSI’s Q2 earnings call a few weeks ago:

PennyMac Financial generated strong earnings in the second quarter with an annualized operating return on equity of 16 percent. Given our continued strong financial results, I am pleased to note that PFSI’s Board of Directors approved a quarterly common cash dividend of $0.30 per share from $0.20 per share, an increase of 50 percent.

Keep in mind, with lower interest rates, PFSI wins two ways: the prospect of increased refinancing volume, plus a fresh wave of new mortgage loan originations.

This is likely part of the reason why Spector concluded, “While our financial performance in recent periods has been strong, I continue to believe Pennymac’s best days are yet ahead.”

Lower rates also would be a tailwind for leading home renovation companies

Think Home Depot and Lowe’s (full disclosure, I own Home Depot stock in my personal account).

Now, Home Depot gets a “D” rating according to Louis’s Portfolio Grader (and Lowe’s only gets a “C”). Three big reasons contribute to this: a lack of earnings momentum, lackluster sales, and a lack of positive earnings surprises.

But this makes sense as it reflects the stifling interest rate policy of the last two years. When Home Depot reported earnings last week, management commented on those tough conditions.

From Chief Executive Ted Decker:

During the quarter, higher interest rates and greater macroeconomic uncertainty pressured consumer demand more broadly, resulting in weaker spend across home improvement projects.

But the question becomes “what will happen to earnings momentum, sales, and earnings surprises when the Fed begins slashing rates?”

Well, logic suggests that lower rates would unlock a wave of demand for new home projects. On that note, let’s go to MarketWatch:

[Home Depot] also indicated that there has been less demand for larger home-improvement projects that need financing, as people are waiting for a drop in interest rates to make them cheaper…

“Everyone’s expecting rates are going to fall, so [they’re] deferring those projects,” Decker said.

We believe it’s only a matter of time before this pent-up demand turns into action…which turns into profits for home renovation companies.

To be clear, Home Depot didn’t call for demand to explode this year. But for investors, there’s a balance between “waiting so long for proof that we miss out on solid, early gains” and “moving so quickly that we have to sit through more losses.”

From our perspective, if the Fed truly is on the verge of a new rate-cutting cycle, then getting into position now – even if it’s slightly early – is the wise move.

At a minimum, if this play has you interested, keep it on your radar as we move into the fall.

Finally, what about homebuilder stocks?

Regular Digest readers know that we’ve had this trade on for years at this point.

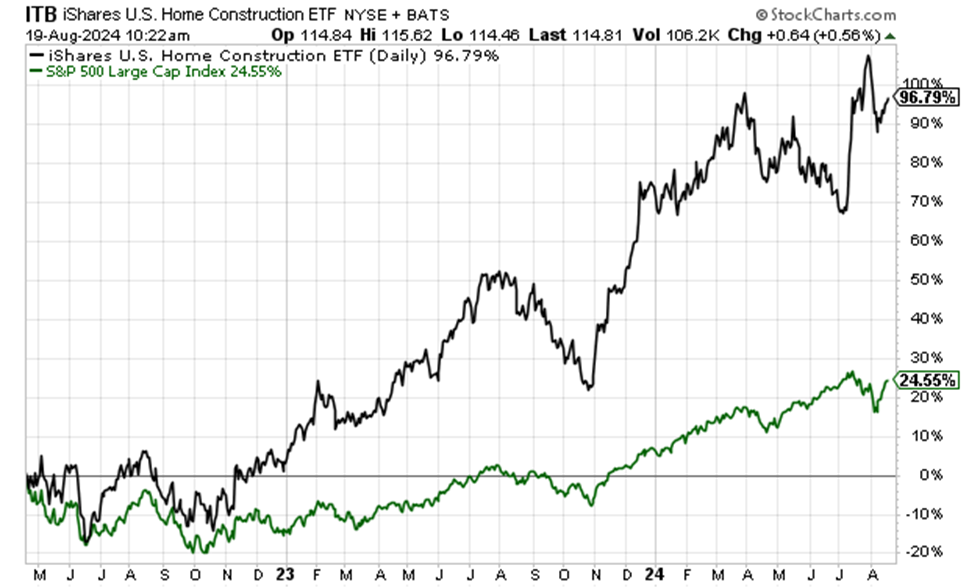

In our April 20, 2022, Digest, we suggested that aggressive investors could jump into an iShares Home Construction ETF (ITB) trade. ITB holds homebuilding heavyweights including DR Horton, Lennar, NVR, Pulte, and Toll Brothers.

Here was our disclaimer from that Digest about our timing and the potential for further volatility:

If you’re an aggressive trader who doesn’t mind the possibility of being early and sitting through some sideways (or even down) action, this is a reasonable entry point.

Below, you can see ITB falling further after our April Digest as we warned, but then rallying hard.

An aggressive trader who took this ITB position would be up 97% right now, nearly 4Xing the S&P’s 25% return over the same period.

So, what happens when the Fed begins cutting?

Well, with lower rates, these builders won’t need to offer the same incentives to offset higher rates. That’s going to increase their margins and add a tailwind for earnings.

On the other hand, builders could choose to maintain thinner margins to keep prices lower relative to existing home prices to attract buyers.

Remember, as we noted at the top of today’s Digest, housing inventory is up, but sales volume is still down due to high prices. So, if homebuilders are willing to undercut existing home prices, what they give up in margins stands to be offset by heavier sales volume – especially if Corcoran is right and home prices explode in the wake of mass demand from lower mortgage rates.

So, there you go. Three ways to play the broader housing market as we look forward toward rate cuts.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg