The “tradwife” may be making a comeback, but the “trad commute” is definitely not. That’s bad news for the owners of commercial skyscrapers and other office buildings.

The rise of artificial intelligence is even worse news for commercial landlords.

A “tradwife,” short for “traditional wife,” is a woman who embraces traditional gender roles. She stays home to raise children, cooks sit-down meals, and maintains a tidy house, while her husband focuses on bringing home the bacon.

For those of a certain generation, think: June Cleaver from Leave It to Beaver. Or, in the last decade, Betty Draper from Mad Men.

Thanks to these influencers, the tradwife lifestyle has gained renewed popularity in recent years. However, the Don Draper’s – or those who commute to work – are far and few between.

Suburban-dwelling commuters are becoming a relic… as recent data from the New York region’s Metro-North Railroad makes very clear. Total ridership on these commuter rail lines is barely higher than it was in 1990, and 30% below the peak levels of 2019. A sharp falloff in “commutation tickets” like monthly passes explains most of the drop.

Commuter tickets accounted for only 31% of total ridership last year, which is half of what it was in 1990. Discretionary one-way tickets are filling part of the void, but as Metro-North management explains…

Many riders use… non-commutation or discretionary tickets for work travel, due to hybrid schedules that [do] not require daily travel to offices. As a result, ticket-buying has shifted from commutation tickets to these media.

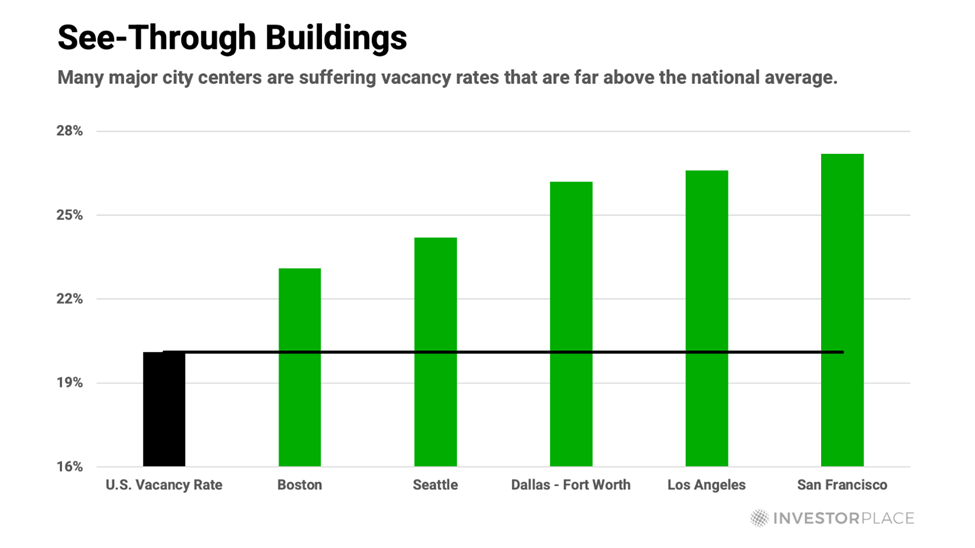

Commuter trends in New York are not unique. They are representative of similar trends from coast to coast, which is why vacancy rates in many major city centers are far above the national average. Take a look at the chart below…

The growing work-from-home trend has been weighing on office demand for several years already. Artificial intelligence adds even more downward pressure on that demand by eliminating jobs up and down the food chain.

According to a Forbes article, “The State of Hybrid Workspaces in 2024,” 12.7% of full-time employees now work from home, while 28.2% use a hybrid model that includes both at-home and in-office activity. Both percentages are rising rapidly.

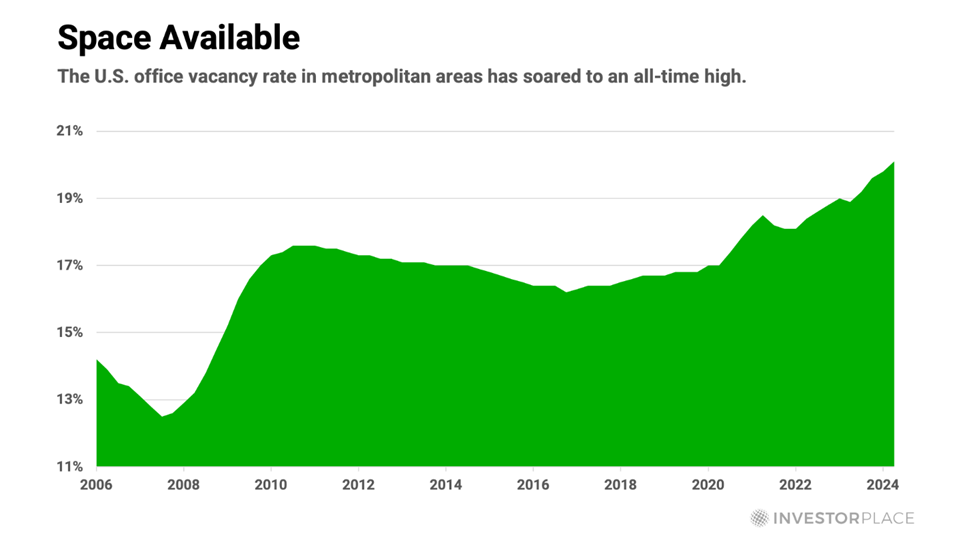

Not surprisingly, the year-end 2023 U.S. Office Market Outlook report by Colliers makes for grim reading. The report states…

The U.S. office market now has 233.3 million square feet of available sublease space, notably higher than the previous cycle’s peak of 133.3 million square feet in Q2 2009… lenders will remain active with extend-and-pretend loan extensions, but with $2.8 trillion of loans across all asset classes coming due by 2028… distress will rise.

Colliers also reports that the U.S. national average vacancy rate for central business districts (CBD) has soared to a record high, as the chart below shows.

Surprisingly, the vacancy rate of downtown Class A properties is now higher than the vacancy rate of suburban office properties. This data point is consistent with the fact that a growing number of employees are working closer to their homes, if they go to an office at all.

So, while the “tradwife” may be making a comeback, the “trad commute” is definitely not. And although urban office properties do still serve a purpose in the modern economy, they now sit squarely in the crosshairs of the AI megatrend.

And as the megatrend is only accelerating, it’s crucial to prepare for its inevitable disruption… which is exactly what I addressed in my Road to AGI Summit last Thursday.

In that presentation, I also delivered a “futureproof” blueprint and revealed the name of my #1 stock idea for The Road to AGI. In case you missed it, click here to watch a replay.

Now, let’s take a look back at what we covered here at Smart Money last week…

Smart Money Roundup

How AI Could Lead to the “Death of the Spirit”

The Road to AGI raises crucial questions about our future. In this special guest issue, InvestorPlace Digest editor Jeff Remsburg draws parallels between John B. Calhoun’s mouse utopia experiments and Artificial General Intelligence’s (AGI) potential impact on the human race. Curious about the implications? Read more about AGI’s possible effects here.

The Road to AGI’s Hazards (and How to Avoid Them)

AI’s rapid progress offers unique investment opportunities. While more near-term gains may come from investing directly in AI technologies, Eric believes the most promising long-term strategy is unintuitive. As AI matures, it will disrupt tech centric businesses. Thus, investing in industries AI can’t replace may be one of the best ways to prepare for AGI. Click here to learn more about these “futureproof” sectors.

Take These Steps Before Tech Becomes Mentally Superior to Us

Here at Smart Money, we often dive into global macro trends and cycles, from healthcare to precious metals. Understanding these patterns not only provides insights into where we’ve come from and how we’ve evolved, but they can also help investors better anticipate what may lie ahead. But what happens when we’re faced with something no one has ever seen before – a disruptive force that has no clear historical precedent? Click here to find out.

The “Unpopular” Stock That Can Beat the Pants Off Nvidia

A certain tech giant has been making headlines recently… albeit the wrong kind. However, because I believe this well-known company will use AGI to create some potential new avenues for success, I expect its unpopular shares to outperform the wildly popular ones of Nvidia. Continue reading to learn why I’m not abandoning this leader just yet.

Elon Musk’s AI startup, xAI, is pushing the boundaries of technology. With the rapid pace of AI advancements, Musk estimates we could be living in an AGI world within just 24 months. And with xAI’s investment opportunities, the startup has the potential to be at the forefront of this revolution. In Sunday’s special guest issue, Luke Lango updates us on xAI and how this venture could shape your portfolio. Read all about it here.

Looking Forward

We’re officially off the heels of The Road to AGI Summit, but that doesn’t mean the ride is over. In fact, it’s just beginning. For investors, this means new opportunities on the horizon as the AI landscape evolves.

We weren’t able to get to all your questions during the event, but I didn’t want to leave the most pressing of those questions hanging.

So, keep an eye on your inbox, as I will answer your most important Road to AGI questions later this week.

Stay tuned.

Regards,

Eric Fry