Louis Navellier’s roadmap for the next couple months … expectations of job losses … AI venture capital failures … how to “future-proof” your AI portfolio

Let’s begin today with legendary investor Louis Navellier and his roadmap for where the market goes as we approach the fall.

From Louis’s Flash Alert in Growth Investor:

Nvidia will announce on the 28th. I expect guidance to be phenomenal.

We’ll get the Personal Consumption Expenditures report on the 30th. I expect it to be highly favorable, showing inflation is growing at one-tenth of a percent or less, so we’re in the Fed’s target range.

So, those should be positive developments for the market.

We tend to rally going into holiday weekends like Labor Day. And then the market will probably have to hit the “pause” button. We’ll pause for a few days and consolidate.

Then we have the presidential debate on September 10th. And we will certainly have a better feel for who the lead candidate might be after that debate.

Then, we have to pay our quarterly taxes on September 15th. That’s why the market is often soft, because people are selling stocks to pay their taxes.

And then, of course, we’ll have the Fed rate cut on September 18th and a dovish FOMC statement. And we’ll get a new Dot Plot, which will forecast the FOMC members’ rate cuts for the rest of the year, and next year too.

So, a lot of positive things are about to happen.

Now, despite this bullish forecast, Louis points out that the market has become overbought because it’s climbed so quickly. So, he tells his listeners to expect oscillations – it will not be a straight line higher.

That said, the bottom line is that Louis is very bullish as he looks toward the fall.

Market hot spots to keep our eyes on

Last Friday, Federal Reserve Chairman Jerome Powell signaled that a new rate-cut cycle has arrived. Behind this decision are two influences: 1) Powell’s confidence that inflation is finally on a sustainable path to 2%, and 2) Powell’s concern about accelerated cooling in the labor market.

The labor market is “hot spot” number-one.

As we detailed in the Digest last week, not only is the unemployment rate climbing faster than the Fed wants and previously predicted, but our economy has been swapping out full-time jobs for part-time jobs at a brisk pace.

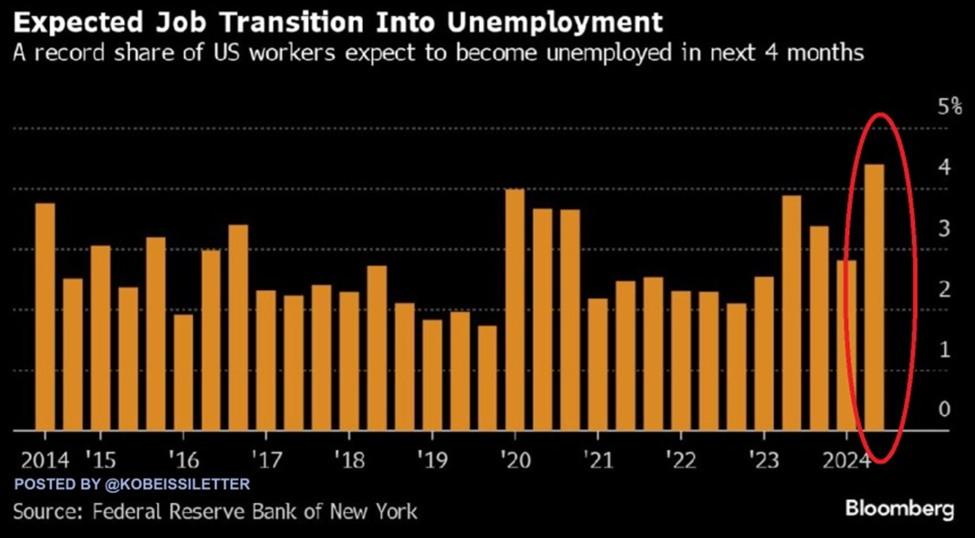

With that as context, last week, we learned that the highest number of U.S. employees on record believe they’re on the verge of losing their jobs.

From The Kobeissi Letter:

The share of people who believe they will become unemployed in the next 4 months jumped to 4.4%, the highest on record.

This is a significant surge from the 2.8% share seen in March 2024, according to the NY Fed job situation and outlook survey.

At the same time, the share of workers who reported searching for a job in the last 4 weeks increased to 28.4%, the highest since the survey began in 2014. This was also up 9 percentage points from 19.4% recorded in July 2023.

Further evidence the labor market is weakening.

If we look at the venture capital market – hot spot number-two – we see similar weakening

Last week, we learned that U.S. start-up failures have jumped 60% over the last year.

What’s more eye-opening is the speed at which these new ventures are failing. The Financial Times notes that 254 startups went under in Q1 of 2024, which is more than seven times greater than back in 2019. The article goes on to state that millions of jobs in these starts-ups are at risk, “risking slipover to the wider economy.”

Now, while we could continue to dig into why VCs are failing or discuss the likely positive impact of coming rate cuts, there’s a more interesting angle. And it ties to the hottest investment trend in today’s market…

The growing connection between VC failures and AI

Venture capital failures are dovetailing into today’s AI trend.

For more on this, let’s go to PYMNTS.com:

The funding slowdown is leading to a wave of failures, leaving venture capitalists on the outside looking in. This trend threatens other startups attempting to develop their own AI large language models and raises concerns that VCs cannot compete with Big Tech companies in terms of investment.

The European Business Review argues that the coming wave of AI startup failures is a natural part of the technology’s evolution, clearing the way for innovation and paving the road to broad adoption…

But it’s not just VC companies that are struggling to find their groove with AI. As we’ve detailed here in the Digest, AI itself is not yet profitable. Yes, the companies that enable AI – like Nvidia – are enjoying a profit bonanza, but most AI implementers today are spending up a storm without certainty of the financial payoff.

Back to PYMNTS.com:

PYMNTS Intelligence’s research shows that despite big budgets and ambitions, most large companies are struggling to employ AI in meaningful ways, with a significant gap between the perceived potential of AI and its actual application in the corporate world.

Given these realities of AI investing, last week’s AGI event with Eric Fry is even more important…

Is the best AGI investment an anti-AGI investment?

Last Thursday, Eric hosted The Road to AGI Summit. And while the event focused on investing in AGI (Artificial General Intelligence), some of the action steps likely aren’t what you’d expect.

Here’s Eric to begin unpacking this:

The biggest gains from the next few years may come from investing directly in AI technologies. However, once AI matures, it will continuously create and then destroy tech centric businesses. A technology that facilitates early AI, for example, could become a victim of advanced AGI.

Instead, one of the best ways to invest in the eventuality of AGI is by getting in on the industries or assets that AI could never replace.

No matter how intelligent AI becomes, it will never morph into timberland. It will never sprout into a lemon tree or transform itself into an ocean freighter, platinum ingot, espresso bean, or stretch of sandy beach.

One example of this potential AGI-tech-destruction is Adobe. This software leader makes products that help digital designers.

For some part of the foreseeable future, AI advancements should help Adobe make jaw-dropping products for its designer clients that we would expect to boost earnings. But what happens when AI grows so advanced that we no longer need digital designers? Instead, you’ll just tell an AI Digital Design Bot what you want.

Well, in that case, without a drastic pivot, Adobe’s entire business model goes “poof.”

If you think this is fearmongering, Adobe’s own employees are the ones who voiced this concern

Here’s Benzinga from last month:

Employees at Adobe are worried that the company’s AI tech puts its customers’ jobs at risk. Not just that, Adobe staff is also concerned that this may disrupt the company’s business model, a large part of which caters to graphic designers.

According to a report by Insider, Adobe employees are concerned about the impact of Firefly, the company’s AI tools suite that was unveiled earlier this year…

“A new wave of AI systems may also have a major impact on employment markets around the world. Shifts in workflows triggered by these advances could expose the equivalent of 300 million full-time jobs to automation,” a Goldman Sachs report said…

The report cites Adobe employees calling these developments “depressing” and an “existential crisis” for designers.

To avoid this resulting in a crisis in your portfolio, Eric urges investors to consider a holistic approach to AGI

While it will certainly include investing in companies that utilize AGI, it balances that by also containing anti-AGI investments.

Back to Eric:

Investing in the industries or assets that AGI will never replace is a valuable and essential AI strategy. These are things that an AI-centric world will require, no matter how intelligent it becomes.

A short list of examples might include industries like…

- Shipping

- Cosmetics

- Lumber

- Energy Generation and Storage

- Travel

- Sporting Goods

- Rail Transit

- Agriculture

These industries might not be completely future-proof from the onslaught of AI, but they are at least close to it.

We’re beginning to run long so I’ll wrap up. But for Eric’s entire research on AGI, as well as more on his “future-proof” investment ideas, click here to watch a free replay of last week’s Road to AGI Summit.

This is a critically important aspect of AGI investing that too many people are overlooking. Yes, what’s coming is exciting and we want to invest in it. But that very same AGI technology is going to have a “destructive” side, as Eric calls it. Make sure your portfolio is not just somewhat insulated from this but positioned to benefit.

We’ll keep you updated here in the Digest.

Have a good evening,

Jeff Remsburg