Hello, Reader.

This is a bellwether…

This is also a bellwether…

The furry bellwether with funny ears is the leading sheep of a flock. Shepherds sometimes attach a bell to that animal to help them locate the flock later, especially in mountainous regions where a sheep can easily disappear from view.

The other bellwether is the world’s preeminent AI semiconductor company. Unless you’ve been hiding under a rock for the last two years, or been tending sheep in the Alps, you would know that Nvidia Corp. (NVDA) has become much more than just a “chip company.”

It is the enterprise that produces the world’s most sophisticated graphics processing units (GPUs) for artificial intelligence. And over the past few years, it has become the bellwether that all other chip companies are following.

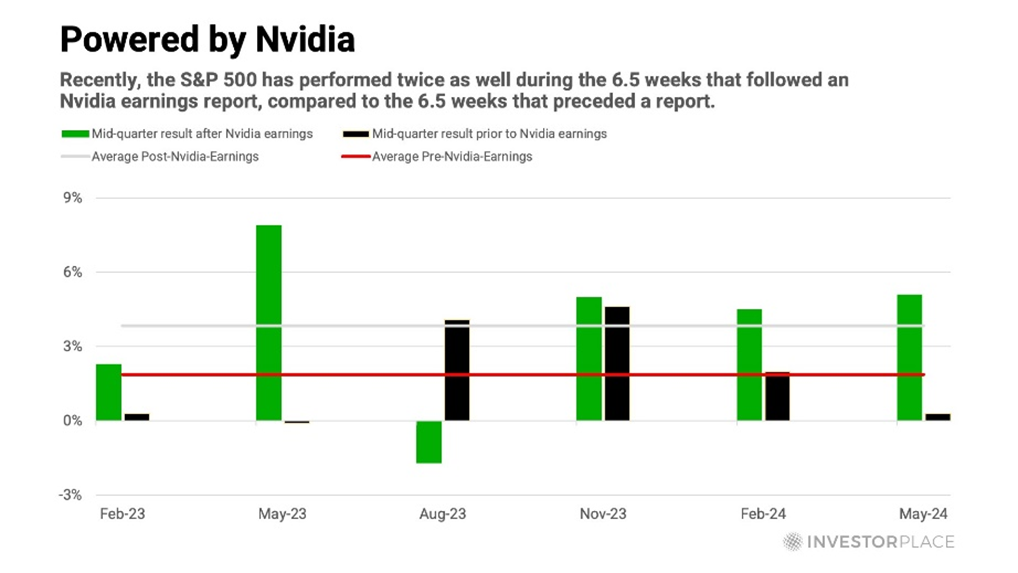

But Nvidia’s influence extends far beyond the chip sector, and even beyond the broad technology sector. It has become the most influential company in the entire stock market, as the chart below indicates.

Simply stated, the stock market has performed three times better during the six and a half weeks following Nvidia’s earnings reports compared to the six and a half weeks preceding them. (That might seem like an odd measurement period, but it is simply half of a 13-week quarter.)

On average, the Nasdaq-100 index gained 6% during the weeks after Nvidia’s earnings release, but only 2.1% during the weeks preceding it. Obviously, the company’s earnings were not the only factor that produced those disparate results, but they were an important one.

Somewhat akin to Punxsutawney Phil, Pennsylvania’s famous groundhog, Nvidia emerges from its accounting office once a quarter and never sees a shadow of a slowdown. Then investors cheer the news that springtime weather lies ahead on Wall Street.

For several quarters in a row, Nvidia’s earnings reports have not only beaten Wall Street expectations, but trounced them. No matter how high analysts reset the following quarter’s estimates, Nvidia manages to top them.

In fact, as I reported in a recent Smart Money, the mighty chip company accomplished that feat once again last Wednesday when it reported a massive 122% jump in sales, year-over-year. Nvidia delivered more than $30 billion in sales in the quarter, which was well ahead of the $28.7 billion Wall Street analysts had expected. Profits from the quarter also more than doubled to $16.6 billion – also well head of the $15 billion analyst projection.

Therefore, if recent tendencies hold, the stock market should deliver pleasing gains over the coming six weeks. Obviously, factors like the upcoming presidential election and the ongoing hostilities in Gaza could overwhelm the “good vibes” Nvidia imparts to the market.

But the chipmaker’s recent earnings results provide at least one reason to expect summertime conditions on Wall Street to linger for a few weeks more.

Similarly, the pendulum can swing in the opposite direction. Giant tech companies like Nvidia, Microsoft Corp. (MSFT), and Meta Platforms Inc. (META) are so responsible for the market’s recent gains that any significant downturn in their earnings could have a noticeable negative impact.

With valuations reaching astronomical levels, the tech sector’s stability comes into question. In fact, the world’s wealthiest investors are already preparing for that possibility.

To discover where billionaires like Warren Buffett and Jeff Bezos are moving their money, and how you can profit alongside them…

Now, let’s take a look back at what we covered here at Smart Money last week…

Smart Money Roundup

Answering Your Biggest AGI Questions

As The Road to AGI Summit concluded, though the journey continues, Eric addressed your most pressing questions on artificial general intelligence (AGI). Curious about AGI’s timeline for mainstream arrival, the industries poised to benefit the most, and more? Click here to continue reading.

Nvidia Beats, but I’m Still Looking Elsewhere

Nvidia Corp. (NVDA) reported its second quarter earnings last Wednesday, surpassing expectations. And while this stock market bellwether continues to assert its dominance to validate and/or expand its valuation, I’m still looking elsewhere. Click here to learn why.

Not Much Can Stop This Election Shock

My colleague Charles Sizemore, from The Freeport Society, has a track record of making shocking predictions that come true. Now, he has a major election forecast. In Saturday’s special guest issue, Charles explains how almost nothing can stop the shock he sees coming. Read more here.

These Sleeping Giants Are the Best Stocks to Buy Outside of AI

A sharp rise in interest rates has put a crease in consumer stocks. But with near 100% certainty of rate cuts later this month, that means lower mortgage rates… lower auto and debt financing rates… and of course, more consumer spending. For more insight on what that means for consumer stocks, read Luke Lango’s special guest issue here.

Looking Forward

Later this week, keep an eye out for your next Smart Money update. We’ll delve deeper into the big-picture trends shaping my investment outlook, with a special focus on employment.

We’re anticipating the ADP National Employment Report on Thursday, which will provide valuable insights into the workforce, the market, and the economy.

Stay tuned…

Regards,

Eric Fry