The month of August is now behind us, and I don’t think anyone is disappointed to put it in the rearview mirror.But what many investors have seemed to forget is that September can also be a bumpy and volatile month.

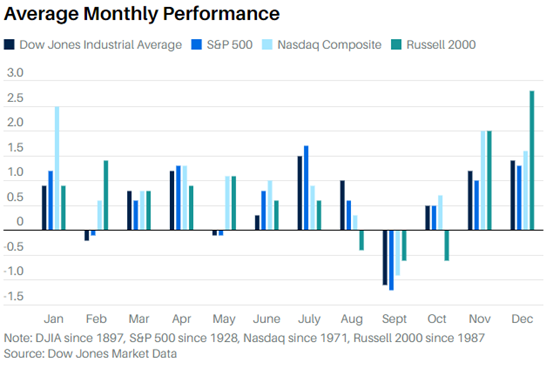

The fact is, September is the seasonally weakest month of the year for the stock market. As you can see in the chart below, the Dow, S&P 500, NASDAQ and Russell 2000 have all averaged declines in September since their inception.

Source: Barron’s

Clearly, September takes the cake. It’s why the financial media likes to call it the “September Swoon” or “September Effect.”

The September Effect has hit the stock market this year, too. The Dow is down more than 2%, the S&P 500 has declined about 4%, while the NASDAQ is down 5.8% and the Russell 2000 has slipped 5.7%.

So, in today’s Market 360, I’ll explain what’s behind the volatility, and why I believe the weakness is only temporary. Then, I’ll share why investors should remain optimistic for the month. Let’s get into it…

The Temporary Seasonal Shenanigans

Estimated Taxes

Each quarter, small business owners, independent contractors and freelancers are required to pay taxes based on their reported income for the period. This can also include landlords or people with significant income from investments.

It’s easy to forget about this if you’re a W2 worker who has taxes automatically taken out of your paycheck. But we’re talking about a sizeable chunk of people – up to 40% of taxpayers, according to some estimates.

So, if you’re one of the folks who has to do this each quarter and you are facing a large tax bill, you may need to sell some shares in your portfolio to pay your taxes.

This quarter’s estimated taxes are due September 16, and that is weighing on the stock market a bit. But after the taxes are done and paid, this will no longer be a factor.

Extended Summer Holiday

I was in New York last week, and I can tell you that many Wall Streeters (as well as folks in Europe) are still on their summer vacations. As a result, trading volume is often light, and the “B Team” is left in charge. This keeps the door open for more of the seasonal shenanigans that occurred in August.

This explains some of the wilder swings we are seeing right now in the market, but once again, it will be over once the “A Team” returns to the office.

Earnings Season Is Over

The second-quarter earnings season has drawn to a close. Now, this earnings season was excellent. The S&P 500’s earnings growth rate clocked in at 11.3%, marking the highest year-over-year earnings growth rate since the fourth quarter of 2021.

However, this strength is serving as a “problem” right now, as there are cases of “the tail wagging the dog.”

Case in point: NVIDIA Corporation (NVDA).

We reviewed the full earnings report in last Friday’s Market 360, but to briefly review:

- Second-quarter revenue soared 122% year-over-year to a record $30.0 billion, topping estimates for $25.64 billion.

- Second-quarter earnings surged 152% year-over-year to $0.68 per share, compared to estimates for $0.64.

- Data center revenue also set a new record, jumping 154% year-over-year to $26.3 billion.

I was ecstatic with NVIDIA’s results and felt the company clarified the production snafu with its Blackwell chips. However, it seems some investors were concerned about the company’s margins, which were slightly compressed compared to the previous quarter. And by that, I mean, NVDA’s operating margin was about 62%, compared to 65% in the first quarter.

Let’s be honest, though, folks. That is still a fantastic number that any company would kill to have. But Wall Street was looking for even more of a “blowout” quarter and took profits when the stock didn’t deliver.

NVIDIA is now down more than 18% since its earnings report on August 28. Given that it is the third-largest and arguably the most influential company in the S&P 500, when NVDA sneezes, the S&P 500 catches a cold. So, this has added to some of the weakness in both the S&P 500 and NASDAQ.

Two Catalysts to Propel Stocks Higher

Although the market weakness has been gut-wrenching, there are two catalysts that should help stocks bounce back in the latter half of the month: the Federal Reserve and quarter-end window dressing.

Fed Set to Ease in September

Two weeks ago, during the Federal Reserve’s annual Jackson Hole meeting, Fed Chair Jerome Powell made it clear that our central bank will cut key interest rates in September.

With inflation cooling, a 0.25% key interest rate cut is baked in the cake for the Fed’s next Federal Open Market Committee (FOMC) meeting on September 18. However, as the labor market deteriorates further, there is added pressure on the Fed to cut even more this year.

Just yesterday, the Labor Department announced that only 142,000 payroll jobs were created in August, compared to economists’ expectations for 165,000 jobs. But the big news is that the June and July payroll jobs were revised down by a cumulative 86,000 jobs.

The markets liked this “bad news,” and Treasury yields declined in its wake. The 10-year Treasury yield now stands at about 3.7%, down from about 3.9% at the end of August. That also compares to 4.3% in late July and this year’s peak of about 4.7% in late April.

Falling Treasury yields also add to the pressure on the Federal Reserve to cut rates by more than 0.25%. But I still think a 0.25% cut is likely at this point, as the Fed does not like to panic. Plus, we are still likely to see additional rate cuts this year, which should help breathe some new life into the markets.

Quarter-End Window Dressing

With the end of the third quarter approaching, this will also ignite quarter-end window dressing.

As my Breakthrough Stocks members know, quarter-end window dressing occurs when fund managers and institutional investors shore up their portfolios prior to the end of the quarter. Essentially, they make their clients’ portfolios “pretty” by selling the worst-performing stocks in the quarter and replacing them with the best performers.

That means fundamentally superior stocks should benefit from persistent institutional buying pressure in the second half of September.

With the stock market likely to start regaining momentum in a few weeks, the current weakness is a great opportunity to go bargain-hunting and snap up shares of fundamentally superior stocks at deep discounts.

If you’re not sure where to look, then consider Breakthrough Stocks. My Breakthrough Stocks Buy List is characterized by 22.8% average forecasted sales growth and 101.8% average forecasted earnings growth, so I suspect my stocks will be at the top of most investors’ buy lists in late September. I’m also taking advantage of the market selloff, as I just recommended a new stock yesterday with triple-digit forecasted earnings growth.

(Already a Breakthrough Stocks subscriber? Click here to log in to the members-only website.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)