The second week of the NFL season started Thursday, and after just one week it seems like the league’s popularity just keeps getting bigger and bigger.

According to the NFL, the league averaged 21.0 million viewers per game during the opening week, making it the most-watched Week 1 on record.

The league and ratings agency Nielsen said Wednesday morning that the per-game average viewership on TV and digital platforms was a 12% increase over last year.

Like so many other Americans, I love the NFL.

I’ve loved it since I was a kid. Sundays were about getting home from church early enough for the pregame, and then watching as much football as the networks could show.

I was one of those “never say die” kids who watched every minute of every game no matter how far behind his team was. I remember my mother waiting impatiently to go somewhere as I insisted on staying for every moment despite being behind by double digits with less than a minute to go.

But those days are gone for me.

As a busy husband, father and homeowner, I just don’t have the time any more…

The average game length is three hours and 12 minutes according to Statista. Although I fantasize about sitting around all day watching TV … the truth is I just have too much to do.

Maintaining a house, getting chores done, shuttling my kids here and there….

I don’t have the time to sit and watch a complete game.

Thank God for highlights…

I can see the most exciting part of a game, of all the games, without dedicating hours to sitting in front of the television.

I can still follow my team – follow all the teams – without letting chores go by the wayside, irritating my wife, or having my kids miss their own sports.

Really, that’s how I keep up with all the sports I love now. Baseball highlights every morning, soccer highlights on Saturday, and NFL highlights on Sunday.

What does this have to do with investing?

Imagine if you only got the highlights of the stock market?

I’m not talking about picking out a stock or two and following it for forever. I’m talking about only the best parts of any stock holding – the times when the stock is going up.

That’s what Stage 2 investing is about and what Luke Lango does in his Breakout Trader service.

Regular Digest readers are familiar with Stage 2 investing, but for newer readers, the idea behind Stage 2 investing is simple.

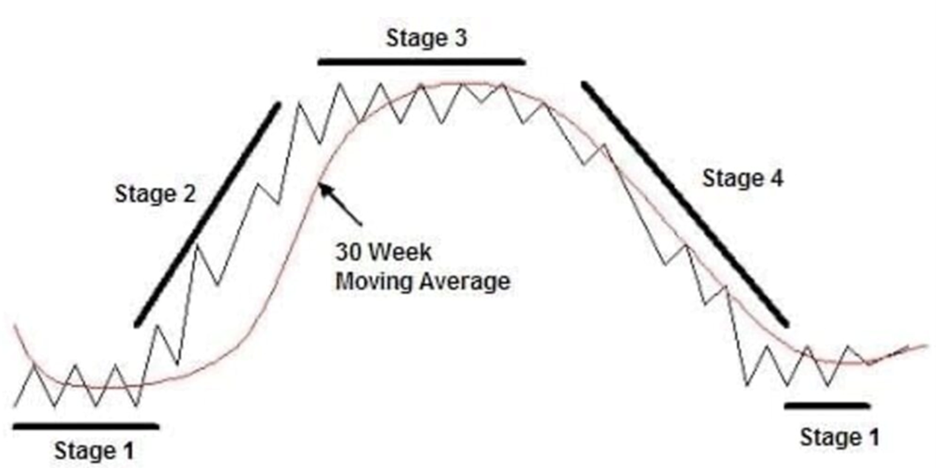

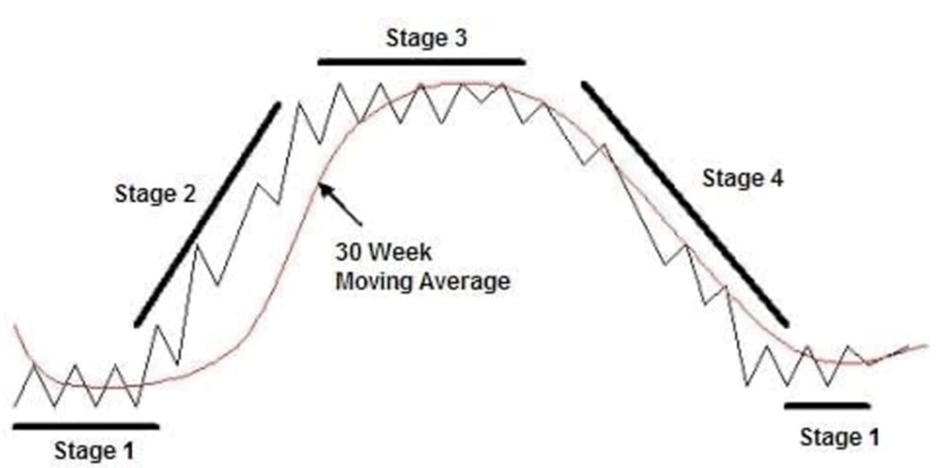

At any given point in time, an asset is either going up, down, or sideways.

To that end, it’s always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time, and then only investing in a stock when it’s surging in Stage 2.

Think of it as the “highlights” for any particular stock.

You don’t have to bother with the two-yard running plays or watching the teams huddle. Instead, just catch the best plays for select stocks.

Here is how Luke explains it.

Everyone has a “system” when it comes to the stock market.

An investor may not think of their investment approach that way, but that’s what it is.

Are you a blue-chip investor?

Your system involves finding veteran stocks that stand the test of time thanks to beloved brands and loyal customers.

Are you a value investor?

Your system involves finding companies with stock prices that appear undervalued relative to the intrinsic value of the company’s assets and cash flows.

Maybe your system is more sector-based. You find cutting-edge technology stocks.

With all due respect to whatever your preferred market approach might be, our Breakout Trader system focuses on the one thing that really matters to your wealth…

A price breakout.

At the end of the day, the only thing that will make a difference to your portfolio is whether the stocks you own rise in value while you own them.

If you’re a blue-chip investor, you might own the bluest of the blue. But if its price falls while you own it, you’ll lose money.

If you’re a value investor, you might own the most undervalued stock of all time. But if the market doesn’t see it the same way and the price drops after you buy, your system has made you poorer.

Let’s look at an example.

Yext, Inc (YEXT) is a cloud-based platform that helps businesses manage their online presence.

Early in 2023, Luke’s system detected that it was approaching a Stage 2 breakout. He advised his subscribers to buy on February 28 when the stock was trading for $6.97.

Not two weeks later, the stock had shot up 38%, and Luke advised his subscribers to sell one third of their position to lock in gains.

By early June, less than 4 months since the initial buy, the stock had climbed 88% and Luke advised selling another third. He advised subscribers to hold on to the rest to see if it was going to continue climbing in Stage 2, or perhaps roll over into Stage 3 (a period in which a stock trades sideways in a consolidation patter, suggesting that its next move could be either bullish or bearish).

And finally, when it became clear the stock was no longer in Stage 2, he advised selling the last third for a 23% gain.

I marked the buy and sell points on the chart below. The initial buy point is in red, and the profit-taking points in green.

It’s easy to see how this type of investing is really the “highlights” of any stock. After Luke recommended selling the last third, the stock dropped well below the initial buy point.

A max gain of 88% in less than six months. The Breakout Trader subscribers took their profits and moved on!

Luke believes we’re about to see a new tidal wave of opportunity, his preferred manner of playing it is through Stage Analysis.

Breakout Trader subscribers can click on this link to get all the analysis right now.

Luke recommended two new stocks this week and one is already up 16% as I write Friday morning!

If you’re not a subscriber, you can click here to see Luke’s analysis of a big market catalyst that could lead to more and more opportunities to grow your wealth!

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace