Hello, Reader.

This weekend, I asked my wife, a physical therapist, what she thought had triggered the acute pain I was feeling in my right shoulder and neck.

She promptly replied, “Too many birthdays.”

That response reminded me of the affliction that many public companies suffer. Even iconic, industry-leading companies sometimes struggle to maintain their leadership for more than a few decades.

That’s because the history of capitalism is a history of creative destruction. The creators of one particular era often become the “destroy-ees” of a subsequent era. Because of this phenomenon, a set-it-and-forget-it investment portfolio rarely thrives over the long term.

The exceptions to the rule are folkloric, like the “friend of a friend” who forgot about the 10,000 shares of Apple Inc. (AAPL) his mother gave him in 1989. Over the ensuing years, Apple would skyrocket more than 67,000% – boosting the $4,000 value of those ancient 10,000 shares into more than $2.7 million.

More commonly, a “friend of a friend” opens an old desk drawer to find some long-forgotten stock certificate for Bethlehem Steel, Eastman Kodak, Blockbuster, or some other company that has long since scuttled off toward bankruptcy.

The history of the Dow Jones Industrial Average underscores the tendency of capitalism to destroy as it creates. The 12 original members of the blue-chip index in 1896 featured names like American Cotton Oil Co., Distilling & Cattle Feeding Co., National Lead Co., U.S. Leather, and U.S. Rubber.

U.S. Leather declared bankruptcy 15 years later. Most of the other original Dow members have long since faded into larger enterprises.

Because of nonstop technological progress, the composition of the Dow and the S&P 500 have evolved continuously. They’ve changed their membership rosters like a runway model changes outfits.

Inadvertently, the rock group Journey described the continuous effects of creative destruction in its legendary party/karaoke anthem “Don’t Stop Believin’”…

Some’ll win, some will lose

Some are born to sing the blues

Whoa, the movie never ends

It goes on and on and on and on

Even though creative destruction “goes on and on and on,” it doesn’t do so at a consistent rate. Technology accelerates it.

As the pace of technological progress accelerates exponentially, so does the pace of creative destruction. This dynamic helps explain why members of the major stock market indices tend to get the boot more quickly than they used to.

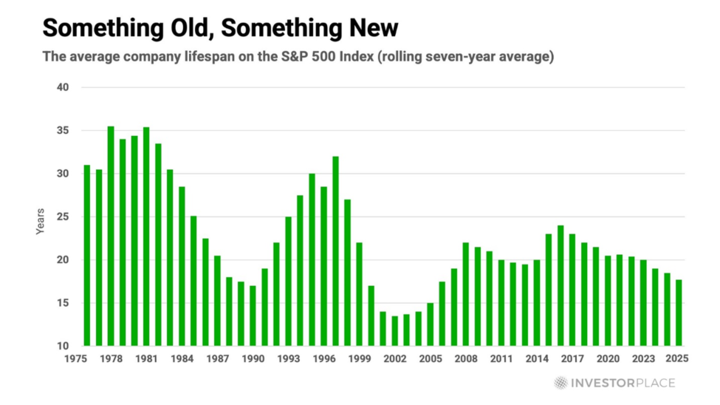

The nearby chart illustrates this phenomenon. In the 1970s, stocks that belonged to the S&P 500 would spend about 32 years as members of the index. Today, however, the average S&P 500 stock spends only about 16 years – or half as much time – as a member of the index.

This trend was well established, even before artificial intelligence burst onto the scene. But with the arrival of AI, the processes of both wealth creation and wealth destruction should accelerate dramatically.

Therefore, we investors must remain alert to emerging investment opportunities. But at the same time, we must keep a wary eye on the companies and industries that AI will likely “disrupt.”

To be sure that you are not inviting victims of AI’s creative destruction into your portfolio, join me today at my elite-trading service The Speculator. As a member, you will receive access The Speculator Model Portfolio, as well as my latest trade alerts.

You will also receive access to all of my special reports, including 5 Victims of the Race to AGI. In this report, I’ve identified five specific companies that seem particularly vulnerable to AI’s expanding presence in the global economy, especially as it blossoms into AGI, or artificial general intelligence.

Now, let’s take a look back at what we covered here at Smart Money last week…

Smart Money Roundup

The Latest Inflation Reports Are in… Is the Wild Ride Over?

In light of the recent CPI and PPI reports – and with the Federal Reserve’s crucial meeting around the corner – I invited Louis Navellier to break down the current economic landscape. In this Smart Money Special Issue, he offers insights on inflation trends and potential Fed actions, and a warning about an upcoming “financial tsunami” driven by AI. Click here to read more.

If You Haven’t Struck Oil, Do This Instead

While there is no perfect investment method, there is a way to allocate your assets intelligently. This will then help you set yourself up for the best chance at success. Now, there are multiple facets to this strategy, but the one I want to focus on is stocks to buy and hold forever. So, here are three stocks that I consider to be some of the best “Forever Stocks” out there. Read more here.

Stock Investors Can’t Ignore This “Alert” From the Bond Markets

Two weeks ago, the 10-Year Treasury yield rose above the 2-Year yield for the first time in over two years. This “dis-inversion” (or reversion) of the spread is an extremely bullish sign because it undoes the yield inversion we’ve seen since June 2022 – a typical warning of an upcoming recession. This “dis-inversion” means the recession alarm has now been lifted. So, we remain highly bullish on commodity-based bets and mean-reverting plays in tech and healthcare. Click here to read more.

The One Thing That Could Unleash Stock Market Rally in Just a Few Days

My colleague Luke Lango has identified a rare economic event that historically triggers a massive stock market boom. According to oddsmakers, there’s a 100% chance this event is happening this week. Despite September’s slow start, he believes this event will trigger numerous stock breakouts and has selected three trades poised for significant growth. In this Special Guest Issue, learn why he thinks these circumstances will succeed again.

Looking Forward

More so than any other time in history, emotions and impatience are driving the stock market. Remember what happened back in early August?

On July 31, some lackluster news started to come out about the strength of the U.S. economy and it rekindled fears of a recession. Investors also started to worry that the Fed had waited too long to begin cutting interest rates. And over the next three trading days, the S&P 500 lost over 6% of its value, and the Nasdaq Composite lost nearly 8% over the same period.

Roughly 10 days later, though, the markets recovered their losses and started marching to new highs. However, many investors had panicked and sold their stocks for a loss instead of just sitting tight.

So, to understand how to set yourself up for success, especially in today’s market, you need to know one very important thing: deciding when to sell.

Nothing is harder. In fact, it’s often called the “hardest thing to do in investing.” Yet, deciding when to sell is one of the most important decisions you can make when it comes to managing your portfolio over time.

That’ why, along with a special guest, I will soon reveal a breakthrough that can help keep you confidently in the markets, squeezing out as much profit as possible…

While also alerting you before the next big selloff occurs.

I will provide more details throughout the week ahead. So, be sure to keep an eye on your inbox.

Regards,

Eric Fry