Today, the U.S. Federal Reserve officially began its first rate-cutting cycle in four long years – and with a “bang,” no less.

In our view, this bold move opens the door for stocks to party like it’s the 1990s all over again.

The big news here, of course, is that the Fed has cut interest rates by a whopping 50 basis points (bps). That’s uncommon. Typically, the central bank cuts in 25-bp increments. Jumbo 50-bp moves are rare, typically reserved for when the Fed wants to really support the economy.

In other words, with today’s jumbo cut, the central bank is making it clear that the U.S. economy has its full support.

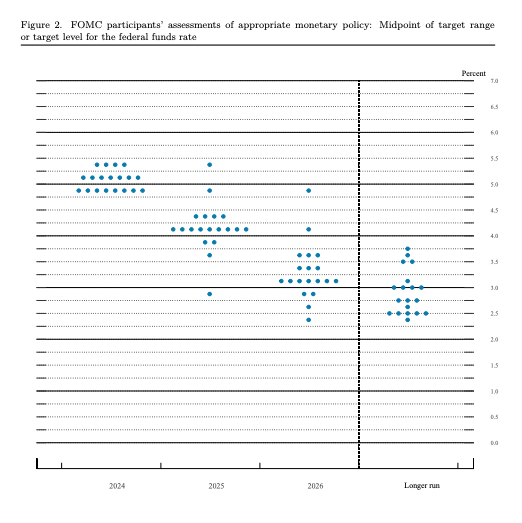

Indeed, in its updated Summary of Economic Projections, the Fed pointed to more rate cuts this year… more rate cuts next year… and more cuts the year after that. In total, the Federal Reserve is projecting another seven to eight rate cuts over the next two years.

And in the bank’s post-meeting press conference, Fed Board Chair Jerome Powell sounded very dovish. He expressed that if the economy begins to weaken unexpectedly, the Fed will cut rates even more aggressively than it’s forecasted.

Between that dovishness, the rate projections, and this initial jumbo cut, the Fed demonstrated that it will do everything it can to help the economy regain its strength over the next few years.

We think that’s exactly what will happen.

What’s Coming Down the Pike

As the ‘dot plot’ shows, the Fed will cut rates consistently over the next one to two years.

Collectively, those cuts will help to reinvigorate the economy.

Mortgage rates will crash, reenergizing sidelined homebuying demand and unfreezing the housing market. Auto financing rates will plummet, too, reheating the stalled-out auto market. And debt costs will fall, prompting both individuals and institutions to borrow and spend more money.

In other words, it seems the economy is about to bounce back in a big way. As it does, the markets should, too.

But this thesis isn’t set upon a hunch. We’ve looked to historical precedent to find a bit of a roadmap here.

As we’ve mentioned in previous issues, we’ve experienced six rate-cutting cycles since 1990. Three of those cycles were ‘good;’ three were ‘bad.’

And one of those ‘good’ cycles holds particularly strong parallels to the economic setup we have right now.

Indeed, throughout 1997 and ‘98, the stock market and economy did very well, partly powered by internet investment tailwinds. Then, in the summer of 1998, the economy started to slow, and the stock market began losing its footing. The Fed rode to the rescue with rate cuts. And over the next 18 months, stocks – led by tech stocks – absolutely soared. The Nasdaq 100 actually rallied more than 300% from trough to peak (late 1998 to early 2000).

And it appears history is repeating right now.

Throughout 2023 and ‘24, the stock market and economy performed well, partly powered by AI investment tailwinds. Then, in the summer of 2024, the economy started to slow, and the stock market began losing its footing. The Fed has ridden to the rescue with rate cuts.

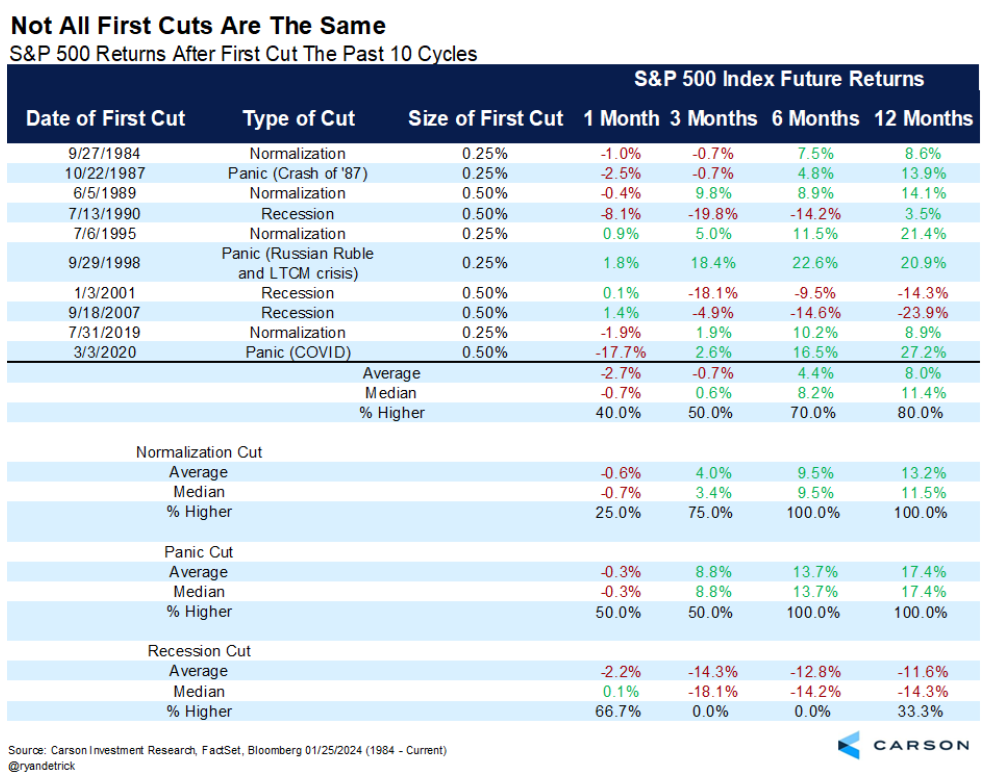

Going into this cut, however, we knew that it was possible for a large rate cut to elicit a reaction similar to panic within risk assets, as it could be seen as a sign of an impending recession.

That’s not unusual. And it’s nothing to worry about.

Looking back, we see patterns of negative performance from stocks within the first month when the Fed cuts rates. Of the past 10 rate cuts going back to 1984, the SPX’s ROI has been negative 60% of the time. That’s true of the last two rate cuts in 2019 and 2020 as well, which we can see in the following chart:

Nevertheless, the U.S. economy has managed to avoid a recession thus far, and the expectation is that it continues to handily navigate recessionary risks. As we saw in the aforementioned chart detailing rate cuts and SPX performance, the three-, six-, and 12-month periods all turn positive when the economy avoids a recession. We expect that will be the case for stocks in the fourth quarter.

What’s more, Franklin Templeton data shows that the risk of a recession remains muted versus March 2024, as the economy continues to remain stable as far as consumer, business activity, and liquidity are concerned.

Now we expect that over the next 18 months, stocks should soar – paced by tech stocks.

Therefore, we are walking away from today’s Fed meeting feeling very bullish.

The Final Word on the Latest Fed Decision

Folks, we think the greenest of shoots may lie ahead.

The next 12 to 24 months could prove to be fantastic for the markets… especially so for tech and AI stocks.

The bulk of evidence suggests that we will get the ultra-powerful, ultra-rare combination of falling interest rates and rising earnings over the next few years.

So long as that dynamic persists, stocks should keep pushing higher, led by those with the biggest earnings growth – which, as of now and likely for the foreseeable future, are technology stocks.

That’s why we want to get positioned with the strongest stocks in the market.

This moment feels extremely reminiscent of the dot-com boom of 1998/99… which means that AI stocks could absolutely soar over the next few years.

Let’s get ready for that rally and pile into AI stocks with the highest upside potential out there.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.