Yesterday, the U.S. Federal Reserve cut interest rates for the first time since COVID-19 emerged four years ago. And after initially sliding in response to the jumbo 50-basis-point cut, the stock market is now surging to all-time highs.

This behavior isn’t unusual.

We knew going into this Fed meeting that it was possible for a large rate cut to elicit a reaction similar to panic within risk assets. That’s because it could be seen as a sign of an impending recession.

But as we’ve mentioned before, the U.S. economy has managed to avoid a recession thus far. Plus, the data implies that it will continue to handily navigate any recessionary risks.

Now, as it happens, when the economy avoids a recession while the Fed cuts rates, the S&P 500 tends to rally over the three-, six-, and 12-month periods following the first cut. And in fact, given the nature of yesterday’s rate cut, history strongly suggests that stocks will soar over the next year.

History Offers a Post-Rate-Cut Roadmap

The Federal Reserve’s present rate-cutting cycle just began with stocks at all-time highs.

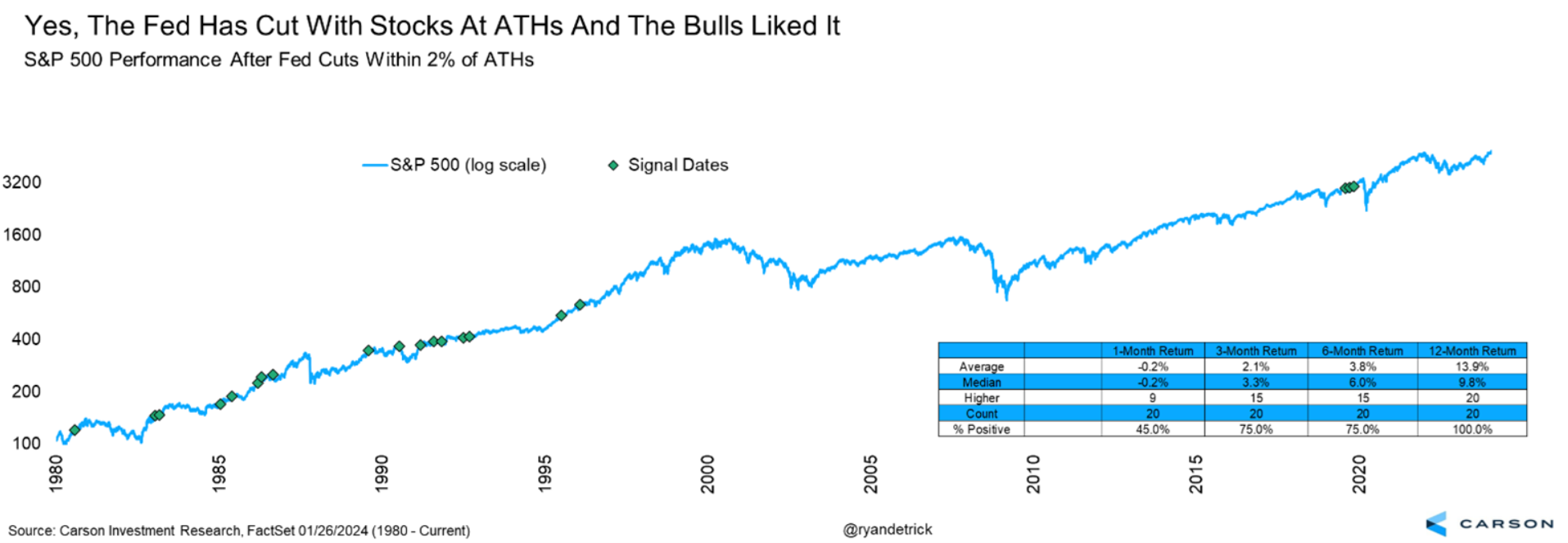

This has happened before – in fact, it’s occurred about 20 times since 1980. That is, over the past ~45 years, the Fed has cut interest rates while stocks were within 2% of all-time highs about 20 times before.

Every single time, stocks were higher a year later, with an average return of nearly 15%.

In other words, history shows that when the Fed cuts interest rates with stocks near all-time highs, stocks almost always soar over the following year.

Well, that’s exactly what just happened yesterday. So, does that mean stocks will head to the moon over the next year?

We think so – because this is about more than the market. It’s about the economy, too. And right now, per real-time estimates of GDP, the U.S. economy is growing at a ~3% pace, with jobless claims running around 1.8 million claims.

In other words, the U.S. is still experiencing good economic growth with low joblessness.

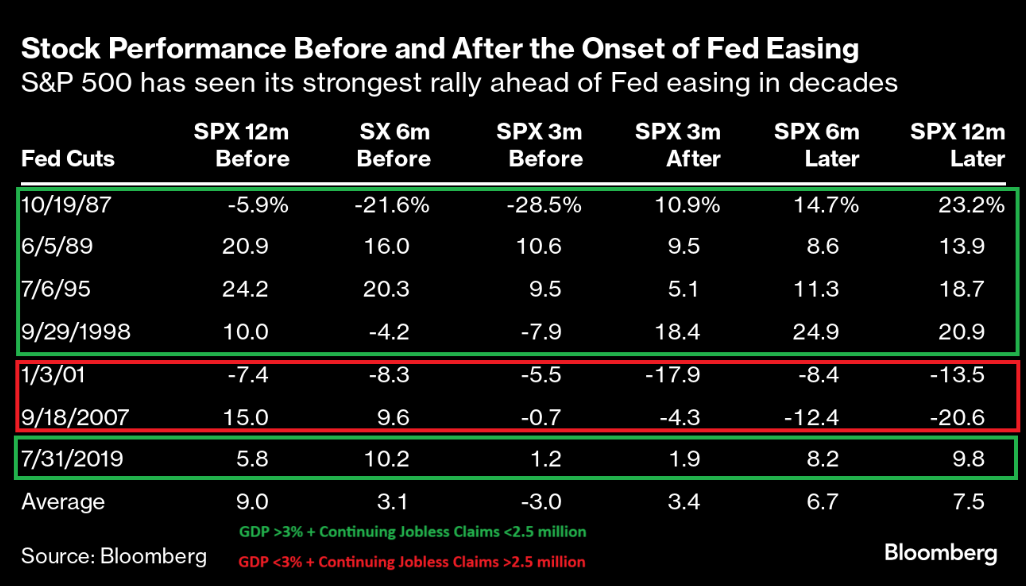

So, that means the Fed also just cut rates while the economy is still growing and joblessness is still low. That, too, has happened before. In 1987, 1989, 1995, 1998, and 2019, the central bank began a rate-cutting cycle while GDP was still running largely north of 3% and jobless claims were largely below 2.5 million. Each time, stocks soared over the next year, with an average return of 17%.

Now, nothing is fool-proof; we live in quite an unpredictable world, after all. But considering this strong historical precedent, it seems there’s a great chance stocks will rake in market gains over the next year.

The Final Word on Rate Cuts and Stock Rallies

The Fed just cut rates with the market near all-time highs, the economy growing at a ~3% pace, and joblessness still at low levels.

That’s a powerful combination. And based on historical precedent, we think it sets the stage for stocks to rocket over the next year.

Though, as with all market rallies, some stocks will rise more than others. And this time around, we’re confident that tech stocks should lead the way – especially top AI stocks.

That’s because the rate-cutting cycle we’ve just entered draws strong parallels to that of 1998/99, wherein tech stocks absolutely surged higher.

In the late 1990s, stocks were benefitting from the emergence of new internet technologies. Companies were investing copious amounts of cash to build new internet infrastructure and create next-gen products and services. That led internet stocks to soar on Wall Street.

Then, in the summer of 1998 the economy slowed – not by much, but enough to worry investors, cause some stock market volatility, and compel the Fed to cut interest rates. Those rate cuts re-stabilized the economy. And that only added fuel to the internet boom’s fire, causing those stocks to explode higher in 1999 and 2000. Indeed, from late 1998 to early 2000, the Nasdaq 100 rose more than 300%!

Similarly, over the past two years, stocks have been benefitting from the emergence of new AI technologies. Companies have been investing hand-over-fist to build new AI infrastructure and create next-gen products and services. AI stocks have soared on Wall Street.

Now the economy is slowing – not by much, but enough to worry investors, cause some stock market volatility, and compel the Fed to cut interest rates. Those rate cuts should re-stabilize the economy. And that should add fuel to the AI boom’s fire, causing AI stocks to explode higher into 2025 and 2026.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.