Welcome to the second-quarter earnings season, folks!

Per usual, the big banks are starting the season off, with JPMorgan Chase & Co. (JPM), Wells Fargo & Company (WFC), Citigroup Inc. (C) reporting their second-quarter earnings this morning.

Now, longtime readers know that while I do look forward to every earnings season, I’m not a big fan of the “big banks”

I used to work for a division of the government that is now part of the Federal Reserve. During my time there, I saw how they essentially “cook their books” – and that scarred me for life.

Banks have had a rough go of it this year following the banking crisis in early March. You may recall that this was when Silicon Valley Bank collapsed, and several other regional banks fell shorty after.

So, going into earnings season this week, Wall Street is laser focused on the big banks’ loan loss reserves and guidance.

In today’s Markey 360, let’s dive into these three banks’ second-quarter earnings. Then, I’ll share which sector you should be looking at right now instead.

Here’s what they’re reporting…

JPMorgan Chase & Co.

For the second quarter, JPMorgan reported earnings of $4.37 per share and revenue of $42.4 billion, beating analysts’ expectations for earnings of $4.00 per share and revenue of $38.96 billion. From the same quarter last year, earnings rose 58% and revenue increased 34%.

JPMorgan Chairman and CEO Jamie Dimon said, “The U.S. economy continues to be resilient. Consumer balance sheets remain healthy, and consumers are spending, albeit a little more slowly. Labor markets have softened somewhat, but job growth remains strong.”

And here’s what JPMorgan had to say in its press release about its loan loss reserves:

The provision for credit losses was $2.9 billion. Excluding First Republic, the provision was $1.7 billion, reflecting net chargeoffs of $1.4 billion and a net reserve build of $326 million. The net reserve build included $389 million in Commercial Banking and $200 million in Card Services, partially offset by a $243 million release in Corporate. Net charge-offs of $1.4 billion were up $754 million, largely driven by Card Services.

As you may remember, First Republic Bank (FRC), collapsed back in the spring. The bank was then acquired by JPMorgan – which benefited the company this quarter, as the acquisition added around $203 billion in loans and securities and $92 billion in deposits.

JPMorgan also increased its future guidance for 2034 net interest income to $87 billion, up from its previous guidance for $84 billion in May.

Following the better-than-expected earnings report, shares of JPMorgan climbed to a new 52-week high.

Wells Fargo & Company

Wells Fargo announced second-quarter earnings of $1.25 per share, up from $0.82 per share in the second quarter of 2022. Revenue also saw a year-over-year increase, coming in at $20.53 billion, up from $17.03 billion in the same quarter last year. Analysts were calling for earnings of $1.16 per share and revenue of $20.12 billion.

About its loan loss reserves, here’s what the company said in its press release:

We reported solid results in the second quarter, with net income of $4.9 billion and revenue of $20.5 billion. Our strong net interest income continued to benefit from higher interest rates, and we remained focused on controlling expenses. As expected, net loan charge-offs increased from the first quarter. Consumer charge-offs continued to deteriorate modestly.

Commercial charge-offs increased driven by a small number of borrowers in Commercial Banking, with little signs of systemic weakness across the portfolio, and higher losses in commercial real estate, primarily in the office portfolio.

We had a $949 million increase in the allowance for credit losses, primarily for commercial real estate office loans, as well as for higher credit card loan balances. While we haven’t seen significant losses in our office portfolio to-date, we are reserving for the weakness that we expect to play out in that market over time.

Wells Fargo also raised its full-year guidance for net interest income to rise 14% instead of 10%, as previously projected.

WFC shares slipped lower in the wake of its earnings report.

Citigroup Inc.

Citigroup reported second-quarter earnings of $1.33 per share. Earnings beat analysts’ expectations of $1.30 but fell from earnings of $2.19 per share in the same quarter last year. Revenue came in at $19.44 billion, which also beat analysts’ estimates of $19.29 billion. However, this was still down 1% year-over-year from $19.64 billion.

“Markets revenues were down from a strong second quarter last year, as clients stood on the sidelines starting in April while the U.S. debt limit played out,” CEO Jane Fraser said. Fraser also commented, “Amid a challenging macroeconomic backdrop, we continued to see the benefits of our diversified business model and strong balance sheet.”

In the company’s press release, it had this to say about loan losses:

Citigroup’s total allowance for credit losses on loans was approximately $16.0 billion at quarter end, with a reserve-to-funded loans ratio of 2.44%, compared to $19.2 billion, or 2.88% of funded loans, at the end of the prior-year period. Total non-accrual loans decreased 31% from the prior-year period to $3.0 billion. Consumer non-accrual loans decreased 35% to $1.4 billion, while corporate non-accrual loans of $1.7 billion decreased 26% from the prior-year period.

The company raised its full-year guidance for net interest income by $1 billion.

Shares of Citigroup fell more than 3% today.

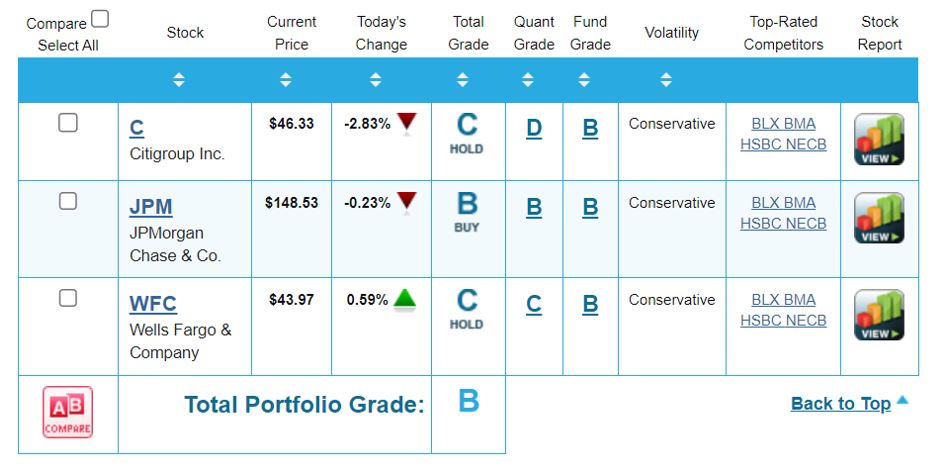

If you take a look at my Portfolio Grader, I would not consider Wells Fargo or Citigroup good stock picks, even after their earnings beats.

As you can see from the report card above, Citigroup and Wells Fargo both have C-Ratings, making them “Holds.” The fact of the matter is that these stocks have low Quantitative Grades. The Quantitative Grade, which accounts for about 70% of a stock’s Total Grade, measures a company’s institutional buying pressure.

You can think of this as “following the money.” The more money that floods into a stock, the more momentum a stock has to rise. The opposite is also true; the more money that flees a stock, the more momentum a stock has to fall. So, these stocks are not good buys right now. I should add that although JPMorgan holds a B-rating, I do not view at a good growth play.

Instead, there is another sector that I am focusing on right now: tech.

Technology stocks have dominated for the better part of this year. During the first six months of 2023, the tech-heavy NASDAQ surged nearly 32%, compared to the S&P 500’s 16% gain and the Dow’s 3.8% rise.

My Growth Investor Buy Lists are a great place to find fundamentally superior tech stocks. In fact, I just added a new tech stock to my Elite Dividends Payers Buy List in my Growth Investor Monthly Issue for July.

To learn more about Growth Investor, and gains access to my Buy Lists, simply click here.

(If you are already a Growth Investor subscriber, you can log in here.)

Sincerely,

Louis Navellier

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

JPMorgan Chase & Co. (JPM)