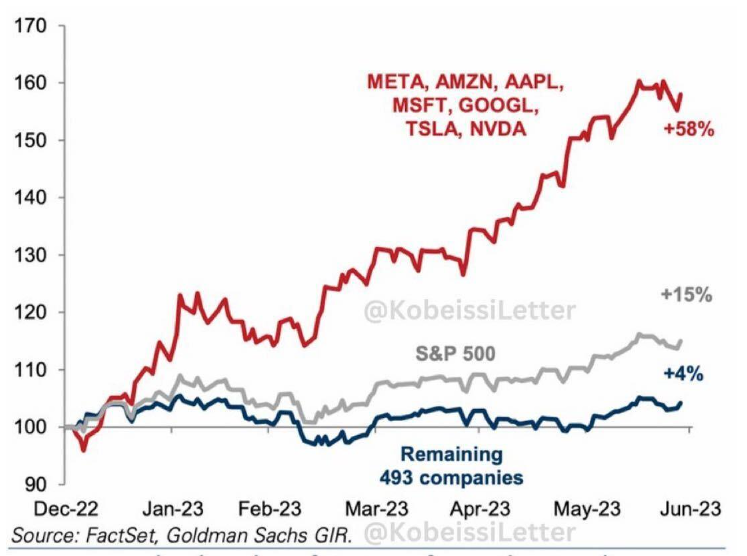

You may have noticed. The 2023 stock market rally has been very unbalanced. The so-called Magnificent 7 mega-cap tech stocks – Meta (META), Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Tesla (TSLA), and Nvidia (NVDA) – are up nearly 60% so far this year.

The other 493 stocks in the S&P 500 are up just 4%.

It’s been a mega-cap tech-dominated stock market rally so far in 2023.

But we think that is about to change in a major way.

It isn’t unusual that large-cap stocks dominated the stock market rally in the first half of 2023. In fact, it is very normal.

We’re in a new bull market. There’s really no arguing that. The length and magnitude of this rally off October lows has no historical precedent as a bear market rally. It is 100% consistent with a new bull market.

And every new bull market starts with large caps.

That’s because at the start of new bull markets, investors start to become more confident; but they still remain largely cautious. Therefore, they aren’t willing to get too risky, so they buy only “safe stocks” – large caps.

This is Phase 1 of every new bull market – the Large-Cap Domination.

But at some point in every new bull market – usually about six to nine months after the market actually bottoms – we see a major shift.

Optimism and greed replace skepticism and caution. Folks start to take increasingly riskier bets. They leave the large-cap stocks and start piling into small caps.

This is Phase 2 of every new bull market – the small cap surge.

And we’re about to enter Phase 2 of this new bull market.

The Small Cap Shift

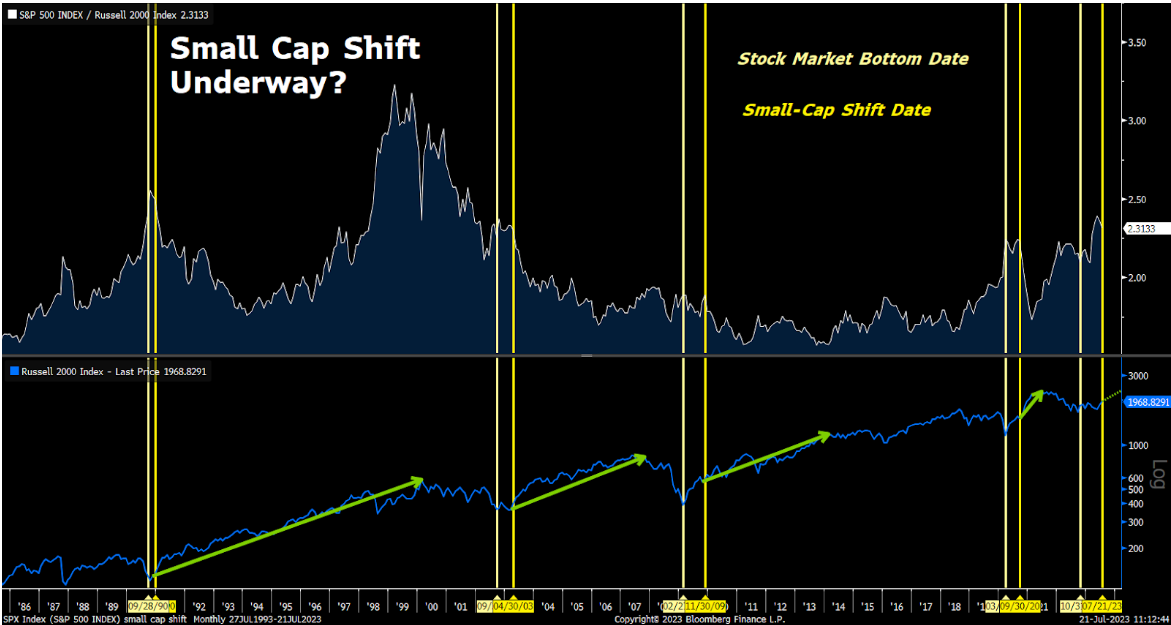

Typically, the bull market shift starts once small caps start to meaningfully outperform large-cap stocks. This is best captured by a steep drop in the S&P 500 to Russell 2000 performance ratio.

Such a steep drop happened in December 1990, three months after the stock market bottomed and right before small caps surged 340% higher over the next decade.

Another steep drop also happened in April 2003, seven months after the stock market bottomed from the dot-com crash and right before small-cap stocks surged 130% higher over the next few years.

It also happened in November 2009 (eight months after the stock market bottomed in the 2008 financial crisis) and September 2020 (six months after the stock market bottomed in the COVID crash). Each time, small caps soared over the next few months and years.

And this dynamic appears to be playing out again right now.

That is, the S&P 500 to Russell 2000 performance ratio dropped sharply in June. It has continued to drop in July.

This looks like this could be the start of a small-cap shift and subsequent surge.

We expect that in the second half of 2023, stocks will keep rallying very strongly. But the rally will look a lot different than the one we saw in the first half of the year.

Large-cap tech stocks will stall out. Small caps will soar.

This is a major shift.

And if you’re prepared for it, you could make a ton of money in small-cap stocks in the second half of this year.

The Final Word

Since ChatGPT’s launch in November 2022, right around when stocks bottomed, AI stocks have been the market’s biggest winners.

ChatGPT is this stock market’s “firestarter,” if you will.

And I’ve unearthed a backdoor way to invest in it.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.