This week, the seemingly unstoppable stock market rally hit some speed bumps. Now, though, it seems like those hiccups are already in the rearview mirror. And it’s time for stocks to rally again.

The bullish inflection point came this morning with July’s job market report. The data broadly underscored that we’re in a “Goldilocks” situation. The economy isn’t cold enough for a recession to be around the corner, but it also isn’t hot enough to warrant more rate hikes.

Breaking Down the Job Market Data

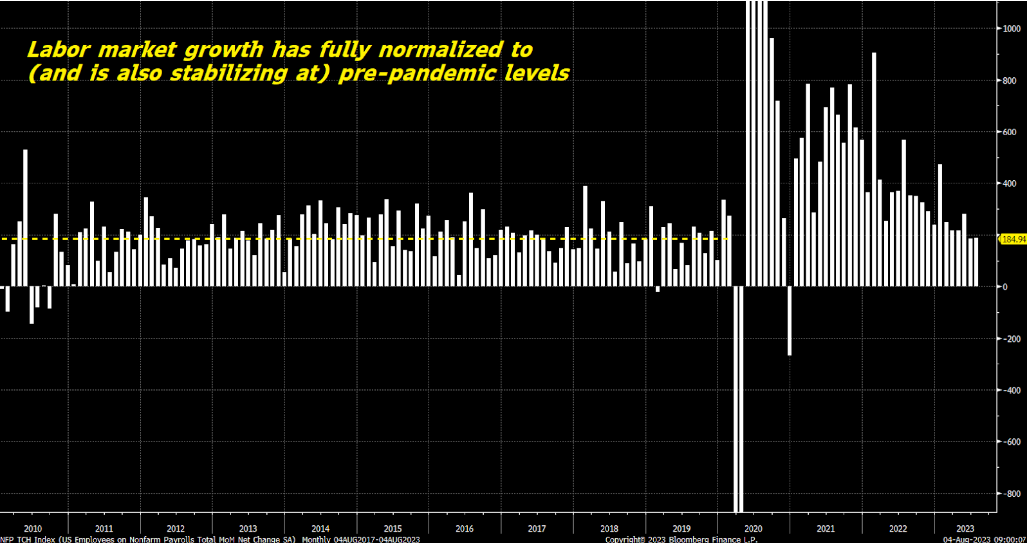

Last month, the U.S. economy added 187,000 jobs, below estimates for 200,000 new jobs. And June’s job growth number was also revised lower. Perhaps most interestingly, it seems we’re right back to the same job growth we had throughout the 2010s, when we averaged 184,000 new jobs per month.

Clearly, this isn’t a labor market that’s “too hot.” Nor is it “too cold.” Instead, the current pace of job creation is a perfect balance of healthy and sustainable.

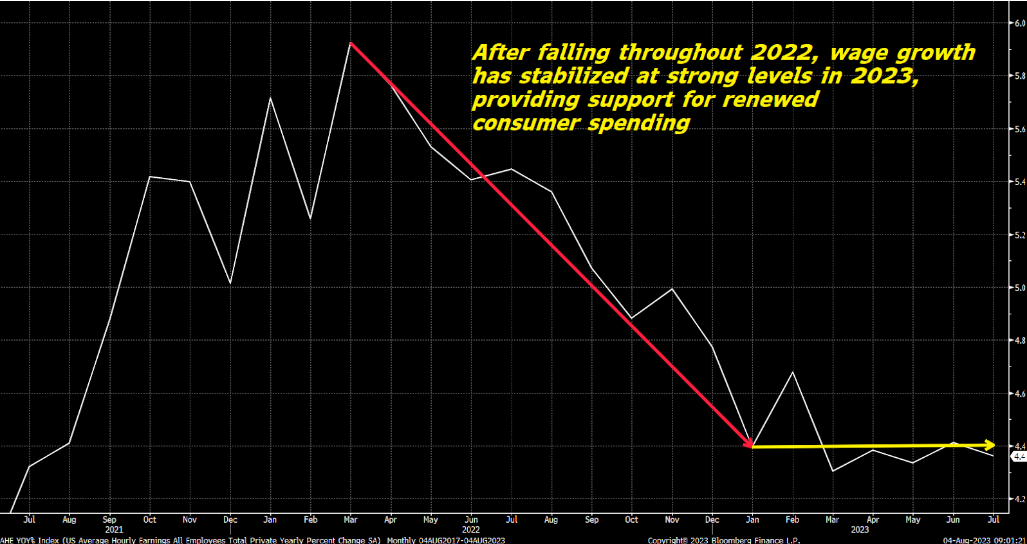

And it’s the same story with wages. Average hourly earnings rose 4.4% in July. They also rose 4.4% in June. Indeed, they’ve actually been rising between 4.3% and 4.7% since January. Wage growth has very clearly stabilized in the mid-4% range.

And that’s bullish because:

- Mid-4% wage growth isn’t big enough to create an inflation problem.

- Wage growth significantly decelerated throughout 2022 but is now stabilizing in 2023, providing support for renewed consumer spending over the next several quarters.

Of course, consumer spending accounts for 70% of U.S. GDP. If consumers start spending again because their wage growth is stabilizing (very likely), then the economy is primed to reaccelerate over the next year.

In other words, today’s job market data painted the picture of a U.S. economy that – after getting too hot in 2021, then too cold in 2022 – is finally settling in at a sustainable and healthy pace of growth.

The result? A so-called “Everything Rally” on Wall Street.

The Dow Jones, S&P 500, and Nasdaq all rallied. So did value stocks, growth stocks, large caps, small caps, and commodities. Even cryptos rallied.

It seems that the 2023 rally has returned.

The Final Word

That’s why I want to tell you about one of my favorite investments for this new bull market.

One great prospective investment is the very company that started this whole stock boom – OpenAI, the creator of ChatGPT.

Since ChatGPT’s launch in November 2022, the company’s valuation has doubled!

But that’s just the start.

I truly believe OpenAI could be one of the world’s largest companies in the near future – if not the largest.

OpenAI represents the potential investment opportunity of a lifetime.

Too bad it is a startup that you can’t buy on a public exchange like a big stock…

Though I did manage to unearth an investment ‘loophole’ that allows you to take a stake in OpenAI now – before its highly anticipated IPO.

This is your chance to invest in the next big thing. Like investing in Apple (AAPL) in the 1980s or Amazon (AMZN) in the 1990s, this is an opportunity you can’t afford to miss.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.