Reinflation fears, spiking Treasury yields, recession risks – and the real reason stocks are falling in August has to do with rate cuts.

You read that right – rate cuts.

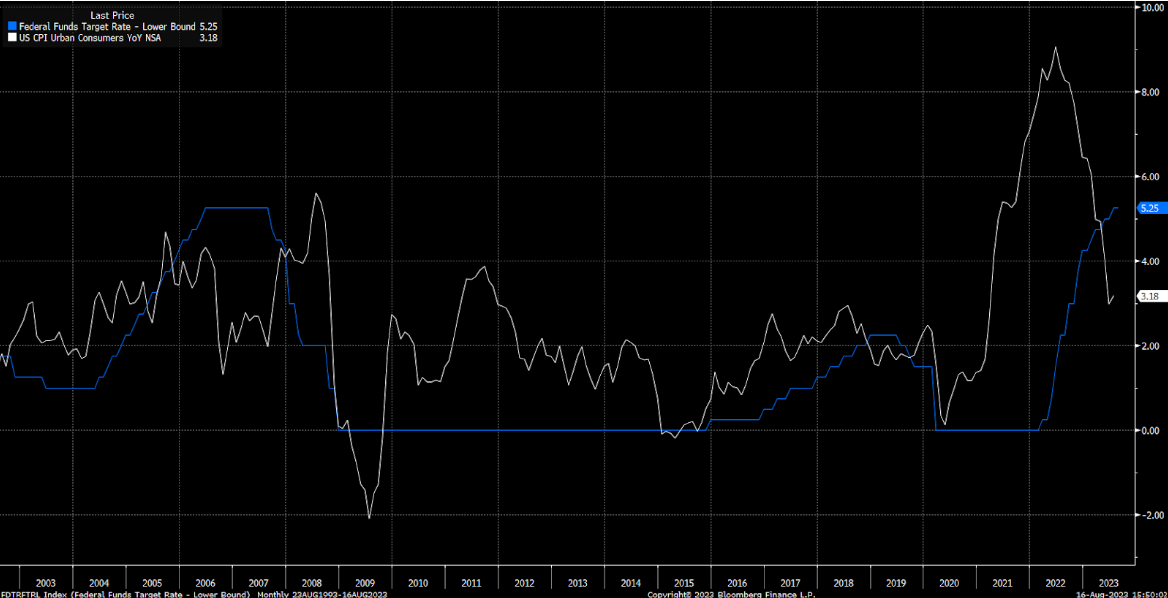

We believe the Fed is done with its rate-hiking campaign. It has lifted its federal funds rate all the way to 5.25%, the highest level since 2007. Inflation is running at 3.2% right now. That means the federal funds rate is ~200 basis points above the inflation rate.

That should be sufficiently high enough to ensure that interest rates have peaked.

And Wall Street is on the same page about that. For the past several weeks, odds for another rate hike in September have consistently hovered around just 10%. And odds for a rate hike after September have consistently hovered around 0%, too.

That hasn’t changed at all in August.

So, what has changed that would alter the course of stocks?

Expectations for incoming rate cuts.

Rate Cuts Are Coming

It has become increasingly clear that the economy is not on the verge of collapse. Recent economic data confirms that consumers are still spending. Jobs are still plentiful. The housing and stock markets are recovering.

As it turns out, the economy is on pretty solid footing right now.

That’s important when thinking about potential rate cuts in 2024.

To be clear, rate cuts are coming. The Fed believes that, at 5.25%, interest rates are currently restrictive. And ultimately, its goal is to return the Fed Funds rate to a neutral rate once inflation is tamped down.

Best estimates for the neutral rate today are between 2% and 3%. That means the Fed fully intends to cut rates by 200 to 300 basis points over time.

But at what pace will those rate cuts happen?

Well, the Fed won’t start cutting rates until it’s sure inflation is completely under control. And the somewhat contradictory reality is that the stronger the economy is today, the longer it will likely take to get inflation in check.

In other words, the stronger the economy is today, the slower the Fed will be in cutting rates next year.

A Slow Pace of Rate Cuts?

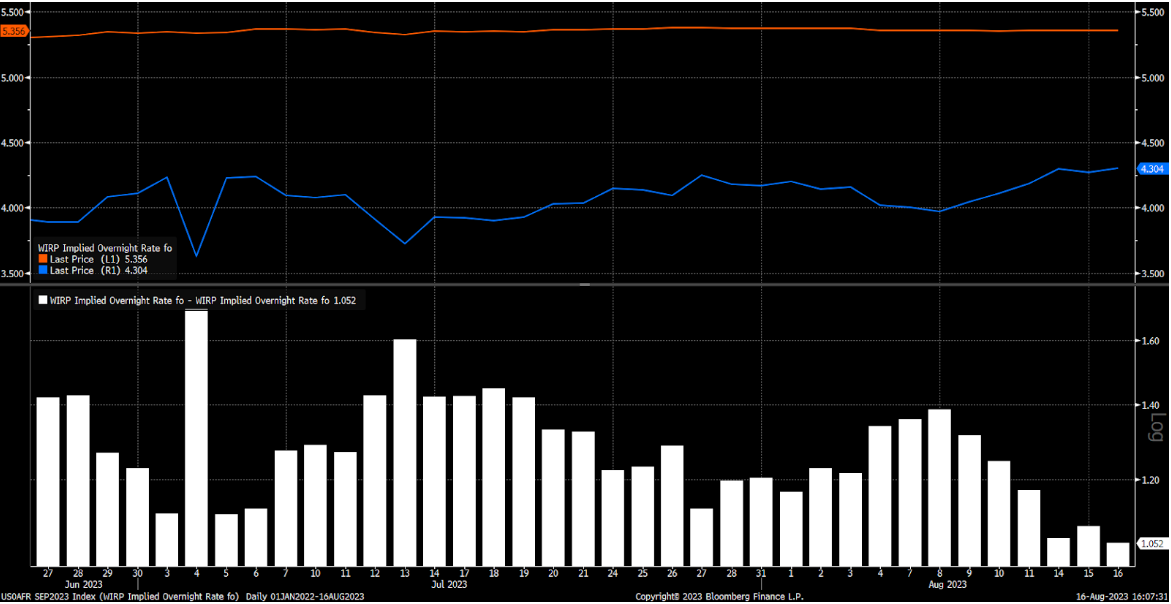

The economy has strengthened over the past month. Consequently, the market has started to price in a slower pace of rate cuts in 2024.

In mid-July, the market was pricing in six full rate cuts next year. Now it’s expecting just four. Over the past month, expectations for 2024 rate cuts have fallen by a two full cuts.

That is what has changed to alter the direction of stocks.

The slower the Fed cuts rates in 2024/’25, the longer rates will stay elevated, and the higher Treasury yields can go in the short term. And when Treasury yields spike, stocks drop.

That is the ugly dynamic we find ourselves in today.

There is a misconception that if the economy stays strong, inflation will stay sticky in the 3% to 4% range. We don’t buy that idea.

The numbers simply do not support sticky inflation.

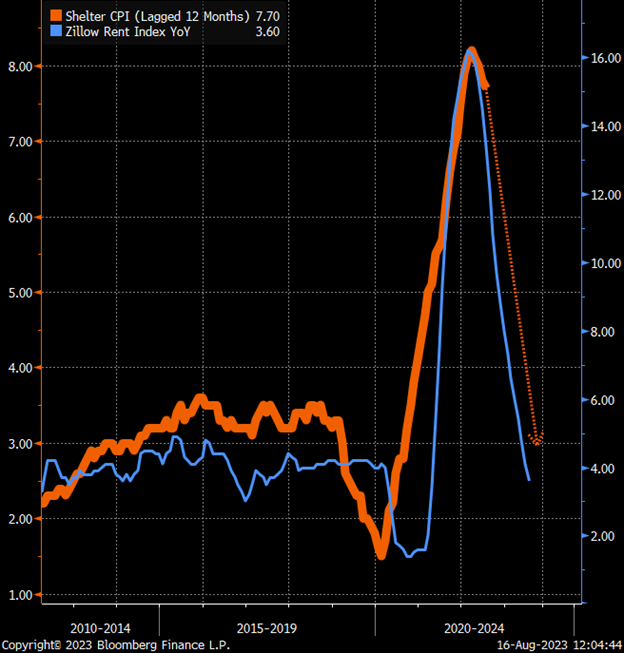

The biggest component of the consumer price index (CPI) is shelter CPI, which is set to crash over the next 12 months. That’s mostly because it is a lagging indicator, and real-time asking rent inflation has crashed over the past 12 months. Our models and models from the San Francisco Fed both suggest shelter CPI will go from +7.7% today to zero by the middle of 2024.

In other words, more than one-third of the CPI basket is set to crash over the next 12 months.

What about the other two-thirds? That will be driven by commodity prices and consumer spending.

Inflation Is Not Sticky

Commodity prices did rise in July – they failed to break out and are falling again here in August. Importantly, many of them – like oil – got rejected at critical resistance levels, suggesting that commodities are still stuck in a downward trend.

We don’t see commodity prices resurging over the next 12 months in a manner that will keep inflation sticky.

And it is equally as tough to see consumer spending becoming inflationary. The post-COVID spending boom was driven by low interest rates, excess savings, and a temporary suspension of recurring payments like rent and student loans.

But interest rates are now high – really high. All of those excess savings from COVID have been wiped out. And student loan payments are restarting next month.

Consumer spending won’t crash. But it certainly won’t accelerate meaningfully higher in the face of those headwinds.

Add it all up, and over the next 12 months, we will get crashing shelter CPI and steady commodity prices and consumer spending.

That equates to 2% to 3% inflation rates, not 3% to 4% inflation rates.

In other words, we’re going to get the best of both worlds next year: a stabilizing economy with still-falling inflation rates, which will allow for a fairly rapid pace of Fed rate cuts.

The Final Word

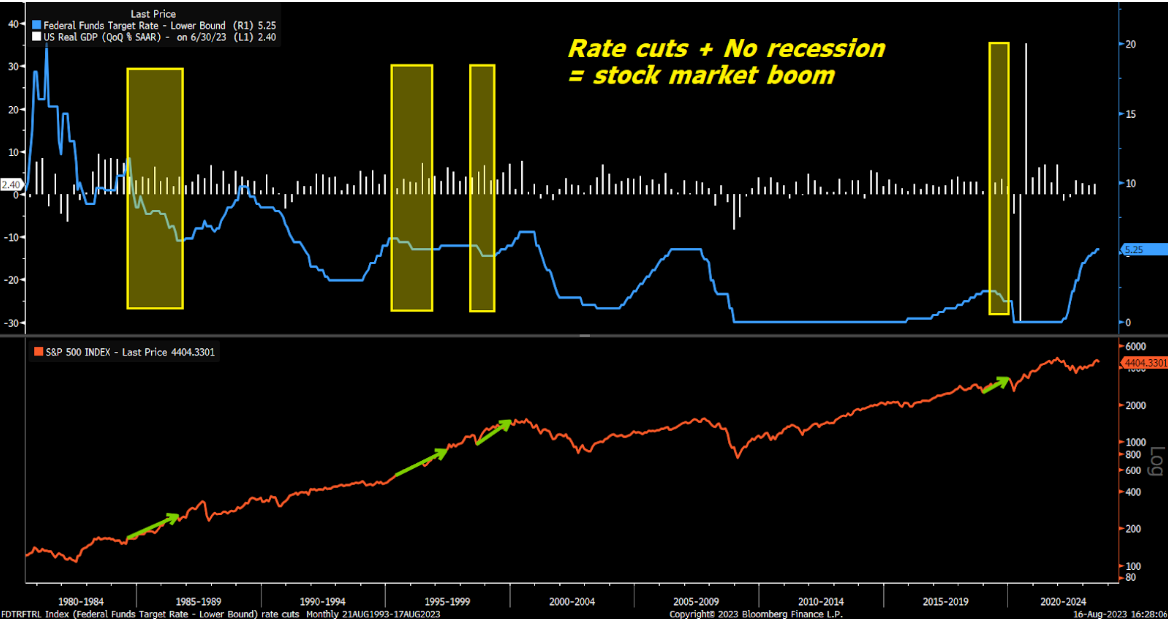

That is very bullish. Just look at what happens every time the Fed cuts rates when there isn’t a recession. Stock soar – every time.

It happened in the mid-1980s, mid- and late 1990s, and late 2010s.

The Fed cut rates. The economy averted a recession. Stocks soared.

We’re confident that we’ll see that dynamic repeat in 2024/25.

And that means you want to buy stocks on weakness ahead of this stock market surge.

We discovered one such great buying opportunity two days ago.

The recent selloff has left one AI tech stock trading at just 10X forward EBITDA estimates, and it’s a firm that analysts believe will see 20%-plus profit growth over the next several years.

This stock is also trading at its cheapest valuation ever and has hit technical levels suggesting it is ripe for a huge rebound.

We think this stock could double before the end of the year.

And just two days ago, we added it to our model portfolio.

Find out its name, ticker symbol, and key business details now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.