The consequences of the Fed’s rate policy … a clear-eyed look at this year’s market gains and next year’s market hopes … believe in “higher for longer” … this is a trader’s market

“Well, well, well, if it isn’t the consequences of my own actions.”

Fellow Digest writer Luis Hernandez introduced me to that quote some months ago, and I now use it far too often.

I wonder if Federal Reserve Chairman finds himself browsing the headlines today, having a moment of quiet self-reflection about the consequences of his own actions.

There’s the wrecking ball of the surging 10-year Treasury yield that briefly pierced 5% yesterday for the first time since 2007…

The gridlocked housing market, with the fewest number of homes being sold since the foreclosure crisis in 2010, as well as the worst affordability levels in nearly 35 years…

A handful of regional banking failures…

The highest average credit card APR of all time (24.45%) wreaking havoc on the highest U.S. credit card debt level of all time (over $1 trillion) …

An explosion in corporate defaults. You may not have heard about this one yet. But as of July, U.S. corporate debt defaults had already blown past 2022’s full-year number…

And let’s not forget the skyrocketing debt service costs for the federal government. Our government is now paying a record amount of interest to service its colossal, record-setting debt (good thing we’re only funding two different global wars today).

Cut to Powell at his Jackson Hole speech in August 2022:

These are the unfortunate costs of reducing inflation.

In the midst of all this, there’s one area that hasn’t yet suffered a significant cost yet

The stock market.

Despite the laundry list of market overhangs that we just rattled off, the S&P was only 4% away from setting a new all-time-high earlier this summer. Today, after the recent weakness, it’s still just 11% beneath its record.

How do we justify this?

Can we do it through healthy, climbing earnings?

No.

According to FactSet, if this current Q3 earnings season results in year-over-year earnings growth, it will be the first time since Q3 of last year.

Below, we look at the S&P 500’s performance compared with the S&P 500’s earning since October of last year.

While prices have surged 20% (in black), earnings have fallen 3% (in green).

Clearly, earnings growth doesn’t support this year’s bull market.

But these earnings are all backward looking…

Do forward-looking earnings support it?

Well, now we’re talking.

According to FactSet, here are what analysts expect for upcoming earnings growth:

- Q4 – 7.6% growth

- Q1 2024 – 8.1% growth

- Q2 2024 – 11.7% growth

- For calendar year 2024 – 12.2% growth

But a few points to keep in mind…

First, if this earnings growth forecast plays out, there are two ways to interpret it:

Is it the fuel for a new wave of market bullishness beginning today?

Or is it simply the earnings backfill necessary to justify an entire year of stock market gains that were not supported by any earnings growth?

Well, based on the chart we just looked at, as well as how Wall Street always tries to price in the market conditions it believes are coming, which conclusion jumps out to you?

Second, how much weight should we put on optimistic earnings growth forecasts anyway?

Studies suggest not much.

A 2017 research paper titled “An Empirical Study of Financial Analysts Earnings Forecast Accuracy” found that over the prior 12 years, financial analysts were routinely too bullish with their 12-month earnings forecasts by a whopping 25.3%.

Other studies that go further back in time find the same conclusion.

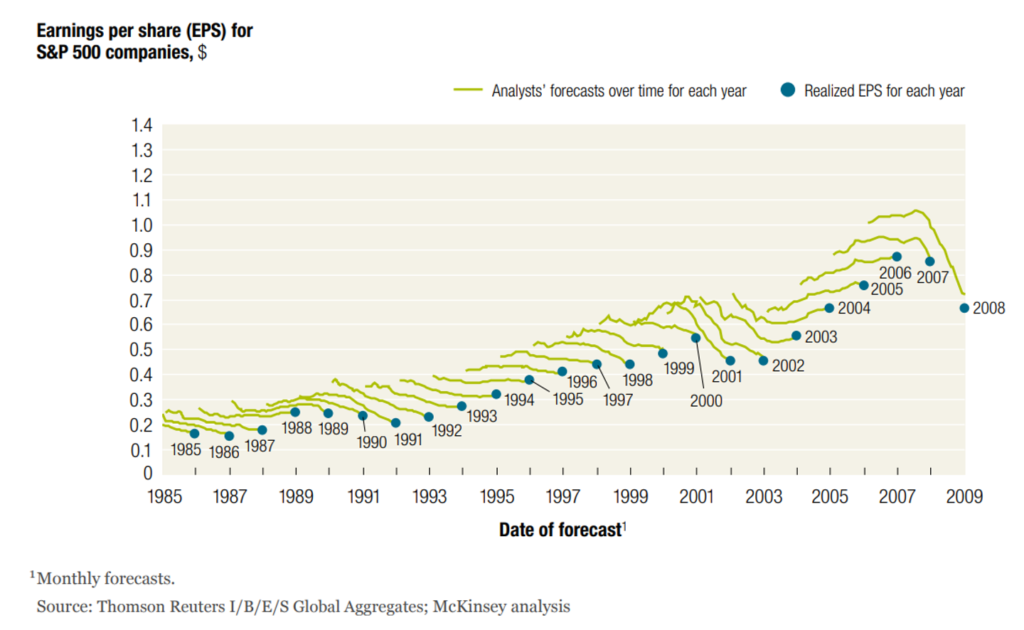

Below is a chart from Thomson Reuters and McKinsey looking at the S&P’s earnings versus analysts’ earnings estimates dating from 1985 through 2009.

The green squiggly lines show you where analysts’ estimates began each respective year… which, in most years, trickled south as the year progresses… ultimately punctuated by the blue dot showing where earnings came in.

Look at all the excessive bullishness.

The research went on to analyze a five-year rolling average of earnings growth and related analysts’ forecasts. It found that actual growth surpassed forecasts just two times in 25 years. And those two occasions happened during the recovery after a recession.

These earnings forecasts matter because they help form analysts’ bottom-up target prices for the S&P 500

And many investors use as the basis for their portfolio positioning.

For example, here’s FactSet with estimates from the analyst community from last week:

The bottom-up target price for the S&P 500 is 5115.99, which is 17.6% above the closing price of 4349.61.

Here too, we need to be cautious about putting too much weight on this forecast.

Josh Brown, the CEO of Ritholtz Wealth Management, recently spoke about these forecasts at the annual conference held by Stansberry Research, one of InvestorPlace’s sister companies. You’ve likely seen Brown speak on CNBC or MarketWatch – he’s a regular on the investment media circuit.

When asked about S&P price targets from the analyst community (Goldman, JPMorgan, Citi, etc), Brown didn’t pull any punches.

From The Stansberry Digest, quoting Brown:

Of all the bull[crap] on Wall Street, calendar-year price targets for the S&P 500 are the biggest bull[crap] you’ve ever seen. Raise your hand if you agree.

Guys, I know the people who make these targets. I’ve had beers with them. I promise you there is no science going on here.

If you take nothing else from today, I promise you this… The market has exceeded pretty much everyone’s expectations… The big takeaway here is there’s a reason why Wall Street produces these price targets. That reason has nothing to do with what’s best for you.

Brown went on to provide two reasons behind these “no science” price targets: free media exposure for the analyst’s bank, and because these price targets are what institutional investors want.

Finally, if earnings growth does, in fact, come in at the analysts forecast of 12.2% for calendar year 2024, consider the unwanted implications

According to YCharts, the average S&P earnings growth rate is 9.03%.

So, if analysts are right about 12.2% growth in 2024, that means next year’s economy will support above-average earnings growth. That suggests the economy will run a little hot – the opposite of what the Fed wants.

Let’s jump to CNBC from yesterday:

Stocks slid modestly on Thursday as Wall Street parsed commentary from Federal Reserve Chair Jerome Powell [who said] inflation was still too high and would likely require lower economic growth…

So, we have analysts counting on higher-than-average earnings growth to support a rising stock market…running into Fed Chair Powell who wants lower-than-average economic growth to squash any final remnants of inflation.

I think you know who wins this battle of market influences, but in case you’re unsure, let’s go to perhaps the greatest trader of all time, Stanley Druckenmiller.

From “The Druck” yesterday:

Earnings don’t move the overall market; it’s the Fed, focus on the central banks, and focus on the movement of liquidity, most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.

With this perspective, who cares about another rate hike? We don’t need another quarter-point increase for the Fed’s actions to date to inflict major damage on interest-rate-sensitive parts of the economy. We’re seeing it happen before our eyes.

So, if the Fed simply leaves rates unchanged for, say, six months, today’s elevated target rate level will continue draining liquidity from the market. Kind of like oil draining from an engine, leaving the pistons to grind against one another, risking an engine lock.

By the way, I picked “six months” arbitrarily. When will the Fed actually give us its first rate cut?

Well, just this morning, Atlanta Federal Reserve President Raphael Bostic said, “I would say late 2024.”

So, basically another 12 months of oil draining out of the engine.

Remind me – why are we expecting the economy to improve?

Our advice remains the same…

Louis Navellier’s newest AI-driven trading service AI Advantage is focusing on the oil and gas sector today. Yesterday, his system recommended two new energy trades.

For newer Digest readers, AI Advantage combines the heart of Louis’ multi-decade market approach – fundamentally superior stocks – with AI-based short-term trading signals. The AI predicts where stocks will be trading 21 trading days into the future with 82% accuracy.

Meanwhile, over in AI Trader, Luke Lango is capitalizing on his AI platform “Prometheus.”

Prometheus is an AI-powered trading system designed and trained to target stocks returning double-or triple-digits before they begin to rally.

Luke has issued five new trades in the last couple weeks to capitalize on opportunities his AI is flagging.

I’ll also mention Eric Fry’s trading service, The Speculator, though this is longer-term in nature. Eric often uses LEAPS (Long-Term Equity Anticipation Securities) to play the megatrends he sees shaping markets. But the payoff can be extraordinary.

For example, in 2021, Eric’s Speculator subscribers closed out a 1,400% return on copper mining giant, Freeport-McMoRan (FCX).

To be clear, that wasn’t a decade-long “buy-and-hold” recommendation from Eric. It was an opportunistic play (if I remember right, it was a hold period of roughly a year or a year-and-a-half). Eric’s subscribers held the position until the market repriced the inefficiency, took their profits, then moved on.

Big picture, this “take advantage of it” mindset is what we’re endorsing today

Forget “the market.”

As Louis likes to say, “it’s every stock for itself.”

Focus on individual opportunities for trading profits. That can mean a hold period of a few days (like Louis’ AI Advantage), a few months (like Luke’s AI Trader) or more than a year (Like Eric’s Speculator ). The hold period reflects the nature of the opportunity at hand.

But whatever it is, look for inefficiencies that create opportunities. Jump in, jump out, grow your wealth.

Coming full circle, perhaps we should rejigger the quote that opened today’s Digest…

Well, well, well, if it isn’t the consequences of the Federal Reserve’s actions.

You and I are paying the price for one of the most explosive rate hike campaigns in history. And even if the “hiking” part is done, the “higher for longer” part is in full swing.

Be careful about the broad market – but be ready to pounce when you see trading opportunities. They’re here today, more are coming tomorrow, and there’s always a bull market somewhere.

Have a good evening,

Jeff Remsburg