The signs pointing toward the resurgence of the global commodity boom … China’s critical role in demand … the cases for aluminum, copper, and lithium … specific trade ideas for you

Today, let’s put you in position to 10X your money.

The opportunity comes courtesy of the “second act” of a sector boom that our macro expert Eric Fry believes is about to kick off.

And when I write “10X,” I’m not exaggerating. In the first act of this sector boom, Eric’s subscribers made an official 1,074% return on one of their trades (while making a handful of triple digits returns on others).

Here’s Eric with the opportunity:

The “commodity comeback” could begin its reign as soon as 2024, which is only a few short months away…

And that could mean big things for a long-struggling corner of the market… and soon…

A few hopeful signs are finally emerging…

There’s one sign in particular that could be a gamechanger. We’ll profile it shortly.

First, let’s get everyone up to speed about the first act of this commodity boom, and why Eric believes we’re at the doorstep of the second act.

Back in summer 2020, Eric made the call that a new commodity supercycle had begun

Given his research, he positioned his subscribers in a handful of related commodity investments … and they took off.

For example, in July 2021, Eric’s Speculator subscribers closed their option trade on copper mining giant, Freeport-McMoRan (FCX), for the 10X return we highlighted a moment ago.

So, what exactly are these supercycles that have the power to produce this type of 10X winner?

Here’s Eric:

Unlike stocks, which tend to move higher over time, commodity prices cycle through powerful multiyear booms, followed by spectacular multiyear busts.

These are called “supercycles.”

No two supercycles are identical. But they all share two distinct traits:

1. In their youth, they produce huge investment gains.

2. In their advanced years, they produce huge investment losses.

That’s why it’s so important to pay attention to them early on. They grow up so fast.

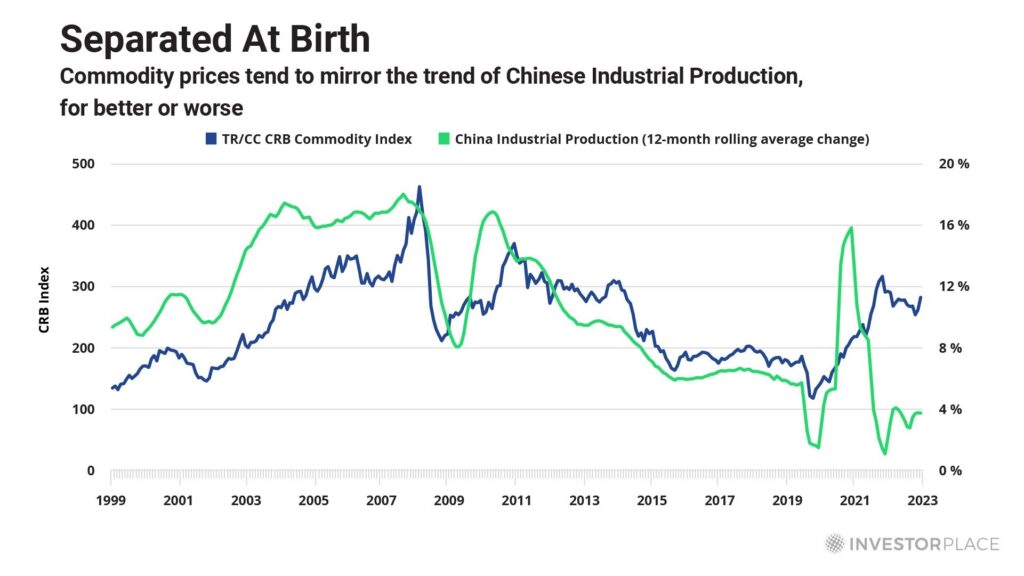

The easiest way to monitor a commodities supercycle is through the TR/CC CRB Commodity Index (CRB), which holds a basket of global commodities.

Below, we look at the CRB Index over the past 20 years, noting the exceptional timing of Eric’s “buy” recommendation based on his identification of a new supercycle.

But as you can see, after hitting a local peak in 2022, commodities began falling

So, is that it? Is the supercycle over?

Here’s Goldman Sachs 2023 Commodity Outlook with some helpful perspective:

Commodity supercycles never move in a straight line; rather, they are a sequence of price spikes, with each high and low higher than the previous spike.

Commodity prices, unlike financial markets, perform an economic function of balancing supply and demand, so once high prices have rebalanced the market in the short term, the high prices are no longer needed, and prices come crashing back down as we witnessed late [last] year.

But ending one spike doesn’t mean the end of the supercycle – long-run supply issues take years to resolve.

We like to say that commodities, while short-run unpredictable, are long-run predictable. The exact timing of these short-term price spikes are difficult to forecast, as it was in 2022.

Conversely, the long run state of the market is predictable as supply and technological trends are far more persistent, with all the conditions required for another spike present in 2023.

And this brings us to Eric’s latest issue of his flagship newsletter, Investment Report. As Goldman just pointed out, commodities are extra sensitive to the relationship between supply and demand.

Well, as you’re about to see from Eric’s research, the biggest influencer on global commodity demand is now showing signs of life after a long stretch of dormancy.

As China goes, so too go commodities

In Eric’s latest issue, he notes that the Chinese economy appears to be strengthening… or at least no longer weakening.

This is enormous news for the commodity markets because China has a voracious appetite for commodities (or at least it did before Covid). Even today, with relatively depressed economic demand, China is the world’s biggest buyer of crude oil, copper, and iron ore.

In Eric’s issue, he illustrates this relationship between Chinese demand and global commodity prices through the chart below.

Here’s Eric to explain the chart:

…Whenever China’s industrial production is trending higher, which it has started to do, the prices of commodities usually follow.

Below, the CRB Commodity Index is in blue with China Industrial Production in green.

China’s influence over specific commodities like iron ore is even more direct and immediate. The country accounts for a whopping 70% of global iron ore imports… and these imports are on the rise.

In the month of August, imports jumped 11% year over year – rising to within a whisker of all-time highs. Reflecting this resurgent demand, China-based iron ore prices have surged 17% during the last four months.

What further evidence do we have that China’s economy is recovering? After all, we don’t want to get lured into a commodity trade only to see China’s flurry of economic activity flame out.

Eric notes that bank credit in China jumped 20% year-over-year in August. He also points toward domestic tourism that’s rebounding sharply. He cites the China National Tourism Administration, reporting that the number of trips organized by Chinese travel agencies in the second quarter of this year soared 342% year over year.

Here’s Eric’s takeaway:

The Chinese economy may be finally emerging from its lengthy post-pandemic slump.

That shift, if it is actually occurring, would be enough to power a significant new rally in the commodity markets.

The three commodities in Eric’s crosshairs

The commodities sector is enormous. The CRB Index includes everything from copper to coffee to livestock. So, let’s narrow down our opportunity set.

There are three metals Eric believes will soar as demand ramps up thanks to green energy initiatives and the growth of the electric vehicle sector.

Aluminum, copper, and lithium.

As Goldman noted earlier, the primary driver of commodities prices is the supply/demand balance. So, how do the respective balances appear for these three commodities?

Back to Eric, beginning with aluminum:

According to Bank of America, a sizable supply deficit will develop in the aluminum market over the next couple of years. The researchers at the bank predict a 1.53 million tonne deficit this year, rising to 1.93 million tonnes next year.

For perspective, global consumption will total about 70.8 million tonnes this year. As that demand level soars toward 108 million tonnes over the next four year, even larger deficits could develop. If these forecasts are close to the mark, aluminum prices should trend higher.

And here’s copper:

Turning to the copper market, Bloomberg New Energy Finance’s (BNEF) new report anticipates booming demand for these metals throughout the balance of the decade, thanks mostly to resurgent demand from China.

The research firm expects yearly global copper demand to jump 17% over the next four years to 29.8 million tonnes. Over the same timeframe, BNEF expects global copper supply to reach just 24.4 million tonnes.

If those forecasts come to pass, a hefty 5.4 million tonne supply deficit would result – putting upward pressure on copper prices…

Finally, here’s Eric’s research on lithium:

As for lithium, the market is currently in balance, but a potentially massive supply crunch is looming…

Fitch Solutions’ research unit, BMI, expects a lithium supply deficit to develop by 2025, then widen considerably over the balance of the decade.

Deutsche Bank researchers agree; they anticipate a “modest deficit” of around 40,000 to 60,000 tonnes by 2025, then widening to a whopping 768,000 tonnes by the end of 2030.

Let’s put a few prospective trades on your radar

For copper exposure, there’s Global X Copper Miners ETF, COPX. Eric has recommended COPX in the past. His official trades have profited to the tune of 100% and 85% respectively (he sold in tranches).

You can also circle back to Eric’s 10X winner Freeport-McMoRan. While he closed the trade in his Speculator service, it’s still in Eric’s Investment Report portfolio today, sitting on a 172% gain as I write Monday morning.

For aluminum, there’s the iShares MSCI Global Select Metals & Mining Producers ETF (PICK). It holds a basket of top miners.

And if you want lithium concentration, there’s the Global X Lithium ETF (LIT). It holds miners including Albemarle (ALB), Sociedad Quimica Y Minera De Chile (SQM), and Pilbara Minerals (PLS.AX).

Whatever way you decide to play it, here’s Eric’s bottom line:

The sluggish economic conditions of the past few months have been curbing demand for most commodities, including the battery metals. But the powerful long-term demand trends for aluminum, copper, and lithium remain intact.

It simply took a breather. I expect that trend to reassert itself forcefully in 2024.

Have a good evening,

Jeff Remsburg