Hello, Reader.

AI is an incredibly powerful – almost scary-powerful – megatrend.

The implications of its deployment will supercharge choice companies into previously unachievable milestones… including the coveted trillion-dollar market cap.

With the power of AI, I believe that the next trillion-dollar companies are out there… and will reward their investors handsomely along the way.

Here are two companies I think will be the next to do so.

Meta Platforms

Facebook’s parent could soon regain its trillion-dollar crown.

Social media giant Meta Platforms Inc. (META) first became worth $1 trillion in June 2021 on an accelerating advertising business. At the time, analysts believed the firm would generate $33 billion the following year.

That didn’t go to plan. The company would instead post $19 billion in free cash flow due to a slowdown in online advertising and mounting losses from its virtual reality business. Meta’s market capitalization sank as low as $250 million last year. (It’s inched back up to around $600 billion.)

Nevertheless, Meta is still a promising bet.

The firm’s aggressive cost-cutting measures and improving ad business were already showing positive results. And soft inflation figures from last month set the stage for a summer stock surge. Facebook is historically more sensitive than its peers to market cycles.

That means a recovery could happen faster than expected. FCF is now expected to recover to $23 billion this year and hit the “magic” $30-billion level in 2024. Heavy advertising spending from the 2024 presidential election means these figures will likely play out this time around.

International Business Machines

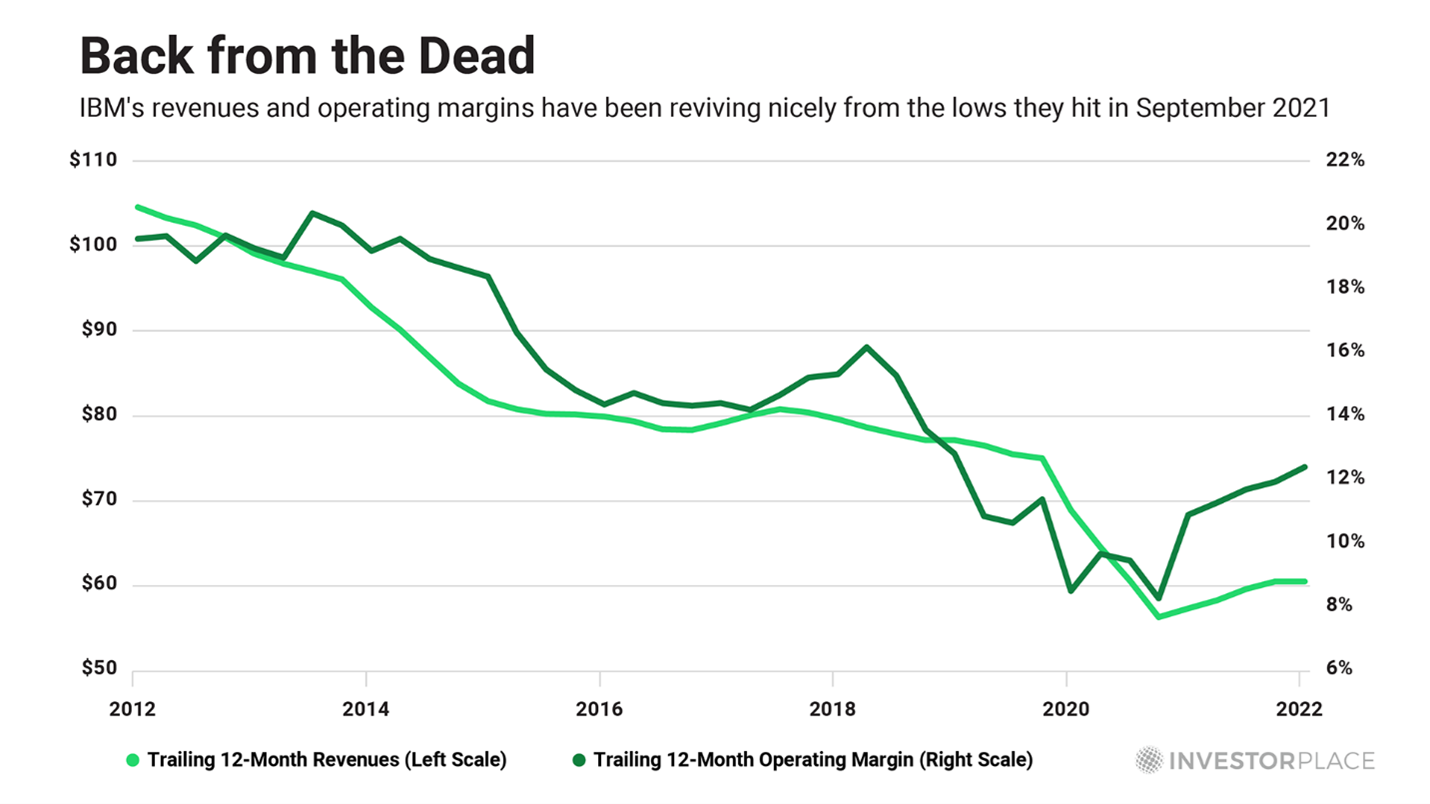

The below chart tells you almost everything you need to know about the “new” International Business Machines (IBM)…

The iconic computer company’s revenues and operating margins are no longer tumbling. They are rising once again.

After hitting a 30-year low in Sept. 2021, IBM’s revenues and margins have been making a noticeable recovery. These favorable financial trends do not prove IBM has embarked on a new growth trend, but they do support that thesis.

Underdog to Burgeoning Champion

Over the past few years, IBM has been reinventing itself as a hybrid cloud and artificial intelligence company. To accelerate this transformation, the company has been pursuing an out-with-old-in-with-the-new growth strategy.

Since 2019, IBM has divested 17 legacy businesses, while also making more than 30 acquisitions. One of the most impactful acquisitions during its shopping spree was Red Hat, which IBM acquired in 2019 for $34 billion. Although the price tag seemed a bit rich at the time, this acquisition brought a market-leading hybrid cloud platform into the IBM family.

Red Hat’s capabilities are so formidable that more than 90% of Fortune 500 companies rely on its platform.

According to Grand View Research, the global cloud-computing market will grow 150% over the next seven years – from about $600 billion this year to more than $1.5 trillion in 2030. The global artificial intelligence industry will reach a similar size by 2030, according to Fortune Business Insights.

IBM is riding the current of both of these powerful megatrends.

The AI Domination

“IBM Watson” is the company’s core AI offering. It integrates with the Red Hat hybrid cloud to enable companies to pool data from numerous sources, then process that data to achieve objectives like predicting future outcomes, automating complex processes, and optimizing employees’ time.

Out in the real world, many companies accumulate and store data in the corporate equivalent of a “junk drawer.” Valuable information exists in every imaginable form…

- Company memos…

- PDFs…

- Charts and other images…

- Databases…

- Customer records…

- Call logs…

- Handwritten documents…

- Blog posts…

- And tweets.

These data are “unstructured,” to put it politely. But Watson can use AI to synthesize and process these data so that businesses can make informed decisions.

In other words, IBM promotes Watson AI as a solution that can enhance productivity across an entire enterprise.

Increasingly, enterprises are buying the AI-empowered solutions IBM Consulting is selling. Revenues from this division have jumped 18% during the last two years.

A Positive Future

Not only are IBM’s revenues and operating margins trending higher, but profits are also following suit. Operating income has jumped 77% during the last two years.

Because IBM’s fast-growing AI and hybrid cloud businesses will power most of its future growth, I expect the company to become a dominant leader of the AI boom.

Course of Action

Broadly speaking, all up-and-coming technologies like AI present investors with daunting challenges. Many of the most exciting plays on the technology are upstarts that stand on the clay feet of poor balance sheets and perpetual quarterly losses.

That’s why a “barbell” approach often works best. On one end of the bar, you invest in leading tech companies that are already profitable and established. But then you stack the other end of the bar with a basket of small, promising tech companies that are not yet producing consistent profits… or any at all.

But as I’ve said before, patience is a superpower… and it pays to use it.

Regards,

Eric Fry

Eric Fry

Editor, Smart Money