Eric Fry’s inflation prediction comes true … why Luke Lango sees 2% CPI inflation within four months … a soft landing is possible, but keep your eye on this issue … Eric’s AI trades …

One month ago, the Consumer Price Index reading for September came in hotter than expected.

Both on a monthly and yearly basis, the inflation measure topped forecasts. Afterward, members of the Federal Reserve warned of resilient inflation while pointing toward a “higher for longer” interest rate policy.

Despite the uptick, our macro expert Eric Fry had a different perspective.

From Eric’s flagship newsletter, Investment Report:

Inflation has dropped precipitously during the last 12 months, which should provide some comfort to the policymakers at the Fed. But some of these policymakers cite the recent uptick in the inflation rate as a cause for concern.

It isn’t. Period. Nothing in the financial markets ever moves in a straight line, not even the inflation rate.

As an illustration, Eric highlighted the inflationary period of the 1970s and early 1980s. In the process of collapsing from 14.8% to 1.1% over seven years, the monthly reading for inflation increased 24 times.

In other words, despite that long-term downward trend, inflation was in an upward march 30% of the time.

Back to Eric:

To repeat; nothing in the financial markets moves in a straight line.

Therefore, the Fed’s handwringing over the recent inflationary uptick is misplaced anxiety. The inflation rate is trending down, and the only thing left to do is to watch it fall.

Fast forward to Wednesday when inflation fell as Eric predicted.

As we covered here in the Digest, the October CPI report showed that inflation not only came in under forecasts, but also was flat on the month – a 0% increase. Similarly, the year-over-year number was beneath its estimate.

Yesterday brought even more evidence of falling inflation with the Producer Price Index.

Whereas forecasts called for a monthly increase of 0.1%, the data showed a decline of 0.5%. That’s the biggest drop since April of 2020.

Now, this is fantastic news…but only to the extent that Federal Reserve members believe it’s fantastic news.

In recent months, various Fed presidents have made it sound as though they’ll require ironclad proof that inflation is vanquished before they would consider rate cuts.

So, even though nothing moves in a straight line as Eric suggested, what’s the likelihood that inflation will continue falling and give the Fed the proof they need to put rate cuts into the discussion?

For that answer, let’s turn to our hypergrowth expert, Luke Lango, editor of Innovation Investor.

Why Luke believes the housing market holds the key to inflation’s final death blow

Like Eric, Luke has been calling for inflation’s collapse for months.

Looking forward, he points toward data suggesting the final nail in the coffin is on the way:

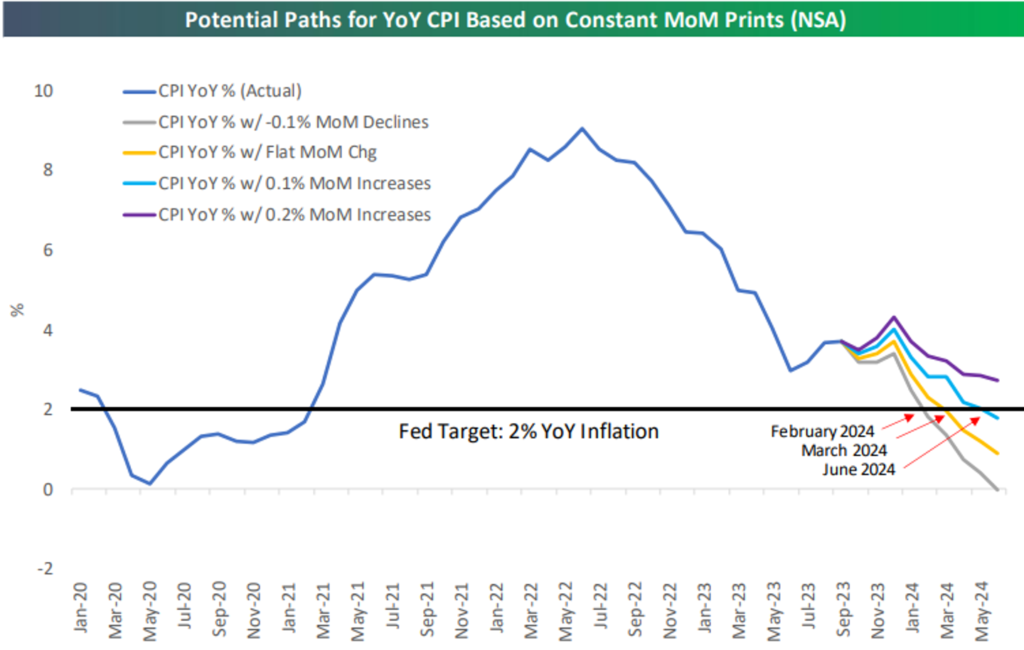

Prices were flat in October, and the Cleveland Fed’s current estimates see prices falling flat again in November.

If this trend of flat month-over-month prices continues, then we should return to 2% inflation by March 2024 – in just four months!

You may be asking, is it really possible for prices to flatline for the next four months? Or for inflation to return to “normal” by early next year?

Absolutely. The only thing holding up inflation right now are housing costs; and those are in the process of crashing.

As we’ve pointed out in the Digest, “shelter” (which includes housing and rental costs) is the largest component of the CPI. The Federal Reserve Bank of Boston reports that it constitutes a full 42% of the bottom-line CPI reading.

Luke notes that Wednesday’s report showed CPI excluding shelter climbed just 1.5%. In other words, if housing wasn’t a CPI component, the Fed would have already achieved its goal of 2% inflation.

Obviously, we can’t ignore housing costs. So, what’s the trend in housing costs?

Back to Luke:

Home prices have flatlined as an 8% 30-year mortgage rate crushes homebuying demand. And due to a huge influx of new supply, rents are actually coming down across the country.

As a result, according to Zillow’s observed rent index, real-time measures of asking rents across the country have been steadily dropping for the past 18 months.

Now, because shelter CPI uses actual rents as a proxy for housing inflation (not asking rents), this disinflation is just starting to be reflected in the official shelter CPI number. Of course, since renters usually sign 12-month leases, asking rents lead actual rents by about 12 months. It should be no surprise, then, that the official shelter CPI number follows Zillow’s observed rent index, with about a 12-month lag.

True to form, while Zillow’s rent index peaked 18 months ago and has been crashing since, shelter CPI peaked six months ago at 8.2%. It has since come crashing down.

Assuming this trend continues to hold true, Shelter CPI will collapse to 2% within the next 12 months.

After aggregating all the data and component inflation forecasts, Luke concludes that at our current pace, the overall inflation rate in the U.S. will hit 2% within four months.

Does this mean we’re going to get the mythical “soft landing” after all?

Well, the fact that we’re even discussing it is a huge win. A year ago, this possibility wasn’t on the table.

Yes, a soft landing is a legitimate possibility. But the most successful traders in history echo a similar refrain – focus on what can go wrong, and what can go right will take care of itself.

So, as we consider the possibility of a soft landing, let’s also see this market through a defensive lens. On that note, here’s some perspective from The Wall Street Journal yesterday:

In the past 80 years, the Federal Reserve has never managed to bring inflation down substantially without sparking a recession.

Now, this doesn’t mean we’re not living through the exception. But it does mean we need to be mindful of a growing risk…

Wall Street has been surging, pricing itself for this rare soft-landing outcome. The S&P is up 9.4% in less than three weeks, and now finds itself just 5.5% beneath its all-time-high.

While we’ve been happy to trade this bullishness higher, consider what it means…

The market is now pricing itself for the soft-landing outcome. So, if we get it, fantastic. But with this Goldilocks outcome now the priced-in expectation, it creates a new downside risk if the landing is bumpier than expected.

Remember, the single greatest driver of short-term price movements is a surprise to a prevailing expectation. Case in point, why did the market explode 2% higher on Tuesday? Because the CPI data surprised the prevailing expectation in a bullish way.

As the market narrative increasingly becomes “soft landing,” and Wall Street prices itself accordingly, then the most likely surprise is any landing other than “soft.”

Now, what might inadvertently complicate our landing?

Coming full circle, the Fed.

Specifically, it’s the risk that the Fed holds onto its rate policy of “higher for longer” rather than pivoting to the “lower for shorter” scenario that Wall Street is pricing in.

Remember, after November’s Federal Reserve meeting, Chairman Jerome Powell said that the committee “is not thinking about rate cuts right now at all.”

Even yesterday, following Tuesday’s fantastic CPI print and Wednesday’s great PPI print, San Francisco Federal Reserve President Mary Daly warned against declaring victory against inflation too soon, and refused to rule out another rate hike.

Yet, Wall Street is pricing stocks as though victory has not only been declared, but also a discussion about rate cuts is imminent.

That dissonance between market expectation and Fed reality represents your portfolio risk.

To be clear, this isn’t a reason to sidestep today’s market

Far from it.

Regular Digest readers know we’ve been encouraging readers to trade this bullish market momentum for months. But it is a reason to maintain some defensiveness as you trade this market higher. And one of the best ways to do that is by being deliberate about which stocks you’re betting on to rise over the next 12-18 months.

And this brings us back to Eric.

On Tuesday, he held a live event detailing how he’s trading the AI sector today . This is inherently defensive because if Powell & Company do throw a monkey wrench into the expectation of “sooner than later” rate cuts, high-quality AI stocks are likely to be less impacted and/or recover faster thanks to their transformative power (not to mention investor enthusiasm).

From Eric:

I want to find the companies that are completely transforming themselves by doing what others are not – by adopting and applying AI to their processes in significant, if not transformational, ways.

Eric believes he’s already found three such AI trading opportunities.

The first is a leading innovator and competitor in the joint replacement business. It provides surgical robots to AI-enabled patient-diagnostic and monitoring systems.

The second is a dual renewable energy/AI company whose software uses advanced artificial intelligence and machine learning to help its customers (its total bookings have rocketed 1,000% over the last three years).

And the third is the leading platform for creating and operating interactive, real-time 3D content for video games and other specialized commercial applications.

To watch a free replay of Eric’s event from Tuesday, just click here.

Bottom line, yes, there’s a legit chance that we could achieve a rare soft landing

But if it doesn’t materialize, high-quality AI stocks remain a good way to trade the market as we round out 2023 and look ahead to 2024.

Here’s Eric to take us out:

The AI megatrend is real, powerful, and gaining momentum by the day.

Fortunately for we investors, this megatrend is still in its infancy, which means it will nurture a growing number and variety of investment opportunities over the coming months and years.

Have a good evening,

Jeff Remsburg