A Note from Louis Navellier: From the looks of it, we’re in for a muted holiday shopping season. Walmart reported earnings yesterday, and despite the numbers being fair, investors took exception to the dim outlook. This begs the question: Is a recession back in the cards for 2024? To answer, I invited Charles Sizemore – Chief Investment Analyst at InvestorPlace’s publishing partner The Freeport Society – to explore what trouble we could be heading into in 2024. He does one better and shares a way to thrive through it all.

Charles has released a brand-new special report to help launch his free email letter, The Freeport Navigator. It’s called The 24 Best Stocks for 2024. Click here to get your FREE copy and to sign up for Charles’ FREE letter.

Take it away, Charles…

*********

My enduring memory of Walmart Inc. (WMT) will always be its response to Hurricane Katrina back in 2005.

New Orleans looked like something out of the Day After Tomorrow movie before all the flood waters froze. Yet the government response was embarrassing.

It was a humanitarian disaster on American soil that left Uncle Sam looking both impotent and incompetent.

And then Walmart stepped in.

The company’s logistics system enabled delivery of food and water to the hurricane refugees faster and more efficiently than the U.S. Army. When the government failed, Walmart succeeded. And it’s only gotten stronger since then.

Walmart isn’t just an iconic part of America’s retail economy.

It is America.

Ninety percent of Americans live within 10 miles of a Walmart store, and in any given month, approximately two-thirds of all shoppers buy something in a Walmart store.

So, you can glean a lot about the state of the country by reading Walmart’s quarterly earnings reports and listening to management’s comments.

The insights it shared when reporting before the bell on Thursday were troubling.

In today’s letter, let’s break down the “findings” from Walmart’s earnings, dissect the warnings, and make a plan to navigate what lies ahead to safety and profits.

A Consumer in Trouble

Walmart’s third quarter fiscal earnings were a mixed bag. The company exceeded analyst expectations on revenues and earnings. And foot traffic was up 3.4% over the previous year, which was better than analysts expected. Great news!

Only…

The average ticket size was a mere 1.5% higher. A weak showing. And CEO Doug McMillon said that shopping has trailed off, noting that that “in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

Investors did not like hearing that one bit, and WMT slid 7% in morning trading Thursday.

We’re in for a bleak holiday spending season, folks. All signs point to the average American scaling back, due in large part to the brutal inflation of past few years biting into their budgets. The return of student loan repayments and the crushingly high rental and property markets aren’t helping.

I expect us to see a recession in 2024… along with stubborn inflation. The best way to hedge against that is with the shares of America’s strongest, most Armageddon-proof companies… or what I call the “Rich Man’s Currency.”

In an environment like this, you want companies in your portfolio that are largely:

- Recession proof…

- Immune to government-insolvency…

- And inflation resilient.

Despite its forecasts and investors’ reaction on Thursday, Walmart checks all of those boxes. In fact, that 7% sell-off in WMT stock makes for a great bargain on a must-own stock.

Investing Lessons From the Past

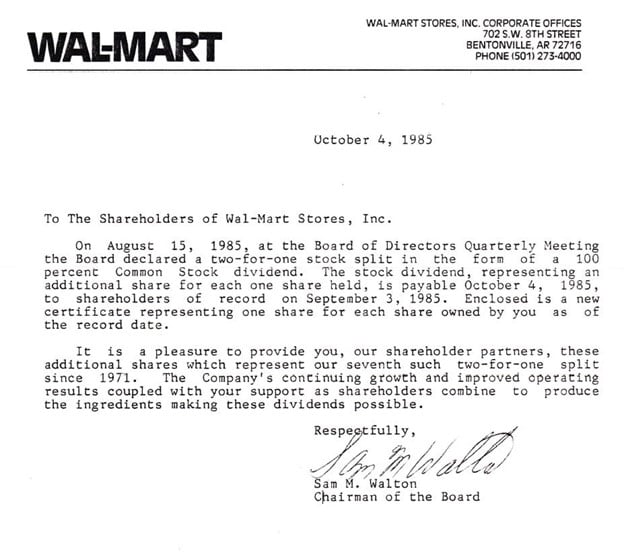

Talking about Walmart makes me nostalgic. A few years ago, I was digging through an old file cabinet that had belonged to my grandfather, and I found this little blast from the past: a Walmart letter to shareholders from 1985, signed by chairman and company founder Sam Walton.

Long before Peter Lynch became a household name, my grandfather practiced his own version of the famous investor’s advice: Invest in what you know. It’s a philosophy Warren Buffett applies to his investing as well, and his success speaks for itself.

Grandpa was an Arkansas boy, born and raised not far from Fort Smith. He liked to invest in local companies that he could observe firsthand. Walmart was one of them, with its headquarters in Bentonville.

I remember fondly driving with Grandpa to the Fort Smith Walmart to buy a bright red Cherry Icee at the snack bar. We would walk the aisles to see for ourselves what Mr. Walton was doing with his money.

Long after my grandfather passed away, the cash dividends from the Walmart stock he accumulated in his lifetime continued to pay for my grandmother’s retirement expenses… and for my college tuition.

Without a doubt, Walmart is a great American company. Make sure it’s got its rightful place in your portfolio.

This is the secret of the Rich Man’s Currency. Buy the best, most durable American companies… and let them do their job of compounding their earnings and compounding your wealth.

I list several of my favorites in my new 24 Best Stocks for 2024 free special report (click here to download that report and to sign up for my new free email letter). I also share the companies to invest in to survive the dollar’s debasement, deglobalization, and several other trends combining to create the age of chaos we’re all now living through.

This report is free to you. Simply sign up to receive my new free email letter – The Freeport Navigator – and I’ll send you the details of those five stocks immediately.

To life, liberty, and the pursuit of wealth…

Charles Sizemore

Chief Investment Strategist, The Freeport Society