Screening for stocks with low price-to-earnings ratios is a great place to start when looking for value stocks, but your search for low P/E value stocks should not end there.

That is, it’s not as if you can screen for the stocks with the lowest P/E ratios, purchase them, and expect to generate outsized returns. For one, there are certain cyclical, capital-intensive sectors for which low earnings multiples are the standard. Think auto makers, airlines, banks, as well companies in the oil and gas space.

These types of stocks can move higher on increased earnings, yet are not likely to experience multiple expansion to the degree of other stocks in other sectors.

Second, there are also stocks, across all sectors, that sport a low valuation for a good reason. Either their earnings are on the verge of falling off a cliff, and/or there is great uncertainty over future results.

That said, diving in seven of the low P/E value stocks (forward multiples of ten or less), each of the names listed below appears oversold, and may have the potential to rise towards a much higher valuation, as sentiment improves.

Acco Brands (ACCO)

Acco Brands (NYSE:ACCO) makes and sells a variety of office and school supply products. While profitable, declining sales and inflationary pressures have weighed on the company’s operating performance and a highly-leveraged balance sheet.

With this, it makes sense why the market currently values ACCO stock at just 5 times forward earnings. Still, for deep value investors, Acco could prove to be a profitable opportunity. Buy now, and you’ll immediately start collecting Acco’s relatively high dividend (forward annual yield of 5.8%).

On a longer timeframe, as restructuring efforts keep resulting in improved margins, and as the company uses free cash to (besides finance the dividend) pay down debt, the company may just well report earnings in 2024 and 2025 that are in line with analyst forecasts ($1.13 and $1.30 per share, respectively). An improved bottom line could propel ACCO to a much higher forward multiple.

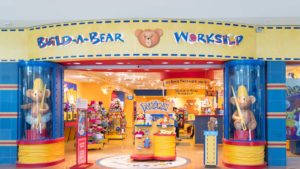

Build-A-Bear Workshop (BBW)

Build-A-Bear Workshop (NYSE:BBW) is one of the low P/E value stocks I have covered many times this year. While short interest in shares of this speciality retailer was declining when I last wrote about BBW last month, the percentage of shares sold short has since bounced back, from 13.3% to 16.6%.

But because of the short side of the trade with BBW stock getting crowded again, Build-A-Bear continues to be held down at a low forward valuation. Shares today trade for only 7 times forward earnings. So far, despite the impact of inflation/interest rates on consumer spending, the company has continued to report strong results and reiterate full-year guidance.

If this trend continues with the company’s upcoming earnings release on Nov. 30, and with subsequent earnings releases, short interest could ease, and shares could jump up towards a much higher valuation.

Boyd Gaming (BYD)

Boyd Gaming (NYSE:BYD) is based in Las Vegas, and owns several small casino properties in America’s gambling capital, but the gaming firm’s portfolio consists primarily of regional casino and racetrack properties in the Midwest and Southern United States.

Back in August, I argued that shares were oversold. Shares have pulled back since then. Admittedly for valid reasons such as an earnings miss. With shares now trading at a fairly large discount (9.6 times earnings) to gaming stocks (which sport a median multiple of (14.7), I still believe there’s merit in going contrarian with BYD stock.

With so much pessimism now baked into Boyd’s valuation, low expectations today could mean positive surprises with subsequent earnings releases. Once uncertainties surrounding the economy clear up, gaming stocks could recover, with undervalued names like Boyd making strong rebounds.

Livent (LTHM)

Recently, lithium stocks like Livent (NYSE:LTHM) have entered the low P/E value stocks category. Yes, there is a good reason why names in the lithium space have plunged toward fire sale valuations. Falling lithium prices point to lower earnings ahead for lithium companies, and Livent is no exception.

However, forecasts call for earnings in 2024 to decline by only 6.7% next year, bouncing back to above 2023 levels by 2025. Hence, the LTHM stock sell-off, which has pushed shares to a valuation of only 6.9 times forward earnings, appears overdone.

Demand for lithium may take a breather right now. The EV proliferation trends points to demand/prices picking back up. Not only that, Livent’s merger with Allkem (OTCMKTS:OROCF) is nearing completion. Potential cost and growth synergies from this deal could also help spark a rebound for LTHM down the road.

Tegna (TGNA)

Tegna (NYSE:TGNA) primarily owns and operates broadcast television stations, with related digital sub-channel and digital news properties alongside this core business. The company was to be acquired by private equity firm Standard General, but because of delays in regulatory approval, they scrapped the deal back in May.

Yet following a more than 25% drop year-to-date, TGNA stock is a great opportunity for value investors. Shares today trade for just 7.8 times forward earnings. Sell-side analysts expect a more than 75% rise in profitability in 2024, thanks to increased advertising demand during the presidential election cycle.

Even as the earnings jump will be temporary, this could still drive a big move higher for TGNA, if the company uses this cash to further enhance its share repurchase program. Also, don’t rule out Tegna’s potential to become a merger target again, as consolidation in the broadcast TV space continues.

Tapestry (TPR)

Tapestry (NYSE:TPR) owns luxury accessory brands like Coach and Kate Spade. As a Seeking Alpha commentator recently discussed, concerns about the company’s pending deal to acquire Capri Holdings (NYSE:CPRI), which owns brands like Michael Kors and Versace, is weighing heavily on shares.

However, despite this high uncertainty, investors bullish on the deal can now get into TPR stock at a bargain basement price. TPR stock today trades for only 7.3 times forward earnings. Much suggests that investors are overly pessimistic about the benefits of this debt-funded transaction.

The Capri deal is expected to be immediately accretive to earnings, with the potential for an additional $200 million in annualized cost synergies to be realized. There are also potential growth synergies, as Tapestry plans to pivot the Capri brands towards a direct-to-consumer business model, which it has been focusing on for its existing portfolio of brands.

Viatris (VTRS)

At first glance, Viatris (NASDAQ:VTRS) may seem like one of the “cheap for a good reason” low P/E value stocks. Shares in the pharmaceutical company, spun off from Pfizer (NYSE:PFE) via a reverse Morris Trust merger with Mylan in 2020, have been a value trap since their debut.

Declining revenue and earnings have driven a steady decline for VTRS stock, which has outweighed Viatris’ high dividend (currently at 5.43%). Nevertheless, things may be finally starting to turn a corner for this extremely low-priced stock (forward P/E ratio of only 3.1).

How so? As InvestorPlace’s Will Ashworth pointed out earlier this month, after slashing costs, selling non-core assets, and reducing operating expenses/debt, the company is now gearing up for the next step of its transformation plans. Success with Phase 2 (organic growth of the business) may help shift Wall Street’s bearish view on VTRS.

On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Healthcare, Biotech, Consumer Discretionary, Travel, Casino, Energy, Renewable Energy, Battery, Lithium, Communications, Media, Retail, Streaming