Shares of Chinese electric vertical take-off and landing (eVTOL) company EHang (NASDAQ:EH) are up by more than 55% so far this year, despite the recent release of a short report by Hindenburg Research. In the report, Hindenburg accused the company of having a misleading order book while trading at a valuation way above its competitors. The short seller also pointed out EHang’s cumulative research and development expenses, which pale in comparison to its competitors.

This morning, the company released its third-quarter earnings. For the period, revenue tallied in at $3.9 million, up by 248% year-over-year (YOY). Unsurprisingly, EHang remained unprofitable, reporting a net loss of $9.2 million, which improved from the net loss of $10.69 million a year ago by about 12%.

“A pivotal milestone was the TC for our groundbreaking EH216-S, the first of its kind in the unmanned eVTOL industry around the world,” said CEO Huazhi Hu. “This certification evidences our adherence to CAAC’s stringent safety and airworthiness standards, and enables us to move toward commercial operations with confidence.”

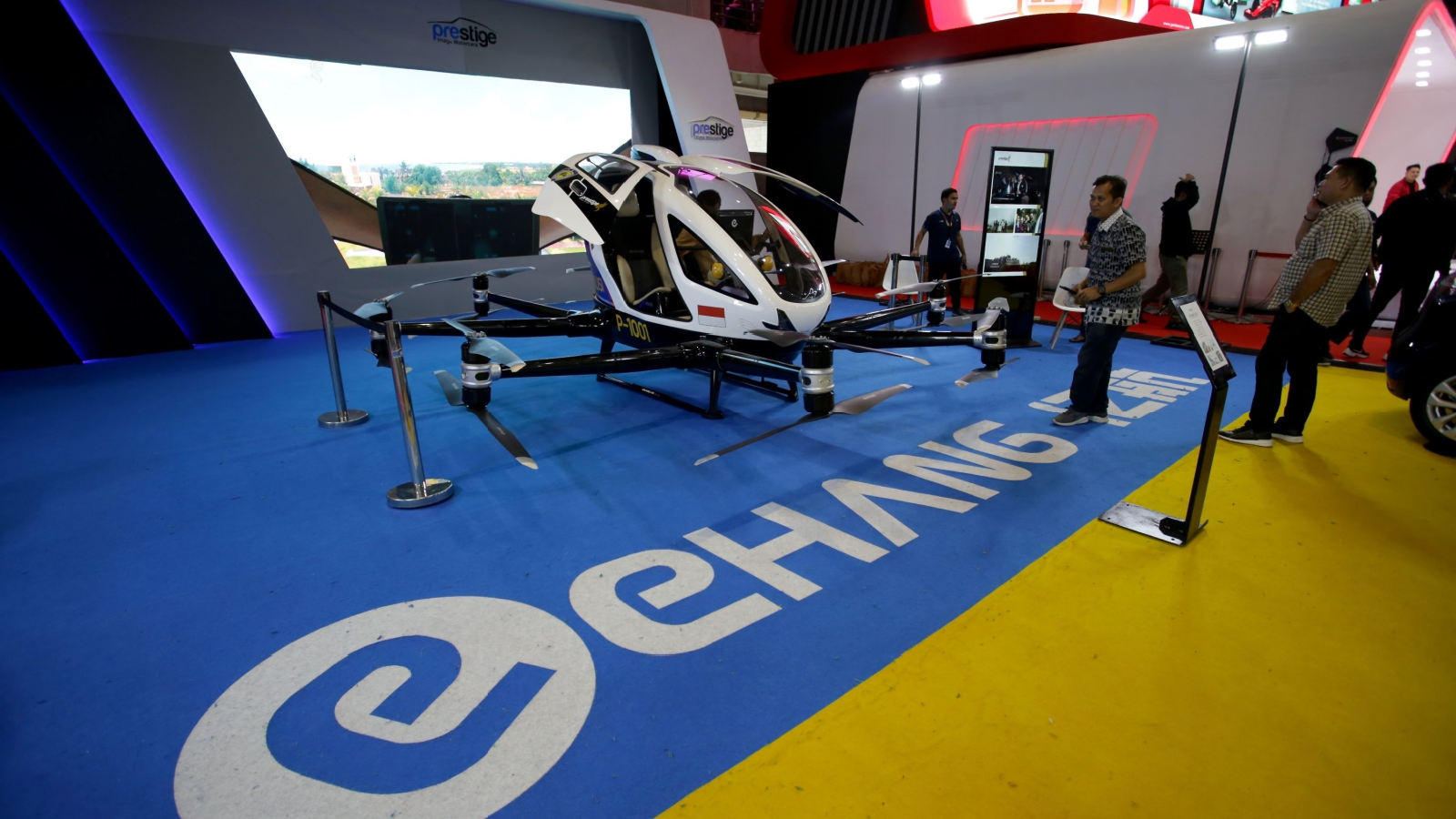

EHang received the type certificate (TC) for its EH216-S aircraft from the Civil Aviation Administration of China (CACC) back in October. The TC signals that the aircraft conforms with the CACC’s safety standards and allows EHang to conduct passenger-carrying unmanned aerial vehicle (UAV) commercial operations.

5 Investors Betting on EH Stock

Tracking institutional ownership is important, as these large investors provide liquidity and support for stocks. During Q3, 58 13F filers disclosed a stake in EH stock, an increase of seven filers from the prior quarter. These filers own an aggregate of 9.61 million shares of EHang, down slightly from 9.62 million shares during the second quarter. Overall, 13F ownership of EH stock still remains low.

Still, hedge funds seem to be picking up interest in EHang. They owned about 458,000 shares as of Q3, up by 53% when compared to their prior ownership of about 300,000 shares.

With that in mind, let’s take a look at EHang’s five largest shareholders:

- CEO Huazhi Hu: 39.94 million shares. Hu’s stake is accurate as of Q4 2022.

- Axim Planning & Wealth: 3.74 million shares. Axim acquired 610,568 shares during Q3.

- Vanguard: 1.54 million shares. Vanguard acquired 24,121 shares during Q3.

- State Street (NYSE:STT): 1.10 million shares. State Street acquired 47,338 shares during Q3.

- Carmignac Gestion: 1.09 million shares. Carmignac sold 411,833 shares during Q3.

On the date of publication, Eddie Pan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.