It has become possible that electric aviation is a current reality, and it will change the air travel industry. The technological advances and environmental considerations in this area provide a very good investment opportunity. The electric aviation stocks have only started but provide opportunities to achieve sustainable growth. Something that is music to the ears of both environmentalists as well as investors.

Another area under development is flying stock cars, which are essentially vehicles that combine the ease associated with traveling on land. They also offer the fast pace associated with air transport. Electrical aviation transformation is very attractive. The concept can revolutionize not only our skies but also investment strategies as well. Innovation and ambition are pushing this sector through to a time of the future where the sky will only be the beginning.

As we witness this electrifying transformation, one can’t help but be captivated by the potential of electric aviation. This dynamic sector is charting a course toward a future where the sky is not the limit. Instead, it is the starting point.

Archer Aviation (ACHR)

With an impressive 249% year-to-date return, Archer Aviation (NYSE:ACHR) is among the world’s first electric vertical takeoff and landing (eVTOL) aircraft pioneers. The rise shows a growing market for electric aviation stocks, specifically for companies such as Archer that lead the evolution of flying cars. Recently, the company had concluded a legal proceeding with Boeing Wisk, awarding it 13.2 million shares in warrants. Critically, this settlement involves an agreement on autonomy technology, which is a key element in the design of eVTOL.

Also, Archer contracts, which include the one with the U.S. Air Force, valued up to $142 million, are worth noting. With this agreement, the DoD states their serious concerns about applying eVTOL to military applications. For now, Archers’ Midnight plane, which has attained FAA certification, will be tested by means of warlike practices.

Additionally, Archer has received $215 million in terms of commitments from top organizations such as Stellantis, Boeing (NYSE:BA), and United Airlines (NASDAQ:UAL), among others. This investment reflects the faith that Archer can succeed in the electric aviation sector. In addition, the company’s disclosure of key figures about the business processes strengthens the trustworthiness of the business amid dynamic markets.

Joby Aviation (JOBY)

The year-to-date return for Joby Aviation (NYSE:JOBY) is up by as much as 92%. Such growth shows that investors are now confident and interested in electric aviation stocks, especially those leading in the development of the industry, such as Joby.

As an example, Joby Aviation has made a partnership with two Japanese companies, namely ANA Holdings and Nomura Real Estate Development, in a bid to transform urban transport within Japan in this era. Joby’s partnership in this is geared towards developing vertiport infrastructure for air taxi services.

Furthermore, electric aviation witnessed another important event last month, as Joby Aviation made an exhibition flight over New York. The technology demonstrates the company’s capability and supports NYC’s objectives to integrate eVTOL into the transport grid. Ready for FAA certification and commercial passenger services by 2024/2025. This is a step promising affordable air travel as simple and cheap as a ridesharer, offering an original answer to urban mobility issues.

The stock performance of Joby Aviation tells about where the company is trying to move forward in the sphere of electric aviation. Investors’ enthusiasm for the stocks has been driven by its rapid growth. This marks a new phase in urban transport and places Job Aviation at the forefront of the emerging electric aviation wave.

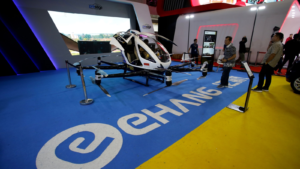

EHang Holdings (EH)

EHang Holdings (NASDAQ:EH), the first mover in electric aviation, has had a turbulent year, registering 73% YTD gains. The company has been leading the electrified aviation and flying car industries. It just brought out its Q3 results, indicating a sturdy market dominance.

Of particular note are the advancements in EHang Urban Air Mobility (UAM) initiatives. This includes the opening of its first European Centre for urban air mobility. This will further strengthen its dedication to transforming urban mobility.

Last October was a turning point for EHang, including key enhancements in the EH216-S Passenger-Carrying Unmanned Aerial Vehicle System. Additionally, its support plan demands a whopping $100 million in collaboration with the Hefei Municipal Government. This goes to show that it has been powerful in the low-altitude economy.

Importantly, EHang’s partnership with a South Korean investor, Lee Soo Man, will see the former invest $23 million in its advanced technology consumer authorization draw. Bringing AAT to its network is a strategic move by EHang. This aims to solidify its standing in the worldwide UAM industry, with particular attention on Asia Pacific.

Overall, EHang strives to revolutionize air mobility by offering affordable, safe, autonomous, and eco-friendly air travel. The company reimagines the urban sky with cutting-edge solutions in passenger transport, logistics, and aerial media.

As a leading trailblazer in the UAM sector, EHang continually redefines possibilities in aviation technology. This innovation brings the dream of urban air mobility closer to reality.

On the publication date, Faizan Farooque did not hold (directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.