If you’re looking for stocks to buy now that will give you robust returns inside of one year, you’ve come to the right place. Here, my intention is to provide premium-level research for free, walking you to potential profits. However, as with anything in life, the higher the reward potential, the higher the risk.

Essentially, we’re dealing with betting on which team will win the 2024 World Series before opening day. If you pick the Oakland Athletics, you’re probably going to lose your bet. But if the stars somehow align and the A’s pull it off – my goodness, you will be profitable. It’s practically the same with these stocks to get rich.

Now, I’m not going to bore you to tears with revenue growth and earnings multiples. Anybody can look those up and frankly, they’re meaningless in the specific context of stocks to buy now. Instead, we’re going to deep dive the options market, extracting some compelling trades through a tool I developed called the options roadmap.

Of course, if you want to stay in the open market, you can do so. However, you’ll enjoy the most (potential) acceleration with stocks to get rich if you choose the derivatives route.

Joby Aviation (JOBY)

A specialist in electric vertical takeoff and landing (eVTOL) aircraft, Joby Aviation (NYSE:JOBY) has attracted plenty of attention for its potential to shift the paradigm regarding air mobility. Following a huge rally in June last year, JOBY stock has faded considerably. Still, the fundamental catalyst that speculators will be betting on is its upcoming earnings report, scheduled for Feb. 21.

If you believe that Joby can deliver a compelling narrative (as it’s a pre-revenue enterprise), you could choose to go the open-market route. However, the options market could give you a better deal. Specifically, one idea would be to consider the Apr 19 ’24 6.00 Call. Following the earnings disclosure, it gives you roughly two months of time value in which you may be able to sell the contract at a profit.

Longer term, I really love the Jan 17 ’25 7.50 Call, which featured a bid-ask spread of only 7.69% as of Wednesday’s close. Given that the average analyst consensus calls for $8 – with the high side landing at $10 – I have confidence that this call option will be profitable.

If you want to split the risk-reward difference, the Jul 19 ’24 7.00 Call seems reasonable, though you’ll probably need the greater acceleration of the high-side target to give you the time-value cushion. While highly speculative, JOBY could be one of the stocks to buy now before the earnings disclosure.

Canaan (CAN)

A blockchain-mining specialist, Canaan (NASDAQ:CAN) is on this list of stocks to get rich quickly for one reason: Bitcoin (BTC-USD). Specifically, I’m gambling on the halving event of BTC, which may occur on April 19 of this year. To make a long story short, the event should reduce the block reward for mining Bitcoin, thus slowing its supply. Theoretically, less supply and more demand should boost the BTC price.

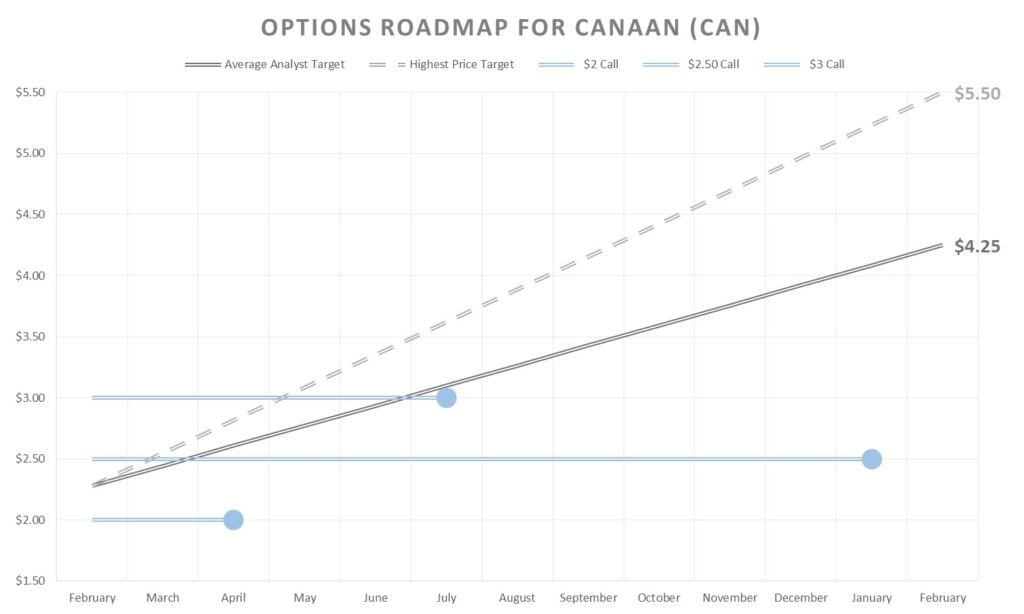

In my opinion, Canaan is so deflated among the stocks to buy now compared to other blockchain enterprises that it’s worth betting on in the open market. However, if you’d like to play the options market, the derivatives arena offers an intriguing play of the Apr 19 ’24 2.00 Call. Basically, the idea here is to bet on the buy-the-rumor, sell-the-news concept. You’re going to be looking to sell into the euphoria before the halving.

However, if you think Bitcoin and other cryptocurrencies can soar beyond April, then the Jan 17 ’25 2.50 Call is awfully tempting. One of the reasons is the spread, which sat at 4.27% as of Wednesday’s close. Also, the open interest is quite high for a far expiry, out the money (OTM) call at 1,488 contracts.

For an aggressive bet, you may look at the Jul 19 ’24 3.00 Call. You should be at the money (ATM) based on average analysts’ price projections ($4.25) and you’d be in the money (ITM) if the high-side target ($5.50) pans out. Whatever you decide, CAN could be one of the stocks to buy now.

Novavax (NVAX)

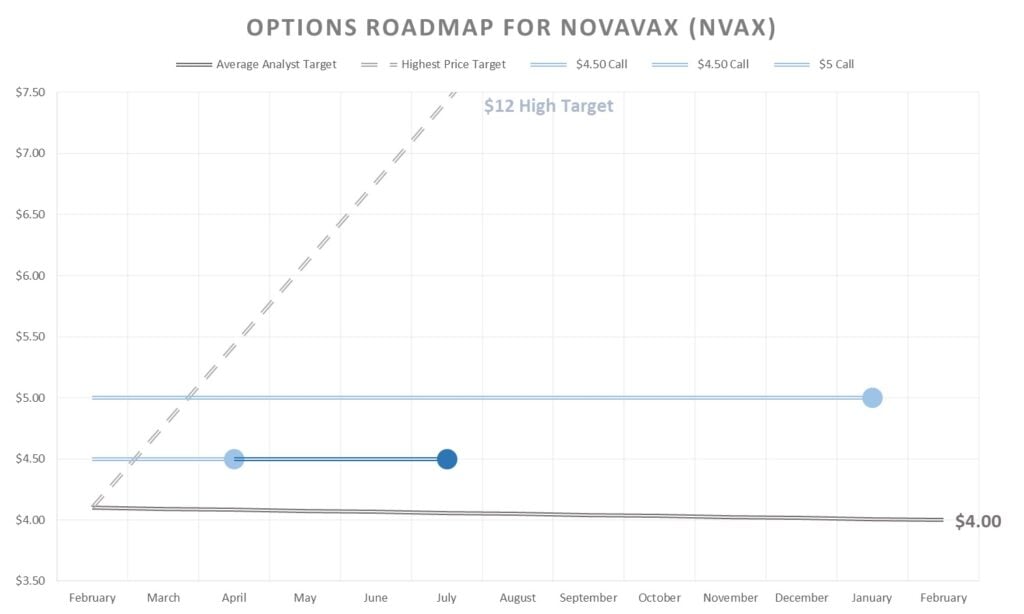

Easily the highest-risk enterprise on this list of stocks to get rich quickly, Novavax (NASDAQ:NVAX) suffered greatly when fears of the Covid-19 crisis faded. At the moment, the most pressing issue is the company’s dispute with Gavi, the Vaccine Alliance, which is accusing Novavax of a breached agreement and wants a refund of nearly $700 million. Obviously, that would put a huge crimp on NVAX stock.

Because of the heightened bearishness against the biotechnology firm, NVAX’s short interest has skyrocketed to 50% of its float. As well, the short interest ratio is elevated at nearly nine days to cover. However, if the contrarian bulls are able to pull something together, NVAX could easily be one of the stocks to buy now due to short-squeeze potential.

If you want to go the options route, the most aggressive approach is the Apr 19 ’24 4.50 Call. It features a wide spread of 17.3% as of Wednesday’s close. However, the price was only $57 (57 cents multiplied by 100 shares). To give yourself a little more time value, you could opt for the same strike price but an expiration date of July 19. That will set you back $77 at a slightly lower spread, interestingly enough.

For the longer term, I’d look into the Jan 17 ’25 5.00 Call. The spread here was only 4.35% when the market closed on Wednesday. And should NVAX hit the high-side analyst target of $12, this bad boy could be off to the races.

On the date of publication, Josh Enomoto held a LONG position in JOBY, CAN and BTC. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.