At some point, even a technology juggernaut like Nvidia (NASDAQ:NVDA) will disappoint investors. It’s inevitable. The company would need to broadcast – and then eventually hit – ever rising financial targets. However, nobody can keep lighting the afterburners indefinitely. Based on an objective NVDA stock analysis – particularly in the derivatives (options) market – I am bearish on Nvidia near term.

Please note that I’m not pessimistic about the long-term viability of the tech enterprise. Certainly, Nvidia commands a dominate market share of the graphics processing unit (GPU) sector. Further, the analysts project that the generative artificial intelligence industry could blossom to a $1.3 trillion valuation by 2032. That’s according to a Bloomberg report, not some random blog on the internet.

Further, I understand the core arguments that undergird the optimistic NVDA stock analysis. Let’s bring up some of the main talking points:

- Market Dominance: As stated earlier, Nvidia dominates the GPU space with about 87% market share. Rivals like Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC) are basically blips in the rearview mirror.

- Data Center Demand: Per Grand View Research, the global data center market size may rise to $437.33 billion. With hunger for AI-based applications, this metric could fly higher, benefiting Nvidia’s GPU business.

- Second Wave: Many experts have discussed the possibility of a “second wave” of AI, which refers to advancements in machine learning, deep learning and neural networks. This event provides fuel for the optimistic NVDA stock analysis.

Other bullish catalysts exist and I certainly acknowledge their potential to lift NVDA stock. But my question is this: aren’t these already known tailwinds?

Earnings Dilemma Warrants a Deeper NVDA Stock Analysis

Believe it or not, Nvidia suffers from an earnings dilemma. It doesn’t look like it. In the company’s third quarter of fiscal year 2024, it delivered earnings per share of $4.02 against an estimate of $3.37. In Q3 of the prior year, Nvidia posted EPS of 58 cents (against an estimate of 70 cents).

Looking ahead to Q4 – which is scheduled for a Feb. 21 disclosure – analysts anticipate that EPS will land at $4.59. In contrast, the company delivered EPS of 88 cents in the prior year Q4 (against a target of 81 cents).

However, at some point, the estimates can’t keep rising indefinitely. Shares already trade at nearly 96X trailing-year earnings. I understand that Nvidia represents a leader in AI-related semiconductors. Still, it’s not the only player in town.

Indeed, one factor that makes me nervous is that while Nvidia dominates its core GPU sector, it’s actually losing market share to Intel and AMD. That’s not the trajectory you want to see when you’re looking for the company to continue delivering astounding earnings beats.

In addition, Super Micro Computer (NASDAQ:SMCI) suffered a significant drop on February, losing 20%. While analysts were generally optimistic about SMCI stock, a familiar concern rose to the forefront: the good news may be priced in. That’s also a source of anxiety regarding risks to the bullish NVDA stock analysis.

An Irrational Put

With baseball’s Los Angeles Dodgers signing Shohei Ohtani, many sports fans expect the Boys in Blue to bring home the World Series. If they don’t, they’d be a failure.

So, if you bet on the Dodgers to win it all – before the season begins – a bookie would likely underwrite that wager. However, you’re not going to get very favorable odds. After all, it’s an expected outcome.

Now, let’s consider the San Diego Padres. If you bet on them to win their first championship, the reward should be stratospheric simply for the reason that no one is expecting them to win. Thus, the bookie needs to incentivize the wager by offering a very favorable betting line.

This is all very sensible stuff – except that it’s not the case with Nvidia options.

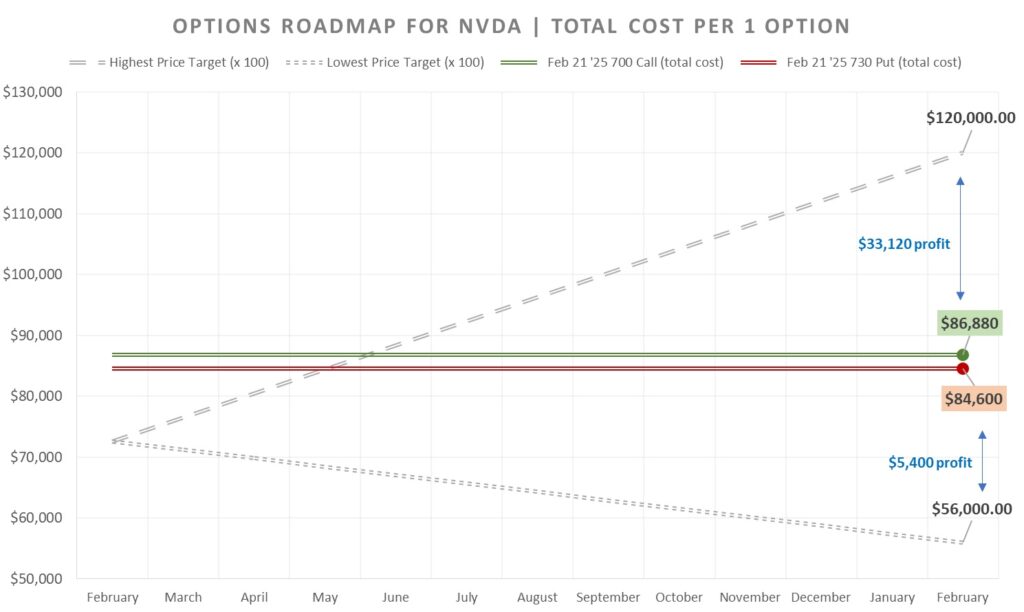

From Barchart’s unusual options activity screener on Friday, strictly looking at intrinsic value and assuming no time value remaining, the cheapest total cost (assuming contract exercising) of a call option expiring in February 2025 is the Feb 21 ’25 700.00 Call. It comes out to a total cost of $86,880.

On the flipside, the cheapest total cost of a put option expiring in February of next year is the Feb 21 ’25 730 Put. Its total cost comes in at $84,600.

Assuming in our NVDA stock analysis that NVDA stock hits the most optimistic price target of $1,200 in one year’s time, the aforementioned call option under exercise would give us a profit of $33,120 (assuming no other fees). However, if NVDA falls to the most pessimistic target of $560, the profit of the put option under exercise would only be $5,400.

That’s an irrational bet…unless you have high confidence that Nvidia will fall flat.

You Have Reason to be Nervous

To be honest, with so much tension in the GPU giant, I’m not participating in the trade personally. It really could go either way. However, what I can definitely say is that I’m not jumping up and down yelling for people to throw their life savings into the company. Based on an options-focused NVDA stock analysis, I don’t like that the market is so weighted to one side of the trade.

Usually, when that happens, you get a situation like Super Micro. One bit of bad news and shares could tumble 20%. However, in Nvidia’s case, the damage could be far worse.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.