With cryptocurrency enthusiasm reaching a fever pitch and blockchain miner Marathon Digital (NASDAQ:MARA) about to release its fourth-quarter earnings report following the closing bell today, all roads arguably lead to the same conclusion if you’re a speculator: Buy MARA stock, either outright or in the options market.

Let’s lay out the framework. Marathon is a digital asset technology firm primarily focused on mining Bitcoin (BTC-USD). As a result, the fortunes of MARA stock are tied to the broader crypto complex. That can be brutal if BTC and other blockchain assets are suffering from a downcycle.

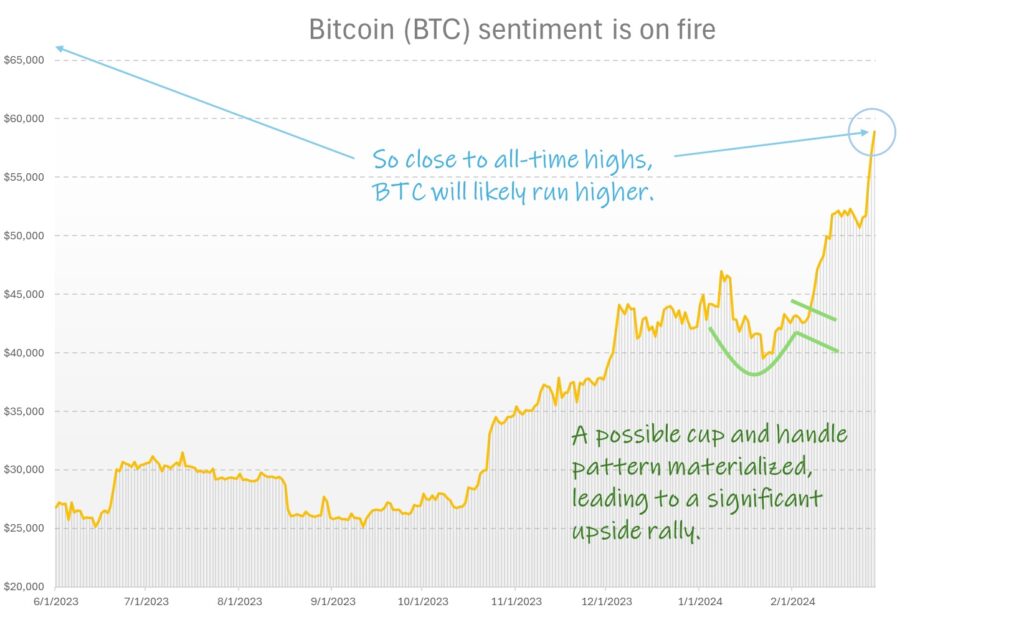

However, the opposite is also true. With Bitcoin topping $57,000 for the first time since 2021, it’s now within striking distance of printing an all-time high. As you might imagine, anticipation has skyrocketed, with several crypto-related assets – including MARA stock – enjoying downwind benefits.

For diversified speculation, betting on a top-tier blockchain miner makes perfect sense.

All Eyes on Bitcoin

For practically any other company, the primary focus centers on headline numbers: Did the firm beat revenue and per-share profitability estimates? How does management see the business performing in the year ahead?

While these are also important considerations for Marathon, they practically take a backseat to crypto market sentiment.

Earnings do matter for MARA stock – but only to a point. For example, in Q2 2023, Marathon posted a loss of 10 cents against analysts’ expected loss per share of only 6 cents. However, MARA really didn’t suffer a substantive impact until the Bitcoin price fell a few days after. Subsequently, BTC took Marathon down with it.

In Q3 2023, the opposite scenario materialized. Marathon posted earnings per share of 38 cents against an expected loss per share of 11 cents. MARA stock actually fell after this profitability beat, but the crypto rally saved the blockchain miner.

So again, earnings do matter, but Bitcoin sentiment matters more.

Trade of the Day: Buy MARA Stock

With Bitcoin so close to its all-time highs and with technical sentiment for BTC incredibly robust, the downwind trade appears obvious: Just buy MARA stock.

Because Marathon’s Q4 covered much of the dramatic rise of the crypto ecosystem, the company likely benefited with a robust revenue and earnings surge. Plus, with everyone and their dog trading crypto, MARA will likely continue marching northward.

Chart by Josh Enomoto, InvestorPlace.com

For those that want to add leverage to their trade, turn to the 19 April 2024 $31 Call. Here, we’re going to bet on a slightly out-of-money (OTM) call option, with the primary focus centered on the upcoming halving event, also scheduled for April 19.

Essentially, the halving reduces the reward for mining new blocks of transactions by half, which should negatively impact supply. By principle, reduced supply for a hot commodity should increase its value. However, we’re going to bet on the April call on the principle of buy the rumor, sell the news.

By the time the halving does occur, there’s a good chance Bitcoin (and by logical deduction MARA stock) will correct. Simply, there’s nothing immediate for the market to look forward to. Thus, by understanding this market psychology, we can get ahead of the move, extract our profits and then look for the next big opportunity.

On the date of publication, Josh Enomoto held a LONG position in BTC. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.