The alarming statistics behind the market’s winners … most stocks are duds … today’s market remains heavily concentrated … why a period of “hyper-gains” could be nearing

Mark Twain wrote “the difference between the right word and the almost right word is the difference between lightning and a lightning bug.”

There’s a stock market parallel…

The difference between the right stock and the almost right stock is the difference between Super Micro Computers and Supernus Pharm.

As you can see below, “super” is about the only commonality between Super Micro and Supernus Pharm.

Over the last two years, while Super Micro Computers has exploded 2,688%, Supernus added less than 6%.

With this radical performance differential in mind, let’s jump to legendary investor Louis Navellier and his Special Market Update Podcast from Breakthrough Stocks last week:

Literally 4% of stocks account for most of the S&P’s gains historically. And the top 1% of stocks are extraordinary. That’s what our research is showing.

[We’re finding that] the top 35% of the stocks in our Stock Grader and Portfolio Grader databases are the place to be. But the top 5% are extraordinary.Louis’ findings echo research we’ve highlighted here in the Digest

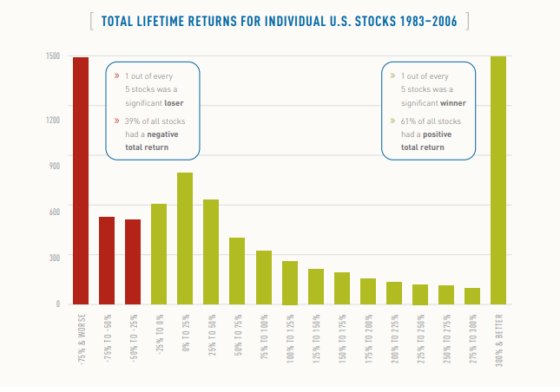

About a decade ago, the research shop Longboard studied the total lifetime returns for individual U.S. stocks from 1983 through 2006.

They found that the worst-performing 6,000 stocks — which represented 75% of the stock-universe in the study — collectively had a total return of … 0%.

The best-performing 2,000 stocks — the remaining 25% — accounted for all the gains.

Here’s Longboard with its takeaway:

The conclusion is that if an investor was somehow unlucky enough to miss the 25% most profitable stocks and instead invested in the other 75% his/her total gain from 1983 to 2006 would have been 0%.

In other words, a minority of stocks are responsible for the majority of the market’s gains.

It gets worse.

While it would be unfortunate to sink your money into a stock that generated nothing (0% returns), the unspoken implication there is that you’d at least walk away with your original investment capital.

Not so much.

The Longboard study found that 18.5% of stocks lost at least 75% of their value.

In other words, nearly one in five stocks didn’t just return nothing, they were double-digit losers that destroyed investment capital.

Here’s the breakdown:

Other studies have found similar results.

Research from economist and academic Hendrik Bessembinder, which analyzed equities from 1926 to 2015, concluded that about 60% of stocks were so bad that their performance was worse than one-month U.S. Treasury notes.

Bessembinder’s most recent study, “Do Global Stocks Outperform US Treasury Bills?” examined the performance of more than 61,000 global stocks between 1990 and 2018.

It found that the top-performing 811 companies – so just 1.33% of the total – accounted for all the stock market’s wealth creation over the 28-year period studied.

From Bessembinder:

It is historically the norm in the U.S. and around the world that a few top-performing companies have great influence over how the market does overall.

It’s the norm and I expect it to be the case in the future.

Here’s what this looks like in real time

Last Friday, analyst Jim Bianco posted the following on X:

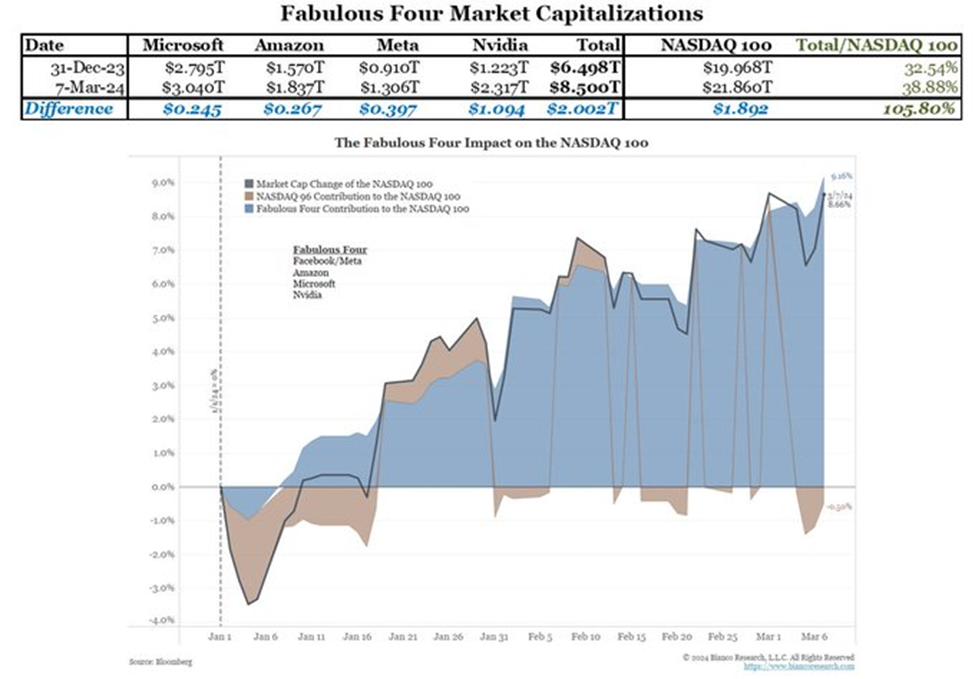

Here’s an update on the concentration of the stock market:

This table and chart show that the ENTIRE gain in the NASDAQ 100 (NDX), which the ETF QQQ tracks, is just four stocks. Collectively, the “other 96” are down on the year.

Year-to-date, the “Fabulous Four” have increased the NDX total market capitalization by 9.16% (blue). The “other 96” have dragged it 0.50% lower (brown).

(Note that NVDA’s market cap has increased by $1 trillion in nine weeks!)

For any readers less familiar, the “Fabulous Four” are Microsoft, Amazon, Meta, and Nvidia.

Here’s Bianco’s chart showing these four stocks accounting for all the Nasdaq 100’s gains, while the other 96 stocks have lost money in 2024.

This points toward a sobering takeaway for investors…

It’s not easy finding a winner and even more difficult to find the game-changing winners.

Meanwhile, if you don’t find those winners, getting a 0% return isn’t the worst potential outcome. Instead, significant loss of your hard-earned money is a very real threat — and it happens with greater frequency than most investors realize.

This tiny subsegment of big winners often results in “fear of missing out” (FOMO), which we’ve been seeing play out in the market in recent weeks

The FOMO that’s helping to push prices higher today is great if you’re already invested, but potentially dangerous if you’re late to the party.

Back to Louis:

Let’s face it, there’s fear of missing out [happening right now].

The people that didn’t have Nvidia were left behind.

An even bigger winner is Super Micro Computer. That’s doing even better.

So, there’s a fear of missing out. A lot of money pouring into these stocks.

Now, sure, there could be decent returns left in Nvidia and Super Micro Computer if you’re just joining the party at this point. But there’s about zero chance that the next 12 months will produce the same eye-watering returns from them as the last 12 months.

Rather, your best shot at a massive return lies elsewhere. But you’re in luck…

History suggests we’re on the verge of a condensed period of hyper-gains thanks to one thing…

Rate cuts.

What history tell us about stock performance after rate cuts

Let’s jump to The Wall Street Journal:

If you have fear of missing out—or FOMO—when deciding whether to invest in stocks, it is because you might indeed miss out.

It is hard to shake the feeling that the market might be a bit frothy…

So, investors’ temptation to leave their cash parked in deposits or money-market funds is more than understandable. Right now, the latter are paying returns of 4.9% in the U.S.

But here is the problem: If you wait for rates to start coming down to buy riskier assets, you could be giving up on a lot of gains.

[Two Wednesdays ago], Swiss bank UBS published the 2024 version of its Global Investment Returns Yearbook, a well-read compendium of very long-run performance data that used to be published by Credit Suisse.One key takeaway is that most returns historically captured by investors have come during times when officials were lowering borrowing costs or leaving them unchanged after lowering them.

The Credit Suisse data show that during interest rate tightening cycles, real annualized returns from U.S. stocks come in at 3%. But during easing cycles, that average return explodes to 9.4%.

Back to the WSJ:

A raft of other research also shows that, historically, most stock-market gains have come during only a few days, sometimes right after central banks cut rates…

Rate-cutting may start later than investors previously thought, but it is still likely to happen at some point this year.

Judging by the post-1995 period, sometimes it only takes that initial easing to trigger a rush of market optimism, even if borrowing costs end up staying high for quite a while.

So, connecting the two big pieces of today’s Digest, here’s the challenge…

The real game-changing wealth from the market only comes from about 1% of stocks…

And even if you’re in that top 1%, the gains aren’t evenly spread across time; rather, there seem to be spurts of hypergrowth related to exogenous market events – and rate cuts are at the top of that list.

Now, last Thursday, in remarks to the Senate Banking Committee, Federal Reserve Chairman Jerome Powell gave a hat-tip to interest rate cuts coming relatively soon.

From Powell:

We’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction

So, per the Credit Suisse research, it appears we’re on the verge of a period of hypergrowth. You might think of the market as a sprinter, crouched in the starting blocks, waiting for the gun to fire.

But what about the top 1% of stocks to own during this period?

That’s the tougher part.

But if you’re looking for help, this coming Wednesday at 1 p.m. ET, Louis is holding a free event called the Emergency Cash Bubble Briefing. The focus of the event is which stocks Louis sees surging from the trillions in cash that are still on the sidelines in savings accounts today, that will be pouring into stocks when the Fed cuts rates.

To immediately reserve your seat for Wednesday’s event with Louis, just click here.

Here’s Louis with our final word:

In short, a $8.8 Trillion “cash bubble” is poised to burst any day now…

And the decisions you make in the next few days could be what makes or breaks your financial future for years to come, because every time this specific financial event has occurred over the past 50 years, a certain niche of stocks have gone on to soar — 100% of the time.

So please make sure you join me LIVE this coming Wednesday. Click here to automatically RSVP.

Have a good evening,

Jeff Remsburg