Battery stocks can get a bad rap owing to the underlying tech. Is the same energy structure powering your phone good enough to power your car or a house? What is the right balance of capacity, charging efficiency and battery longevity? Finding the best battery stocks to buy in April might be the key to answering these questions.

As battery tech keeps pace with demands, the global battery market size is expected to grow at a compound annual growth rate (CAGR) of 15.8%, from $118.20 billion in 2023 to $329.84 billion by 2030.

But now that Tesla (NASDAQ:TSLA) is in a 29% year to date (YTD) slump, which battery stocks makes sense to hold ahead of the inevitable revival?

Microvast Holdings (MVST)

Starting off with a penny battery stock for a cheap entry, Microvast Holdings (NASDAQ:MVST) is 37% above its 52-week low stock price of $0.53, presently at $0.83 per share. Based in Texas, the company vertically integrated its business to deploy battery tech for commercial and specialty vehicles.

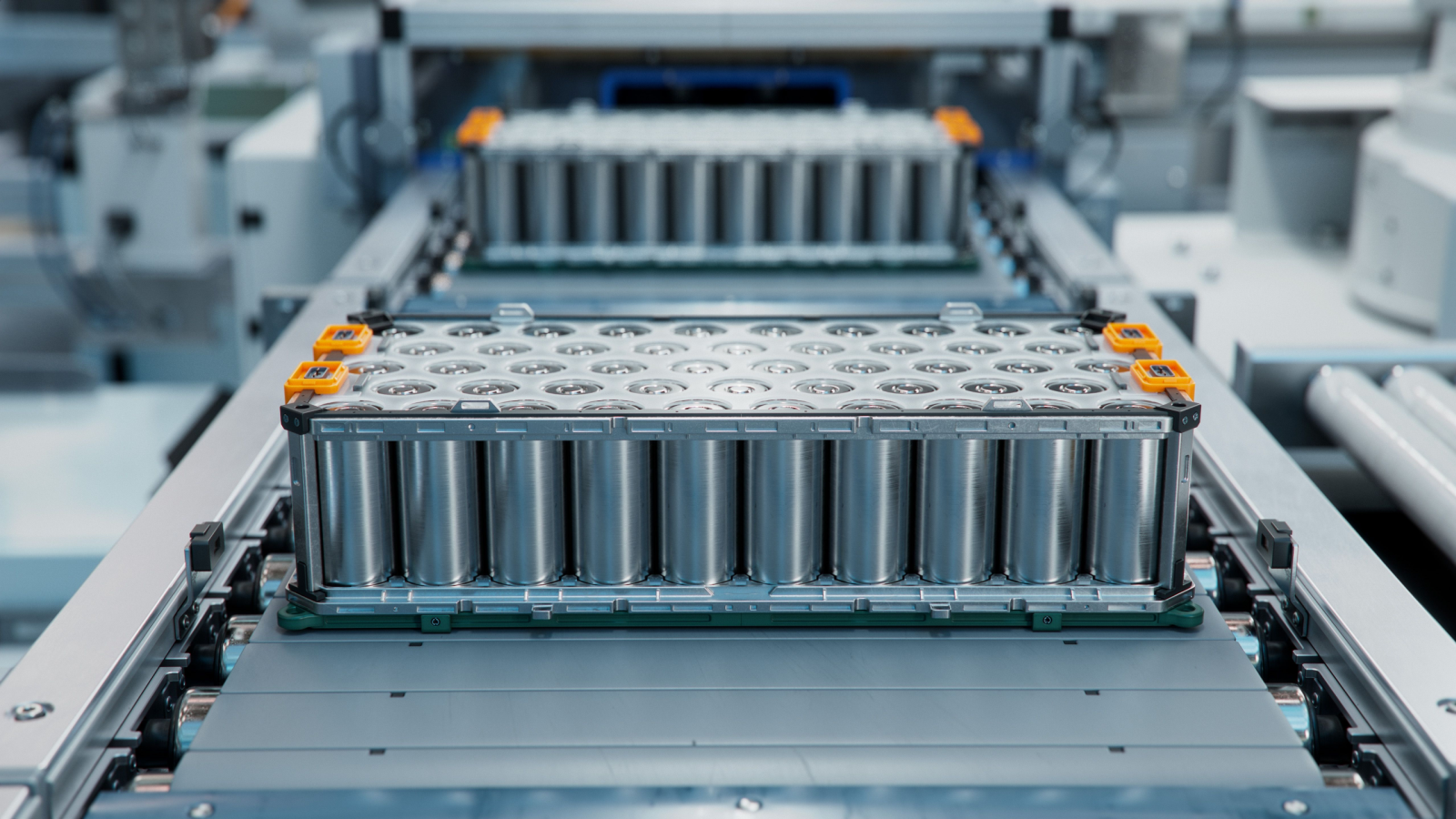

Notably, it developed a high-energy nickel manganese cobalt (NMC) battery. On a quarterly basis, MVST’s revenue grew consistently from Q1 2021, owing to its three battery manufacturing plants and over 630 patents and patent applications. The company concluded Q3 2023 with a 107.5% year over year (YOY) revenue increase to $80.1 million.

More importantly, its gross margin ramped up significantly from 5.2% to 22.3% YOY, indicating successful scaling of operations. On April 1, MVST reported its Q4 2023 earnings to conclude the financial year, delivering $106.4 million loss, the lowest since 2021 ($206.4M) and 2022 ($158.2M).

Additionally, the gross margin for the full year ended with 18.7% compared to 4.4% in 2022. MVST’s estimated earnings per share was negative $0.08 for the quarter, per Zacks Investment Research.

Panasonic Holdings Corporation (PCRFY)

Available as American Depositary Receipts (ADRs), Panasonic Holdings Corporation (OTCMKTS:PCRFY) is the staple of home electronics. From its yearly low-point of $8.73, PCRFY is now up 8.5% at $9.48 per share. Although it is common to view Panasonic Holdings Corporation as the hallmark of dischargeable batteries for small devices, the company has made great strides to expand in both scale and tech.

In 2020, the Japanese Panasonic decided to shift from its Tesla-demand dependency as its oldest partner. Having supplied Tesla with PHEV2 prismatic cells using NCM/LMO hybrid cathode, the company upgraded its PHEV2 form factor to NCM 622 chemistry.

The latter is the next gen for Japanese automakers like Toyota (NYSE:TM). Fast forward to May 2023, Panasonic Holdings Corporation delayed its 4680 battery cells for Tesla, citing needed performance improvements. This rollout should begin in the present period between April and September.

Additionally, PCRFY entered a supply agreement with Mazda (OTCMKTS:MZDAY) for its cylindrical lithium-ion batteries on March 29th. And, in February’s earnings report for Q3 of 2024, PCRFY delivered a 36.7% YOY increase in operating profit and 140% rise in net profit.

Along with a generous stock buyback program, this makes Panasonic Holdings Corporation one of the safest battery stocks to hold.

EnerSys (ENS)

EnerSys (NYSE:ENS) is the global powerhouse for energy storage solutions, primarily for large scale industrial deployment such as renewables and telecom. Based in Pennsylvania, ENS hit the 52-week low at $79.61, now 18% above at $94 per share.

In February, the company selected Greenville in South Carolina to ramp up its U.S.-based battery manufacturing. Taking advantage of President Biden’s Inflation Reduction Act (IRA), EnerSys expects a $200 million green incentive to create a $500 million investment on 140 acres of cutting edge facility.

In the same month, EnerSys reported fiscal year Q3 of 2024 earnings, delivering a 6% downturn in net sales at $862 million. This was to be expected given the cyclical nature of investments from broadband and telecom sectors. However, the company has beaten earnings per share estimates, even though slightly, for the last four quarters.

Also, EnerSys got the invite to participate in Wells Fargo Clean Energy Symposium last Tuesday. Given that Wells Fargo (NYSE:WFC) is a Global Systemically Important Bank (G-SIB), this indicates that EnerSys operates as a cog in a wider machine to push for the net-zero agenda.

On the date of publication, Shane Neagle did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.