CPI inflation comes in as expected … a near-record number of U.S. households own stocks … the reasons to own gold today … bitcoin’s price chart is troubling

The headlines keep coming fast and furious.

Today, let’s do yet another tour through the biggest stories in the investment world.

This morning brought no curveballs with the Consumer Price Index (CPI)

The month-to-month figure climbed 0.2% as had been forecasted. The yearly figure clocked in at 2.9%, which is the lowest reading since March 2021.

Core CPI, which strips out volatile food and energy prices, came in at a 0.2% monthly increase and a 3.2% annual rate, both meeting expectations.

While this morning’s data didn’t provide any softer-than-expected surprises, there were no stumbling blocks for the Fed as it mulls a rate cut next month.

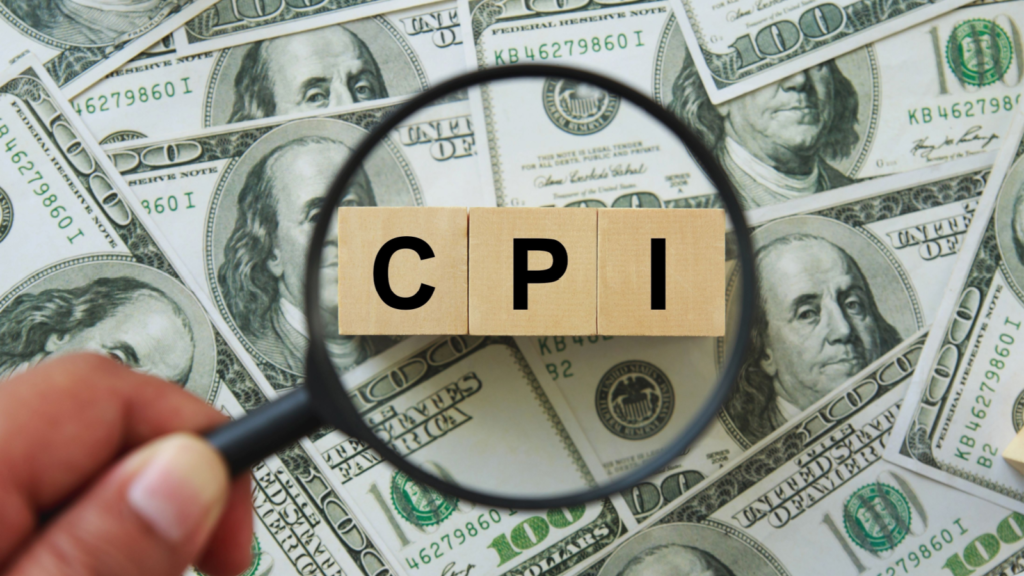

As we’ve been detailing here in the Digest, the market is 100% certain that a cut is on the way; the only question is whether it will be 25- or 50-basis points.

Whereas yesterday’s cooler-than-expected PPI report shifted the odds slightly in favor of 50-basis points, today’s “as expected” CPI report has swung the probability back toward just a single quarter-point cut.

Here’s the latest from the CME Group’s FedWatch Tool, showing a 56.5% probability of a 25-basis-point cut in September.

Regardless of the size of the cut that’s on the way, the prospect of the beginning of a rate-cutting cycle has sent Wall Street back to party mode over the last week-and-a-half…

And it turns out, a near-record number of Americans are attending this party

Let’s go to Visual Capital:

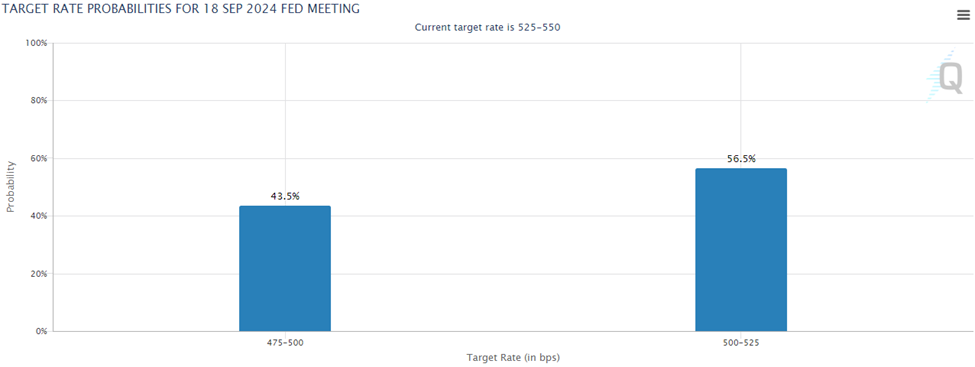

Today, the proportion of Americans’ financial assets invested in public stocks is nearing record highs, just shy of the peak seen in 2021.

Investor confidence, a strong U.S. economy, and superior historical performance over the last several decades is driving allocations to equities. In 2024, 41.6% of U.S. households’ financial assets are tied to the stock market.

For added context, below, we look at data from Visual Capitalist showing U.S. household stock ownership at various points in past decades. All the data below come from January 1 of their respective years.

2024 – 41.6%

2020 – 30.5%

2010 – 26.3%

2000 – 38.4%

1990 – 14.5%

1980 – 10.9%

1970 – 23.8%

1960 – 23.9%

Pay attention to the reading in 2000. The figure, taken from January 1 of that year, came just two months before the March 10, 2000, bubble burst. And here we are today at an even higher percentage of household stock ownership.

That said, the valuations of many of the Dot Com’s market darlings were magnitudes greater than what we find today, even for our top AI stocks.

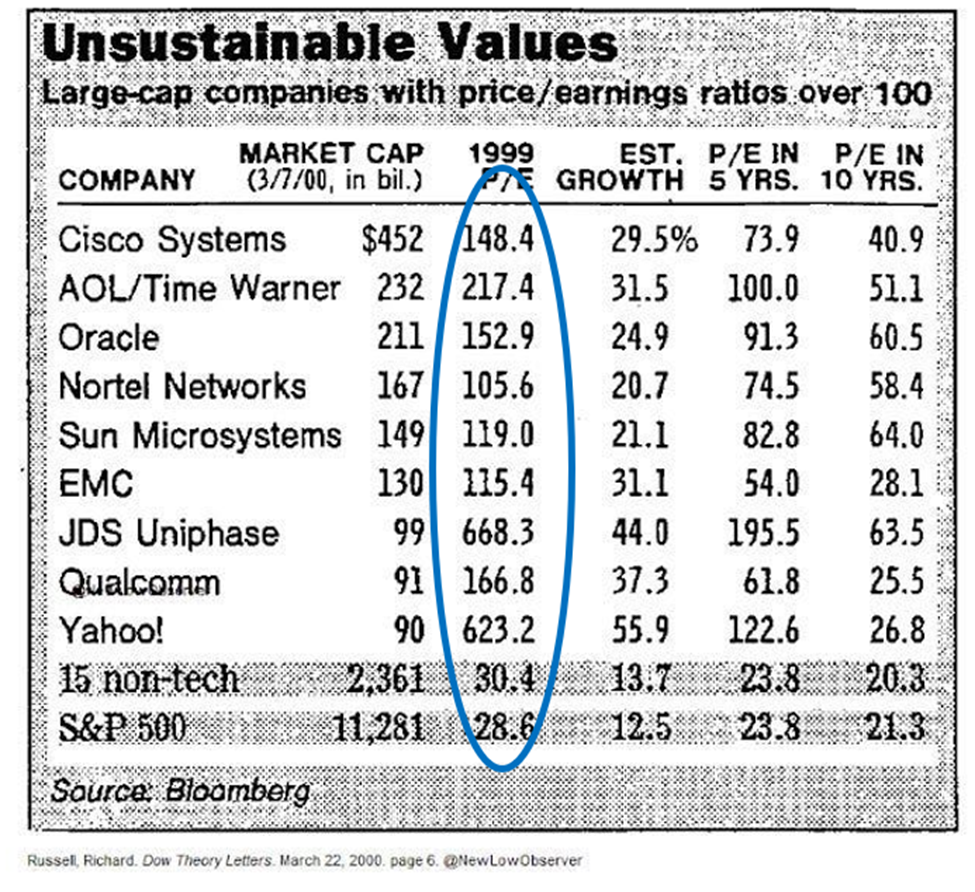

To illustrate, below is a blast from the past for you. We’re looking at the P/E ratios of some Dot Com high-fliers, taken from March 22, 2000.

I remember getting burned by the collapse of JDS Uniphase when it crashed from that P/E of 668.

By comparison, Nvidia, the poster child for AI stocks today, trades at a P/E ratio of 68.

Pricey? Sure. But clearly, nowhere close to the levels seen in bubble stocks from 2000.

But the difference in valuation doesn’t mean we can dismiss the significance of this record-setting allocation to the stock market

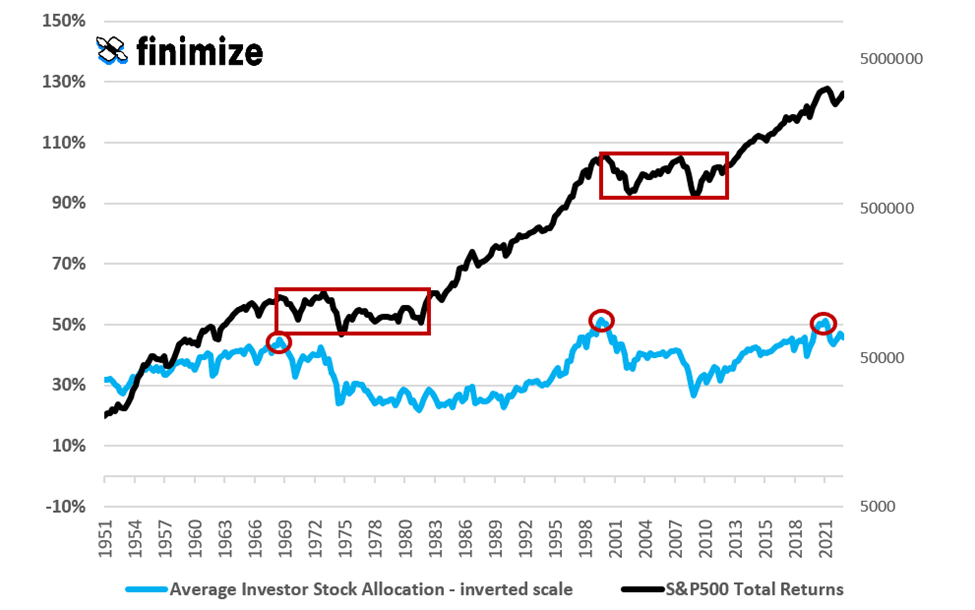

To explain why, let’s rewind to our July 17 Digest, highlighting a quote from Stéphane Renevier from Finimize:

A lot of things can influence short-term stock returns: interest rates, economic data, geopolitical stuff, investor sentiment – even weather.

But for long-term returns, one factor rules them all: the proportion of assets that investors are parking in stocks.

This ratio has proven to be the most reliable predictor of stock returns over a ten-year horizon, outshining even heavyweight factors like valuations.

It says that when investors go big on stocks, their long-term returns tend to be below average…

Investor over-allocation to stocks has been the most precise warning signal of lost decades.

Renevier went on to highlight the chart below that shows how a spike in allocations to stocks (blue line, red shaded circles) preceded both the lost decade of the 1970s and the early 2000s.

We’re at another “red circle” moment today. While we just looked at U.S. household allocation to stocks, if we switch it to Americans in general, the allocation jumps to 62%. That’s a 20-year high.

By the way, this allocation principle works in reverse too.

When investors want nothing to do with stocks, that’s typically the best time to buy hand-over-fist. On that note, take a guess…

1982 – at a reading of just 9.4%.

And had you have gone all-in on stocks in 1982, you would have hitched your money to an 18-year bull market.

Overall, bullish momentum is here, so keep riding it for as long as your stop-losses allow. But don’t ignore the historical significance of what this level of stock ownership suggests for forward-looking market returns.

Meanwhile, stocks aren’t the only asset that’s partying today

Gold has been trading just under its all-time high set back in mid-July, looking poised to set a fresh record.

And while Wall Street is licking its chops for gains in the wake of rate cuts from the Fed, don’t forget what a cut could mean for gold.

Here’s Matt Weller, Head of Market Research at City Index, with some historical context:

Over the past 40+ years of easing cycles, here are some conclusions that we can draw based on this analysis:

On average, Gold has…risen by 11% in the year after.

Gold has risen one year after the first Fed rate cut of a new cycle six of the past seven times.

It’s not just the prospect of rate cuts that’s likely to keep a firm bid under gold’s price. The potential for a full-blown regional war in the Mideast is another (unfortunate) tailwind.

Here’s Reuters from yesterday:

Only a ceasefire deal in Gaza stemming from hoped-for talks this week would hold Iran back from direct retaliation against Israel for the assassination of Hamas leader Ismail Haniyeh on its soil, three senior Iranian officials said.

Iran has vowed a severe response to Haniyeh’s killing, which took place as he visited Tehran late last month and which it blamed on Israel. Israel has neither confirmed or denied its involvement. The U.S. Navy has deployed warships and a submarine to the Middle East to bolster Israeli defenses…

Iran’s foreign ministry and its Revolutionary Guards Corps did not immediately respond to questions for this story. The Israeli Prime Minister’s Office and the U.S. State Department did not respond to questions.

“Something could happen as soon as this week by Iran and its proxies… That is a U.S. assessment as well as an Israel assessment,” White House spokesperson John Kirby told reporters on Monday.

Bottom line: There are simply too many tailwinds to ignore gold today. Make sure your portfolio has some exposure.

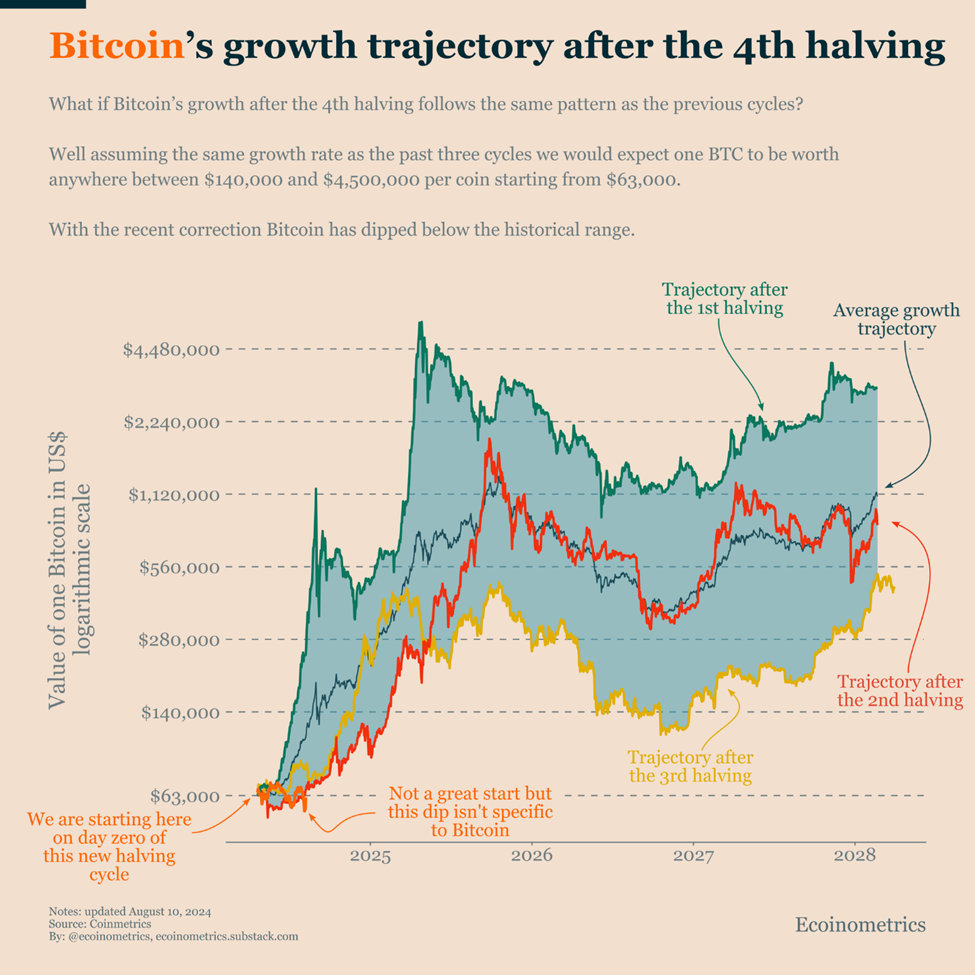

Finally, have we reached a “this time is different” moment for bitcoin?

As we detailed in the Digest last Friday, hopes were high for a post-halving bitcoin surge back in the spring. However, the opposite has played out.

Due to a handful of factors that we’ve detailed in various Digests, the price of bitcoin now trades almost 20% below its high in March. And this time, the price sluggishness carries added significance – bitcoin has dipped below its historical post-halving growth trajectory range.

Below is how this looks. If you’re having trouble seeing the chart, the orange line (not the red line) shows bitcoin’s current trajectory. It’s at the lowest level of all post-halving growth curves.

Now, while this isn’t the news that crypto investors would prefer, it doesn’t mean it’s time to give up on bitcoin.

If the grandaddy crypto catches a bid and returns to its historical growth trajectory range, we’re likely looking at a $100,000+ price tag by year end.

Our crypto expert Luke Lango believes that the potential for this outcome reduces to one thing…

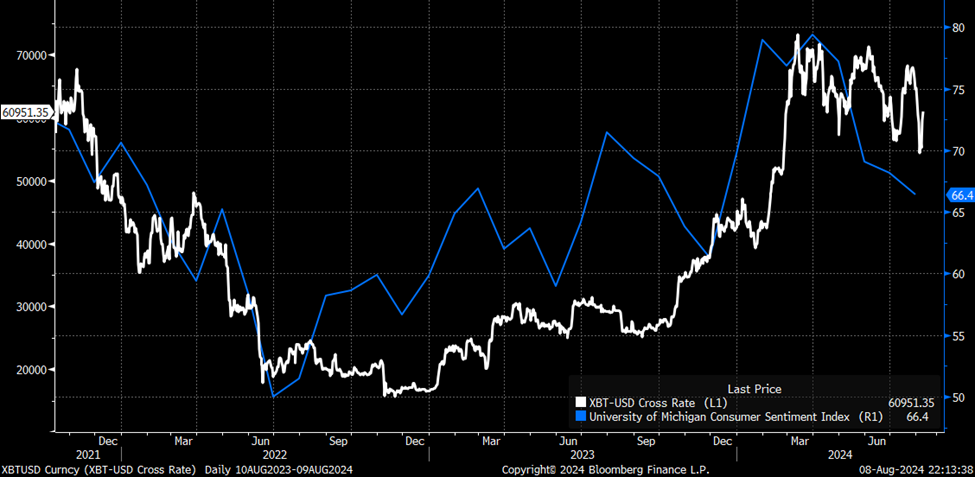

Consumer sentiment.

From Luke:

While a variety of factors do drive the crypto markets – interest rates, economic growth, forced liquidations, ETF approvals, Halving events, etc – we have found that the one factor most closely correlated with crypto price action in this cycle is consumer sentiment.

When consumers are feeling good, they’re buying cryptos, and crypto prices are rising. Conversely, when consumers are feeling bad, they’re selling cryptos, and crypto prices are falling. Oddly enough, it has been that simple.

Luke provides a chart showing how closely correlated the price of bitcoin has been with the University of Michigan’s Consumer Sentiment Index.

Here’s Luke’s commentary, followed by that chart:

Throughout the first-half of 2022, consumer sentiment crashed alongside BTC prices. Consumer sentiment bottomed in June 2022 – very close to when BTC bottomed.

Throughout 2023 and into early 2024, consumer sentiment choppily rose. BTC prices choppily rose, too.

But, ever since March 2024, consumer sentiment has faded. So has the price of BTC (which, maybe not coincidentally, peaked in March, too).

But Luke anticipates a resurgence of bullish sentiment thanks to rate cuts from the Fed:

Given the number of similarities we see between today’s “early innings” AI Economy and the “early innings” Internet Economy of the late 1990s, we think rate cuts today will have a similar impact as rate cuts had back then.

If so, that means consumer sentiment should rebound over the next 12 months – and that should lay a solid foundation for crypto prices to steadily rebound.

It’s tough to “HODL” when prices are languishing, but history shows this is what it takes to enjoy crypto’s outsized returns.

We’ll keep you updated on all these stories here in the Digest.

Have a good evening,

Jeff Remsburg