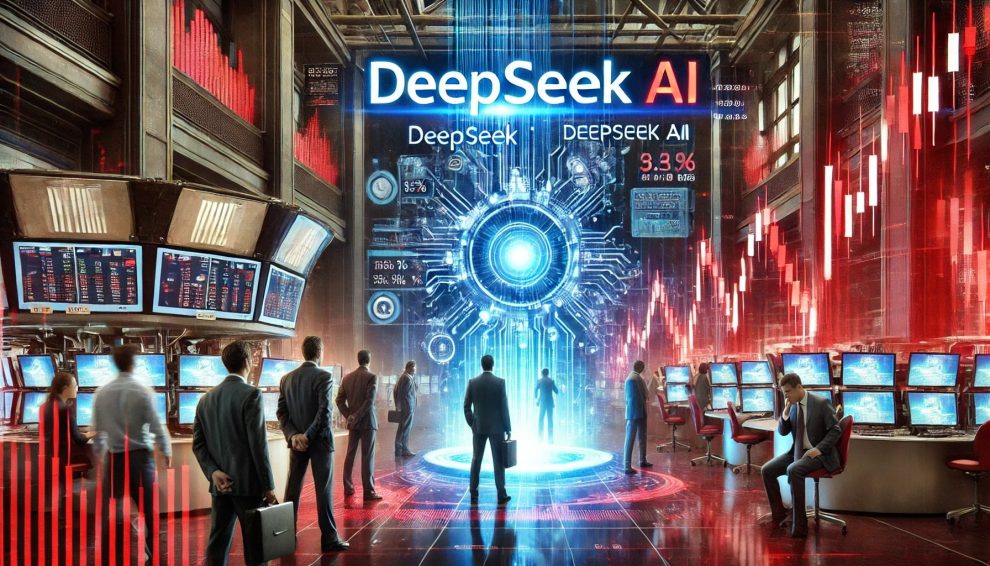

Investors were treated to a rude awakening on Monday, as concerns about reports that a Chinese artificial intelligence service called DeepSeek was substantially cheaper and better than OpenAI.

As I mentioned in Tuesday’s Market 360, news broke over the weekend that DeepSeek claims that its R1 and V3 models performed better than or close to ChatGPT. What’s more, DeepSeek is bragging that its AI search algorithms use significantly less power than ChatGPT and other AI large language models (LLMs), though information on what percentage varies significantly.

Now, DeepSeek’s supposed success has occurred despite export curbs, implemented during the Biden administration, that were designed to limit the sales of the advanced AI chips that NVIDIA Corporation (NVDA) makes.

As a result, the entire roadmap of how AI is supposed to evolve is being questioned. Some investors are wondering whether or not the chip-hungry and energy-intensive U.S. AI industry will win the AI race. This led to a massive selloff in AI names, with NVIDIA losing a staggering 17%, and many of the AI infrastructure/power names lost even more than that.

This is a good time to remind all investors that the stock market is really just a manic crowd. The truth of the matter is crowds react and do not think. In fact, the bigger the crowd, the lower the IQ. So, during Monday’s selloff, the stock market’s violent reaction was particularly stupid, since investors were reacting with vigor and not thinking with equal vigor.

The stock market seems to be thinking more clearly again as investors reassess things and realize that we can’t take these claims at face value.

Still, President Donald Trump was right when he called the DeepSeek news a “wake-up call” for U.S. companies to reassert their dominance over AI.

If you’re one of the many investors who have been following the AI race closely, you’re probably wondering what to make of this news. So, earlier this week, InvestorPlace Editor-in-Chief Luis Hernandez sat down with the me, Eric Fry and Luke Lango – the creators of the AI Revolution Portfolio – to answer those questions and let you know what we believe investors should do now. (You can find out more about AI Revolution Portfolio by going here.)

Check out our conversation by going here or clicking the video below.

As Luis explains, Eric, Luke and I built our AI Revolution Portfolio to represent the best-in-class stocks for the AI Boom.

Our focus is on finding the AI stocks that could go on to disrupt entire industries and, as a result, go up more than any stock over the next 12 to 36 months. Our AI Revolution Portfolio returned more than 21% last year… and continues to outperform the market this year.

While this week’s market volatility is no fun, at the end of the day, our AI Revolution Portfolio companies are pumping out more profits than anyone else…. and that’s why we believe this week’s selloff is so overblown.

To learn more about our AI Revolution Portfolio, click here.

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)